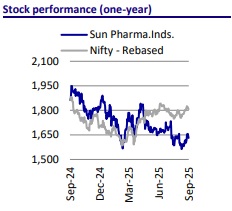

Buy Sun Pharma Ltd for the Target Rs. 1,960 by Motilal Oswal Financial Services Ltd

Well poised to sustain growth in focus segments

New launches/field force addition/marketing spend to drive growth in branded markets

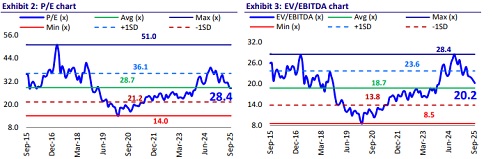

We recently met with management of Sun Pharma (SUNP) to understand the company’s business outlook. ? Management said that SUNP aims to sustain its outperformance in the domestic formulation (DF) segment through increased doctor engagement, new launches, addition of field force and strengthening the brand recall of its existing products. ? Management highlighted its continued focus on building the specialty franchise in developed markets through late-stage acquisitions (derma, ophtha, oncoderma), ramp-up of Leqselvi, Unloxcyt and Winlevi with higher field force/marketing spend (~USD100m in FY26), diversification of Ilumya supply, and improved doctor connect. ? Overall, we expect 14% earnings CAGR over FY25-27E, led by 17% sales CAGR in the specialty segment and 12% in DF/EM markets, and 160bp margin expansion. We value SUNP at 32x 12M forward earnings to arrive at a TP of INR1,960. Reiterate BUY.

SUNP targets consistent outperformance in India branded business

* Despite a large base (INR175b sales over 12M ending Jun’25), SUNP intends to grow better than the industry going forward as well.

* Under the leadership of Mr. Kirti Ganorkar since CY19, SUNP has implemented multiple strategic efforts to sustain superior growth in its DF business.

* SUNP has added workforce to increase penetration and enhance promotional efforts.

* Accordingly, in addition to metro cities, SUNP has established its presence in tier 2 cities in the past five years.

* Subsequently, the engagement with doctors and onboarding more doctors have boosted growth in prescriptions as well.

* Notably, FY25 YoY growth of 13.7% was led by volume, pricing and new launches. In fact, the new launches have been inherently part of its growth strategy in recent years. SUNP launched about 45 products in FY25 and five in 1QFY26.

* Since oncology is largely an institutional business, SUNP focuses less on this therapy in the DF market.

* Management indicated that an in-licensing strategy for products closer to the loss of exclusivity would not make economic sense compared to launching its own branded generic products.

* Overall, management intends to sustain consistent outperformance to the industry in the DF segment.

Pipeline, field force scale-up to drive growth in specialty segment

* SUN has strengthened its focus on building a specialty franchise in developed markets.

* Strategically, SUNP intends to acquire assets at the end of phase II/phase III clinical trials. Subsequently, it plans to invest in the regulatory process for product approval and implement efforts toward building a commercial franchise. Management indicated that the focus is on products in dermatology, ophthalmology and onco-dermatology.

* Interestingly, SUNP has witnessed encouraging trends in prescriptions of recently launched ‘Leqselvi’ despite competing products available in the market and a delayed launch by SUNP due to better efficacy and lesser side effects.

* Notably, SUNP did not have any singly thrombotic event for 8mg Leqselvi.

* SUNP has filed for enhanced efficacy with the USFDA. With a changed label for enhanced efficacy, SUNP would be launching this product in 2HFY26.

* While SUNP already has doctor engagement due to marketing of Odomzo, the company intends to intensify this engagement and onboard more doctors for a better prescription run rate of Unloxcyt.

* Accordingly, the guided USD100m spending on specialty generics would include the addition of field force and the marketing for Leqselvi and Unloxcyt in FY26.

* The change in its distribution structure has led to an increase in the prescription of Winlevi in the recent past. Management expects the prescription run rate to further improve going forward.

* SUNP has a single-source supplier for Illumya and it is looking to diversify the supplier base.

* GM improvement over the past few years is largely led by higher traction in its specialty portfolio. Having said this, there is opex toward new launches like USD100m, which can cap EBITDA margin improvement over the medium term.

* SUNP is in the process of addressing the USFDA regulatory issues at Halol.

Other highlights

* SUNP has maintained its guidance of mid-to-high single-digit consolidated revenue growth for FY26.

* R&D expenses are expected to be 6-8% of sales in FY26..

* The ETR is expected to be 25% for FY26.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412