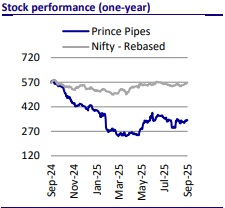

Buy Prince Pipes and Fittings Ltd for the Target Rs. 440 by Motilal Oswal Financial Services Ltd

Navigating challenging times; uncertainty remains

Prince Pipes and Fittings (PRINCPIP) hosted an analyst meet on 18th Sep’25, where it highlighted the current demand-supply and pricing scenarios in the PVC pipes industry. The PVC pipes market remains under pressure due to volatile PVC prices and a weak demand environment. In addition, the delay in the implementation of anti-dumping duty (ADD) has created uncertainty within channel partners, putting pressure on the PVC prices market domestically. Given that 2Q is seasonally weak, the company anticipates a healthy demand outlook in 2HFY26, thereby maintaining its guidance for FY26.

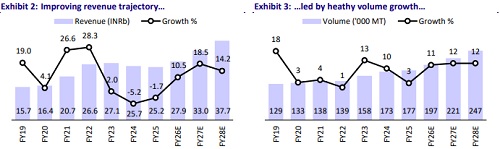

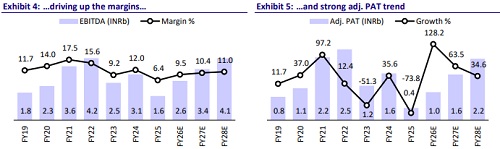

* PRINCPIP expects to deliver high single-digit volume growth in FY26, although management acknowledged that near-term demand visibility remains weak. The company’s strategy is firmly focused on margin expansion, led by an improved product mix and increasing CPVC contribution (currently ~22-25% of volumes). Notably, the current quarter already reflects an improved margin profile compared to the preceding period.

* A significant strategic milestone is the commissioning of the Begusarai facility in Bihar, which has added ~45-50ktpa capacity (including CPVC) by the end of 1HFY26. This plant is expected to achieve 60-65% utilization in FY27 (at full capacity of 60kpta), positioning PRINCPIP with a stronger foothold in Eastern India, a region the management views as a high-potential growth market.

* In parallel, the company continues to diversify into adjacencies: the bathware division is on track to achieve break-even at revenue of INR0.8-1b by FY27. Meanwhile, the company’s CPVC business is gaining traction, with a market share of ~10-12% in the ~INR50b CPVC pipes industry.

* We expect ~12% volume CAGR over FY25-28 with margin expansion, as operating leverage and product mix benefits play out. Structural demand drivers such as government housing schemes, plumbing upgrades, and GST rationalization should provide tailwinds in 2HFY26 and beyond. We maintain BUY with a TP of INR440 (based on 30x FY27E EPS).

Demand muted; restocking remains cautious

* PVC resin pricing remains volatile and is directly impacting trade sentiment. Reliance’s base price is currently ~INR74.5/kg, though open-market prices are lower as traders attempt to liquidate existing inventories at discounted rates in order to free up their working capital.

* On the global front, China’s base price remains under stress at USD585- 590/MT. Should the expected ADD be imposed, the effective landed price would rise to ~USD760/MT (adding average duty hike of ~USD140/MT), translating into INR75-76/kg in India, a level considered sustainable by industry participants.

* Distributor feedback corroborates these observations, with multiple channel partners indicating that demand is sluggish in 2Q (seasonally weak quarter), with limited benefits of price cuts. In several regions, restocking is happening, albeit cautiously, reflecting an underlying lack of strong demand momentum. Currently the channel is holding inventory of ~20 days, improving from one to two weeks of holding period.

* As per management, PRINCPIP is expected to witness a marginally better quarter YoY in terms of volume in 2QFY26, with overall scenario likely to improve in 2H.

* Management has reiterated that demand typically softens in 2Q due to seasonal rains, and it is expected to rebound in 2H, aided by restocking, GST-driven demand in building materials, and broader consumption recovery. Distributor commentary also indicates weak sales trends in 2Q and a strong rebound in 3Q and 4Q, particularly in the West and North regions.

* Government schemes such as PMAY (housing for all) are expected to drive structural demand over the medium term. In addition, while real estate momentum remains weak in select markets, Tier-2 and Tier-3 clusters, along with the Mumbai region, are seeing a steady pickup, offering a near-term cushion to volumes.

Expect improving demand trends in 2H with lower pricing volatility

* PRINCPIP expects high single-digit volume growth in FY26, though management acknowledged that demand visibility is not robust at present. The company is focusing on margin expansion, driven by an improved product mix and a higher share of CPVC. For the current quarter, the margin profile has already shown visible improvement.

* A key strategic milestone is the commissioning of the Begusarai plant, which will add 45-50ktpa capacity (including CPVC) by 1HFY26 end. This facility is expected to operate at 60-65% utilization in FY27 (on full capacity of 60kpta), creating a strong foothold in Eastern India, which management highlighted as a highpotential market.

* PRINCPIP continues to strengthen its CPVC positioning. The company currently has ~10-12% share of the ~INR50b CPVC market, with CPVC forming ~22-25% of its overall volumes. Backed by its tie-up with Lubrizol for CPVC compounds, the company is well placed in project sales, where customers are more qualityconscious. However, the retail segment remains extremely price-sensitive, making it challenging to pass on higher raw material costs.

* Management highlighted that blended realizations currently stand at INR150- 160/kg, with CPVC resin at INR105-120/kg. In addition, ~30% of overall volumes are contributed by agriculture pipes, which are witnessing strong demand over the next two to three months due to affordability.

* PRINCPIP continues to rely on a balanced sales strategy, with ~78-80% volumes coming through retail and 20-22% through projects. Of the total sales, only 5-7% are linked to government contracts, which reduces dependency on volatile state orders.

* Management also highlighted that demand generation initiatives are being strengthened, with greater engagement of plumbers and retailers in underpenetrated geographies to drive future volumes.

* The company remains open to expanding into any category where capacity and demand align, including agricultural pipes, which are currently seeing strong traction.

* In the bathware segment, the company is targeting break-even at revenue of INR0.8-1.0b by FY27, supported by the current scale-up trajectory.

FY26 guidance remains intact

* Margins: Management indicated that at quarterly volumes of ~50ktpa, EBITDA margins of ~11-12% are achievable, with scope for further improvement beyond 56-57ktpa quarterly volumes. This margin recovery is underpinned by scale benefits and a better product mix.

* Inventory: The company has inventory days of ~110 and is targeting ~70-75 days by year end, which should improve working capital efficiency.

* Capex: FY26 capex plans remain unchanged at ~INR2.4b, with a balanced allocation for capacity expansion, bathware scale-up, and maintenance.

Valuation and view

* PRINCPIP is navigating a challenging demand environment, and the delayed ADD decision has caused uncertainty across the trade channel. However, the company’s medium-term growth remains intact thanks to new capacity in Bihar, CPVC expansion, margin accretion on higher utilization and better product mix, and improving demand in Tier-2/3 markets.

* We expect ~12% volume CAGR over FY25-28, along with margin expansion, as operating leverage and product mix benefits play out. Structural demand drivers such as government housing schemes, plumbing upgrades, and GST cuts should provide tailwinds in 2HFY26 and beyond. We maintain BUY with a TP of INR440 (based on 30x FY27E EPS).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412