Buy Hindalco Industries Ltd For Target Rs. 900 By Emkay Global Financial Services Ltd

From hot metal to a firm market; upgrade to BUY

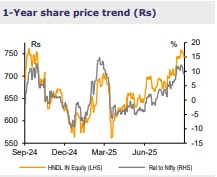

We upgrade Hindalco to BUY from Reduce, with an increased TP of Rs900 (Rs650 earlier). After the flatlined stock performance in the past 12M, we see HNDL doing well from here. We see aluminium prices going from strength to strength which should benefit Hindalco’s India business meaningfully, along with its industry-leading cost curve. Meanwhile, Novelis’s profitability has likely bottomed out, per our scrap spread workings; we expect margins to reset to normalized levels of ~USD480/t by FY28E. From a market perspective, after the ‘commodity supercycle’ sunset around 2012, if there was ever a time to own industrial metals, it is now, as we believe supply restraint alongside the macro tailwind of weak DXY provides an optimal position of strength (read: Grinding higher). To add to it, HNDL is relatively better placed among global peers to benefit from the improving dynamics. Firm aluminium prices should also help in adding duration visibility to earnings, resulting in a valuation re-rating.

India business – above-normal margins and cash generation

HNDL’s India business thrives on aluminium strength and its cost leadership globally. The company operates at a cost of production of USD1,700/t, which is meaningfully lower than the average cost of USD2,300/t in China. We see this working favorably for cash flow generation, with the company generating consolidated operating cash flow of Rs300bn pa (13% of EV), which is sufficient for planned capital allocation decisions.

Novelis – profitability trough likely in place already

The conventional approach to calculating scrap spread has distorted due to a spike in Midwest premia, which accounts for implementation of 50% tariffs under Section 232 (Exhibit 8). Even as scrap spreads appear to have increased optically, the net impact from tariffs is negative for the business. That said, UBC scrap cost pressures have eased in recent months while LME has moved up (Exhibit 9), thereby creating a possibility of mitigation of the tariff impact through improvement in spreads. With that, we believe that a trough in profitability is already in place; we expect Novelis’s margins to improve back to ~USD480/t by FY28E and over USD500/t by FY29E, from ~USD430/t now, when the Bay Minette project is fully ramped-up.

Aluminium risk-reward proposition skewed upward; risks could stem from industry-level capital indiscipline and easing of Russian sanctions

We raise our 0-6M point target for aluminium to USD2,850/t, from USD2,700/t, to reflect the improving fundamentals and deficit expectations for 2026. Likewise, we raise our average price forecasts by 2% to USD2,650/2,750/t for FY27E/28E. We reckon a new earnings upgrade cycle could ensue for aluminium players; we thus raise HNDL’s EBITDA by 3.1%/3.5% for FY27E/28E. Risks to our base case are: 1) higher prices could catalyze a countercyclical industry-level capital allocation indiscipline, resulting in a wave of new supply; 2) easing of Russian sanctions could weaken the cost curve support.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354