Buy Devyani International Ltd For Target Rs.200 by Motilal Oswal Financial Services Ltd

Similar muted growth; pressure on margins

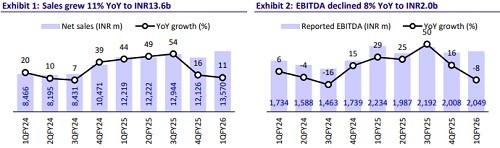

* Devyani International’s (DEVYANI) consol. revenue grew 11% YoY (in line) in 1QFY26. India revenue rose 11% YoY, with a 20% YoY store expansion, which was offset by weak same-store sales growth (SSSG) across brands. However, the LFL store addition was 13%, as the 105 new stores belong to Sky Gate, whose financials have been included only from mid-Jun’25.

* KFC’s revenue grew 10% YoY, supported by 14% store expansion, though this was offset by a 0.7% decline in same-store sales (flat for Sapphire). Pizza Hut’s (PH) revenue rose 3% YoY, with 8% new store additions, while SSSG declined 4.2% YoY (-8% for Sapphire). Costa Coffee’s revenue grew 14% YoY, with 16% YoY store additions.

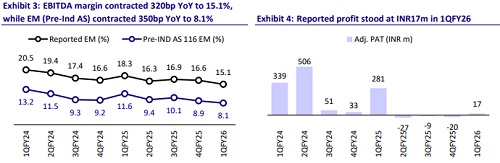

* India’s ROM contracted 17% YoY to INR1.1b, and margin contracted 410bp YoY to 12.1%, marking a 17-quarter low due to operating deleverage. KFC’s ROM contracted 410bp YoY to 15.5% (15.7% for Sapphire); PH’s ROM contracted 600bp YoY and turned negative to 1.1% (-2.1% for Sapphire).

* International revenue grew 11% YoY to INR4.3b, with RoM at INR724m (vs. INR577m in 1QFY25). Margin expanded 190bp YoY to 16.7%.

* Consolidated GM 100bp YoY and 30bp QoQ to 68.2 (est. 69.5%), due to RM inflation. EBITDA (Pre-Ind-AS) margin contracted 350bp YoY/ 80bp QoQ to 8.1%. Consol. RoM margin contracted 220bp YoY and 70bp QoQ to 13.1%.

* DEVYANI is focusing on innovation, customer engagement, and value offerings to drive recovery. KFC’s ADS has corrected ~20% from its peak of FY19/FY23 to INR100k. Given the improving consumption sentiments for FY26, we believe ADS has bottomed out, and we will continue to monitor its recovery. Further, the company is undertaking several initiatives for PH’s turnaround. However, improvement in ADS and SSSG will be key monitorables, as they are essential for restoring unit-level profitability. The stock price has remained flattish for the last three years due to growth challenges, and we believe most risks are largely priced in now. We reiterate our BUY rating with a TP of INR200.

Underlying recovery still awaited; margin pressure sustains

* Muted underlying growth metrics: Consol. sales grew 11% YoY to INR13.6b (est. INR 13.3b). India’s revenue rose 11% YoY to INR9.3b. (est. INR9.1b). KFC’s sales grew 10% YoY to INR6.1b. SSSG declined 0.7% (est. -2%). PH sales grew 3% YoY to INR1.9b. SSSG declined 4.2% (est. 0%). ADS of KFC declined 6% YoY to INR98k, and PH ADS dipped 8% YoY to INR33k. Costa Coffee’s revenue rose 14% YoY, while ADS declined 9% YoY at INR26k.

* Slower store expansion: The company added a total of 106 stores in 1QFY26, reaching 2,145 stores. Of this, 105 stores belong to Sky Gate, whose financials have been consolidated from 11th Jun’25. Store additions in KFC/CC/own brands/International stood at 8/2/105/3, while the company closed 12 stores in PH. The total store count for KFC/PH/CC/own brands/International stood at 704/618/222/223/378.

* Pressure on margins continues: Gross profit grew 9% YoY to INR9.3b (est. 9.3b), while margins contracted 100bp YoY and 30bp QoQ to 68.2% (est. 69.5%). Consol. EBITDA margin contracted 320bp YoY and 150bp QoQ to 15.1% (est. 17%). Consol. ROM contracted 5% YoY to INR1.8b. Margin contracted 220bp YoY and 70bp QoQ to 13.1%. Pre-Ind-AS EBITDA declined 23% YoY to INR1.1b, while margin contracted 350bp YoY/80bp QoQ to 8.1%. International revenue grew 11% YoY to INR4.3b, with RoM at INR724m (vs. INR577m in 1QFY25), and margin expanded 190bp YoY to 16.7%.

* Reported EBITDA declined 8% YoY to INR2b (est. INR2.3b). PBT stood at INR19m (est. INR94m). APAT declined 94% YoY to INR17m (est. INR131m).

Highlights from the management commentary

* India's QSR industry is on a structural growth trajectory, underpinned by rising urbanization, growing income levels, increasing digital adoption, a higher female work participation rate, and a growing appetite for convenience.

* Stores for three new brands (TeaLive, New York Fries, and SANOOK KITCHEN) will be launched during the next quarter. These brands will initially be launched in test markets and gradually be scaled up. Hence, it will take time for them to become significant contributors to DEVYANI’s sales.

* A change in GST applicability on rent has also led to an increase in rental costs. Management highlighted that the QSR industry is not eligible for input credit on GST.

* There are ~300 varieties of biryani available in India. However, 70% of the market is dominated by the top 3-4 types, namely Hyderabad biryani, Lucknowi biryani, and Calcutta biryani, which is offered by BBK.

Valuation and view

* No material changes have been made to our EBITDA estimates for FY26 and FY27.

* Management remains committed to improving ADS and profitability in the existing network across brands, and will adopt a more cautious approach to opening PH stores in future.

* DEVYANI is focused on innovation, customer engagement, and value offerings to drive recovery. ADS and SSSG recoveries remain the key monitorables as they are vital for improving unit economics. DEVYANI is in talks with Yum for PH’s turnaround and is expected to undertake initiatives in the coming months. This will be a positive trigger for the company. The stock price has remained flat over the last three years due to growth challenges, and we believe most of the risks are largely priced in now.

* We reiterate our BUY rating on the stock. We value the Indian business at 35x EV/EBITDA (pre-IND-AS) and international business at 20x EV/EBITDA (pre-INDAS) on Jun’27E to arrive at our TP of INR200.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412