Neutral AU Small Finance Bank Ltd for the Target Rs. 875 by Motilal Oswal Financial Services Ltd

Earnings to accelerate from 2H; risk-reward favorable

Estimate loan CAGR to be sustained at 24% over FY26-28

* AU Small Finance Bank (AUBANK) remains an attractive combination of growth and earnings as the bank navigates through the last leg of stress in the MFI and Cards segments. The recovery in credit cost, margins, and loan growth (led by festival demand and GST cuts) will aid earnings, while the transition to a universal bank provides a strong runway for growth.

* Deposit mobilization continues to remain healthy, with stable deposits forming ~79% of the total deposits. During 1QFY26, NIM contracted sharply to 5.4% but is expected to bottom out in 2Q and recover thereafter.

* AUBANK’s GNPA rose 19bp QoQ to 2.47% in 1QFY26; however, it expects stress to peak in 2Q. The bank has incurred 34bp of credit costs in 1Q, and we estimate 2Q credit costs to be ~30bp. This implies a sharp deceleration in provisioning expenses during 2H as management maintains its full-year guidance of 100bp.

* We estimate AUBANK to deliver 24% loan CAGR over FY26-28, which, coupled with improvement in operating metrics, will enable a 33% earnings CAGR. The recent correction in stock price has made the risk-reward favorable. Hence, we reiterate our BUY rating on the stock with an unchanged TP of INR875 (based on 2.8x FY27E BV).

Growth outlook steady; estimate 24% loan CAGR over FY26-28

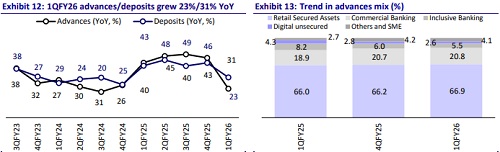

AUBANK delivered 23% YoY gross loan growth in 1QFY26. It maintained a healthy growth in FY25, despite challenges in unsecured lending segments (MFI, Cards, etc.). We estimate loan growth to remain modest in 2QFY26 as well, reflecting softer macro and ongoing slackness in the vehicle financing business, as the reduction in the GST rate has further led buyers to defer their purchase decisions. We thus believe growth trends in the vehicle business will start recovering from 3QFY26, aided by tax cuts and the festival push, while recovery in MFI and the Cards segments will enable improved growth traction. Visibility in loan growth remains strong in secured segments, i.e., Wheels, Mortgages, Small Business Loans, and Gold, while used vehicle finance (45% of VF book) continues to fare well. However, the portfolio loan-to-value is likely to go up as GST cuts drive a reduction in vehicle pricing. We estimate AUBANK to deliver 21% YoY growth in FY26E and ~24% CAGR over FY26–28E.

Deposit mobilization to continue at a healthy pace

AUBANK delivered industry-leading deposit growth of 31% YoY in 1QFY26, significantly outpacing system growth. Despite a competitive environment and sector-wide challenges in CASA mobilization, the bank sustained a CASA ratio of ~29% as of Jun’25, aided by 34% YoY growth in current accounts and 13% YoY growth in savings balances. Stable deposits (CASA + retail TD + non-callable bulk TD) form ~79% of the overall base, underscoring the stickiness and granularity of the liability base. Healthy growth in deposits has enabled AUBANK to keep a tight control on the CD ratio, which has eased to ~86%, an improvement from 92% right after the merger, while the bank maintains healthy liquidity buffers (LCR at 123%). Looking ahead, we expect deposits to grow at ~22% CAGR over FY25–28E,supported by improved brand positioning as AUBANK transitions into a universal bank.

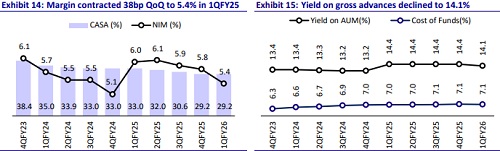

Cost of funds to ease gradually; NIM likely to recover from 3Q

Following the merger with Fincare SFB, AUBANK reported an uptick in NIMs in early FY25, aided by an improved asset mix. However, margins have since moderated, with 1QFY26 NIM contracting sharply by 38bp QoQ to 5.4%. The compression was due to loan book repricing and a declining mix of high-yielding MFI and the Card segments, along with elevated interest reversals caused by higher slippage run rates. We expect margins to dip at a more calibrated pace during 2Q and recover gradually from 3Q. This will be led by liquidity unwind, a gradual decline in funding costs, and stabilization in asset yield, as 64% of the loan book is fixed-rate in nature. The reduction in peak SA and TD rates, as AUBANK transitions into a universal bank, further provides significant leverage to manage its medium-term funding costs.

Cost ratios to remain in control after the recent improvements

AUBANK has shown a remarkable improvement in cost ratios, partly as the business growth has moderated, and the bank incurred additional costs in the prior period towards the merger with Fincare SFB. The C/I ratio has thus improved from 65% in FY24 to 56.5% in FY25. During 1QFY26, C/I improved further to 54%, aided by treasury gains, opex rationalization, and continued softness in business growth. Management expects near-term cost ratios to remain in control with a clear commitment to keeping them below 60% despite continued network expansion, product diversification, and marketing expenses as AUBANK transitions into a universal bank. We estimate the C/I ratio to be sustained at 56% in FY26. Thereafter, it would decline at a more calibrated pace of 100bp every year, aided by recovery in margins and loan growth.

Universal bank license to provide a strong growth runway

The RBI’s in-principle approval for transition to a universal bank is a structural positive. It is expected to unlock additional operating efficiency, strengthen brand acceptance, broaden access to stable deposits, and ease PSL compliance. This will allow AUBANK to further narrow the gap in deposit rates vs. peers, thereby reducing the cost of funds and improving CASA mobilization over time. The license removes limitations on loan ticket sizes and borrower exposure, opening new avenues of growth. In the medium term, this will enable AUBANK to scale up its presence in larger-ticket retail, SME, and mid-corporate segments, thereby enhancing portfolio diversification and boosting capital efficiency.

Asset quality pain nearing bottom; credit costs to dip sharply in 2HFY26

Industry trends suggest early signs of stabilization with easing forward flows and the implementation of new credit guardrails driving more prudent underwriting in the MFI segment. Asset quality in 1QFY26 reflected seasonal weakness in the MFI segment, coupled with elevated stress in the cards portfolio, driving a sharp 19bp rise in GNPA to 2.47%, though the bank maintains a stable PCR in the range of ~65%. Management expects 2QFY26 to mark the peak in stress with normalization from 2HFY26 onwards as MFI stabilizes and credit card flows taper. The bank had revised its FY26E credit cost guidance to 1% of average assets and believes that upside risk seems to be fairly in control. AUBANK has incurred 34bp of credit cost in 1Q, and we estimate 2Q credit cost to be broadly around 30bp, thus implying a sharp deceleration in provisioning expenses in 2H. Over the medium term, management reiterates its long-term sustainable credit costs at 75–85bp of total assets.

Valuation and view: Reiterate BUY with a TP of INR875

* AUBANK remains strategically well-positioned to sustain robust growth, underpinned by steady improvements in operating metrics and effective execution despite ongoing challenges in unsecured business ebbs.

* An improved asset quality backdrop should enable moderation in credit cost during 2H and help sustain it at controlled levels in the medium term.

* The RBI’s in-principle approval for a universal banking license marks a pivotal step, potentially easing regulatory limitations and enhancing AUBANK’s brand positioning. This transition is expected to drive stronger deposit mobilization and improve deposit productivity.

* While AUBANK’s NIM may face near-term pressure due to residual loan repricing, improvement in asset mix and gradual decline in funding costs should aid its margin from 2H.

* We estimate AUBANK to deliver 24% loan CAGR over FY26-28, which, coupled with improvement in operating metrics, will enable a 33% earnings CAGR. The recent correction in stock price has made the risk-reward favorable. Hence, we reiterate our BUY rating on the stock with an unchanged TP of INR875 (based on 2.8x FY27E BV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412