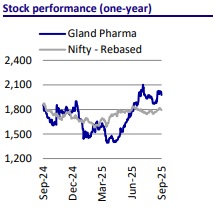

Buy Gland Pharma Ltd for the Target Rs. 2,340 by Motilal Oswal Financial Services Ltd

Growth reignited – New launches, Cenexi, and GLP-1 upside

* Gland Pharma (GLAND) witnessed a significant deterioration in its financial performance, with PAT posting a 17% compounded decline over FY22-25, to INR7b.

* This was largely led by: a) increased competition in certain products, and b) higher inventory at the industry level in base products. Profitability was further impacted by the addition of low-margin Cenexi business.

* GLAND has been working to revive its performance across the segment by focusing on all growth factors. This is reflected in two key areas: securing niche approvals for the US market and delivering higher-value offerings from its Cenexi sites.

* Notably, the company has enhanced its capabilities and upgraded equipment at its Cenexi sites to boost both revenue and profitability.

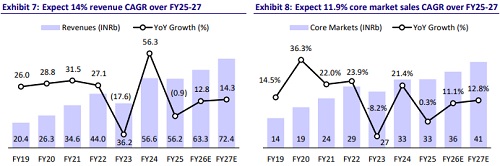

* Accordingly, we expect a 27% CAGR in earnings over FY25-27. We value GLAND at 33x 12M (20% discount to its 10-year average) forward earnings to arrive at a TP of INR2,340. Reiterate BUY.

Core markets: New launches and CMS contract to drive growth

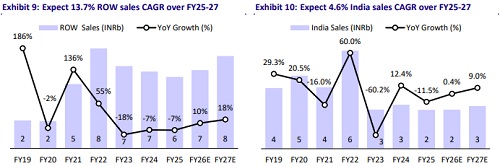

* In FY25, GLAND’s core market revenue remained stable, despite achieving its highest-ever ANDA approvals of 32, bringing the cumulative total to 122 over FY21-25.

* The moderation seen in recent quarters was largely driven by the lower off-take of Enoxaparin supplies.

* Looking ahead, new launches and the approval pipeline for Norepinephrine/Vasopressin/Cangrelor across core markets are expected to enhance the outlook for multiple markets.

* A further upside could come from g-Dalbavancin in the US market and the CMS contract in the US/EU markets, both of which are expected to contribute meaningfully from FY26 onwards.

* We expect a 12% sales CAGR in core markets over FY25-27, reaching INR41b.

Expanding capacity to capitalize on the GLP-1 opportunity

* The global semaglutide market is projected to expand at a strong 40% YoY.

* In FY26, patent expiries for oral/injectable semaglutide will open up key markets in India/Canada/China/South Africa/Brazil/Turkey/UAE, representing one-third of the global obese population.

* Novo Nordisk’s semaglutide portfolio recorded robust sales in CY24, with Ozempic contributing USD17b and Wegovy adding USD8.4b.

* Building on this momentum, GLAND is already active in Liraglutide and is strengthening its GLP-1 portfolio through CDMO contracts.

* To capture growth opportunities in Semaglutide, GLAND plans to expand its capacity from 40m to 140m units. The meaningful revenue contribution from this project is expected to start from 1QFY27 onwards.

* GLAND aims to invest INR2b to achieve a total capacity of 140m units per annum

Cenexi: Margin recovery and capacity expansion to drive growth

* In FY25, Cenexi achieved stable revenue with a marginal growth of 0.3% YoY due to disruptions in manufacturing sites/breakdown in equipment. However, in recent quarters, performance has improved due to a strategic shift from the low-value/high-volume segment towards higher-value offerings such as prefilled syringes, lyophilized vials, and ophthalmic gel.

* GLAND is enhancing Cenexi’s capabilities in pre-filled syringes, lyophilized vials, and ophthalmic gels to boost both revenue growth and profitability.

* In FY25, the performance of the Fontenay facility in Paris, a key revenue contributor, was weighed down by equipment breakdowns/regulatory inspections. Post efficiency upgrades and a new high-capacity ampoule line, operations have stabilized with full commercial production.

* The Herouville facility is set for growth, with new technology transfers, increased ophthalmic gel/vaccine production, and an upcoming pre-filled syringe line boosting capacity.

* In FY25, the Braine-l Alleud site in Belgium was temporarily affected by a lypholizer breakdown, with the remaining equipment operating at full capacity. In addition, two new lypholizers under installation are expected to be qualified by CY25, strengthening future capacity and reliability.

Incremental growth drivers: RTU bags/co-development pipeline

* GLAND’s co-development pipeline is led by radiocontrast agents, which account for over 50% of its 15-product portfolio, highlighting its focus on high-growth segments.

* The company’s RTU bags portfolio is gaining traction, with 20 products already filed and 10 more under development, reflecting its strategic push in this niche segment.

Valuation and view

* GLAND is well-positioned for growth, driven by capacity expansion from 40m to 140m units to capitalize on rising GLP-1 demand following the upcoming patent expiry in FY26. Cenexi’s operational turnaround, supported by higher-value offerings and upgraded facilities, is contributing to margin recovery and revenue stability.

* Incrementally, growth is reinforced by a focused co-development pipeline in radiocontrast agents and an expanding RTU bags portfolio. Together, these initiatives strengthen revenue visibility and support long-term growth prospects, underpinning a positive outlook.

* After three years of decline, we expect a CAGR of 14%/20%/27% in revenue/EBITDA/PAT over FY25-27.

* We value GLAND at 33x 12M (20% discount to its 10-year average) forward earnings to arrive at a TP of INR2,340. We reiterate BUY on the stock.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412