Buy ABB India Ltd for the Target Rs.6,000 by Motilal Oswal Financial Services Ltd

Weakness to persist a bit longer

ABB India’s 2QCY25 results were lower than our estimates as margins contracted significantly owing to forex fluctuations, quality control order (QCO) implementation and competitive pricing. Order inflows declined 12% YoY, while base ordering was strong. Demand remained sluggish across segments during 2QCY25 and is still far off from the highs seen two years ago. We cut our estimates by 15%/8%/2% for CY25/26/27 to bake in lower margins. ABB is currently trading at 63.7x/53.6x/45.6x on CY25E/CY26E /CY27E earnings. We believe that in the near term, ABB can underperform due to margin pressure and sluggish ordering activity in the private and government sectors. However, in the long run, we expect ABB to 1) improve its margins once the QCO implementation is over in the next few quarters and 2) improve its revenue once ordering activity starts ramping up. We, thus, maintain BUY with a revised DCF-based PT of INR6,000, implying 55x Sep’27E earnings. Scope of rerating back to higher multiples will emerge once inflows and margins start showing an improving trend.

Results impacted by forex fluctuation and higher costs due to QCO implementation

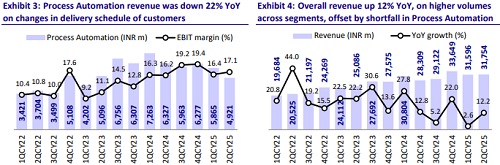

ABB’s margin and PAT came in lower than our estimates due to forex fluctuations and exceptional expenses during the quarter. For 2QCY25, revenue grew by 12% YoY, while EBITDA/PAT fell by 24%/20%. Revenue was in line, whereas EBITDA/PAT missed our estimates by 30%/27%. Electrification revenue growth was strong, while other segments were weak due to delays in clearance and decision-making in certain sectors. Gross margin declined 350bp QoQ and 470bp YoY. EBITDA margin contracted 620bp YoY to 13.0% vs. our estimate of 18.4%. Margins remained under pressure mainly due to the margin contraction in the Electrification and Robotics & Motion segments, which were affected by competitive pricing and forex loss during the quarter. PAT declined 21% YoY to INR3.5b

Ordering activity weak, hopes lie on 2HCY25

Order inflows were weak during the quarter, down12% YoY at INR30.4b. Base orders formed INR30.2b (+5% YoY), while large orders at INR130m were impacted by subdued market conditions. As a result, the order book moved up to INR100.6b. Within segments, for electrification and motion, the company saw softer demand across key areas and expects a revival in 2HCY25. Similarly, for process automation, the company is cautiously optimistic about the demand revival in 2HCY25. Government capex has started moving up but is still lower than previous highs. Private capex is yet to show meaningful signs of revival. We build in weak inflow growth in CY25 and expect it to ramp up from CY26 onward.

Margin performance can remain weak in near term

EBITDA margin declined significantly during 2QCY25 due to a sharp margin contraction seen in the electrification and motion segments. During the quarter, forex fluctuations worth INR565m were recognized pertaining to EUR and CHF appreciation. Along with this, as per BIS standards, in order to adhere to the QCO implementation timeline for certain products, the company had to import a lot of components to stay committed to delivery timelines. This resulted in higher impact of forex fluctuations and higher inventories. The QCO implementation timeline varies for different products, and many products have an implementation timeline between Mar’26 and Sep’26. Thus, we believe that for the next few quarters, ABB would have to rely on sourcing the components from domestic as well as imports. This can weigh on near-term margin performance. Incremental costs are easier to pass on for long-term contracts but difficult for short-term contracts. We, thus, build in 310bp/160bp/40bp reduction in EBITDA margin to 15.2%/16.0%/16.7% for CY25/26/27.

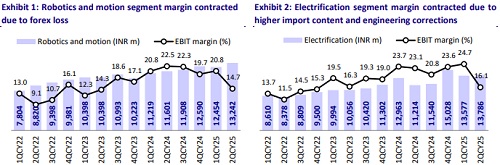

Electrification segment: QCO and forex weigh on profitability

Electrification segment witnessed 23% YoY revenue growth in 2QCY25, while PBIT margin declined 700bp YoY to 16.1% due to higher import content to comply with the QCO compliance requirements, forex volatility, and a one-time impact of INR395m during the quarter. Order inflow for the segment declined 4% YoY owing to a high base of large orders last year. Demand remains strong across key industries such as renewables, data centers, smart building, and infrastructure. We expect the segment’s revenue/orders to clock a CAGR of 21%/20% over CY25-27, with PBIT margins to be in the range of 18%-20%.

Motion and Robotics: Revenue grows amid order weakness

Motion and Robotics segments posted healthy revenue growth, though new order intake remained under pressure. The robotics segment continued to benefit from rising adoption in emerging sectors such as electronics and automotive. While revenue grew 181% YoY, margins contracted to 6.5% (vs. 14.6% in 2QCY24) due to forex volatility, and order inflow dropped 24% YoY to INR1.2b, mainly due to a delay in service orders. In motion, revenue inched up 1% YoY, supported by increased deliveries in drive products, traction systems, and services. However, order inflows declined 17% YoY due to the absence of a large railway contract seen in 2QCY24. Additionally, competitive pricing and forex headwinds compressed profitability. We expect both these segments together to clock a CAGR of 13% each in revenue and order inflows over CY25-27 on stronger execution, with PBIT margin ranging around 17%-18%.

Process Automation: Revenue drag continues amid weak ordering

Process automation remained under pressure as both order inflows (-12% YoY) and revenue (-22% YoY) declined due to delayed finalization in customer projects and changes in delivery schedules. Though demand was visible in sectors like mining and paper, execution suffered in the absence of large orders that benefited the base quarter. However, PBIT margin held up at 17.2% (vs. 16.2% in 2QCY24), supported by a favorable service mix, operational efficiencies, and project closures, which partially offset forex losses. ABB expects near-term pressure to persist due to prolonged customer decision cycles, especially in government and core infra-linked projects. Given weak ordering, we expect a negative revenue CAGR of 3% in the segment over CY25-27 with PBIT margin in the range of 15-17%.

Financial outlook

We cut our estimates by 15%/8%/2% for CY25/26/27 to bake in lower margins for Electrification and Motion segments, which are currently impacted by the QCO implementation and competitive pricing. We build in 310bp/160bp/40bp reduction in EBITDA margin at 15.2%/16.0%/16.7% for CY25/26/27. We maintain our order inflow and revenue estimates and expect order inflow activity to be a bit sluggish during CY25. We, thus, expect revenue/EBITDA/PAT CAGR of 14%/19%/18% over CY25-27.

Valuation and recommendation

We believe that in the near term, ABB can underperform due to margin pressure and sluggish ordering activity in the private and government sectors. However, in the long run, we expect ABB to improve its margins once the QCO implementation is over in the next few quarters and revenues once ordering activity starts ramping up. We, thus, maintain BUY with a revised DCF-based TP of INR6,000, implying 55x Sep’27E earnings. The scope of re-rating back to higher multiples will emerge once inflows and margins start showing an improving trend.

Key risks and concerns

Slowdown in order inflows, pricing pressure across segments, increased competition, supply chain issues, and geopolitical risks could affect our estimates and valuations.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412