The Indian Corporate Bond Market Interview September 2025 with Vishal Goenka, Co- Founder, IndiaBonds.com

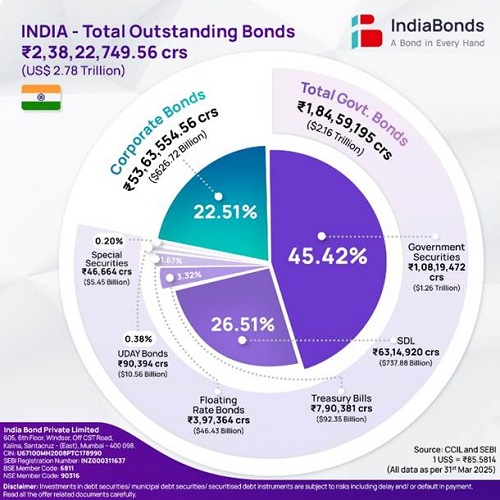

The team at IndiaBonds.com has collated data of India’s Total Outstanding Bonds. The source of the data is Clearing Corporation of India Limited (CCIL) and Securities and Exchange Board of India (SEBI).

The total outstanding Bond market stood at ~INR 238 lac crores (US$ 2.78 trillion) at the end of 31st March 2025 (Source: CCIL, SEBI). The market grew by 10.2% from INR 216 lac crores in FY 2023-24.

The corporate Bonds market stood at 22.51% of the overall market size and outpaced the overall growth standing at INR 53.64 lac crores or +13.4% when compared with FY 2023-24.

Interestingly the corporate bond market contributed 29% of the overall growth of the bond market and grew by INR 6.4 lac crores (US$ 60 billion) versus overall bond market expansion by INR 22.09 lac crores.

The growth in the corporate bond market can be attributed to various factors :

* Emergence of SEBI-regulated Online Bond Platforms (OBPs) which is accelerating retailisation and transparency in the corporate bond markets

* Declining interest rate cycles coupled with equity volatility which has shifted asset allocation to and demand for fixed income securities

* Slower transmission of interest rate cuts in the banking sector making the capital markets access more lucrative for corporates

In the Central Government securities section Treasury Bills, Floating Rate Bonds, Uday Bonds and Special securities declined in size YoY. Government securities stood at INR 108 lac crores (+9.85%), SDL at INR 63.15 lac crores (+14.47%), Treasury Bills at INR 7.9 lac crores (-9.3%).

The change in the composition of Central Government securities points to more long-term funding secured as dependence on T-Bills is on the decline as well as the rise in direct funding at State Government level.

The outlook for corporate bond market growth remains bullish for FY 2025-26as much of the conditions mentioned above remain the same. We continue to be in a downward interest rate cycle faced with economic and global political uncertainties. The number of transactions in retail segment continue to grow exponentially this year after a reported 327% growth in number of transactions last year according to a report by BSE.

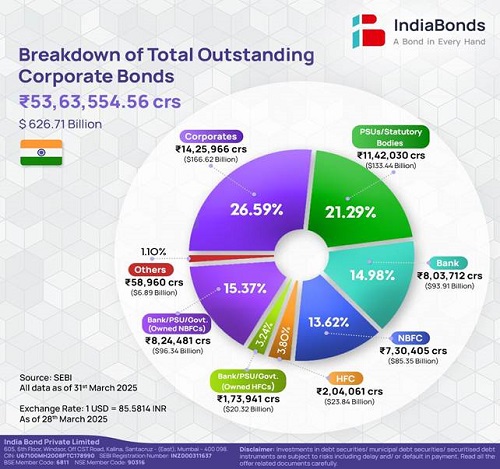

The team at IndiaBonds.com has collated data on the Breakdown of Total Outstanding Corporate Bonds. The source of the data is Securities and Exchange Board of India (SEBI).

Indian Corporate Bond Market grew to INR 53.635 lac crores (US$ 627 billion) as of 31-Mar-2025 (Source: SEBI) - that's higher than entire country GDPs of nations like Sweden, Ireland, Thailand, UAE, Austria, Singapore etc. (Worldmeter data estimates 2023)

The Indian corporate bond market grew by 13.42% in INR terms in FY 2024-25 from a base of INR 47.29 lac crores at the end of 31-Mar-2024. This far outpaced the overall government bond market growth for the year and its share edged higher to 22.5% of the overall bond market size in India.

Interestingly we have a composition and breakup of the corporate bond market for the first time from Sebi. Some stark highlights stood out:

* The private sector (excluding PSU and banks) stood at 45.12% of the total corporate bond market

* The NBFC sector (private and PSU) was 29% of total market

* Financial sector (banks, NBFCs, HFCs) comprised 51% of the total making the non-financial sector at a high 49%

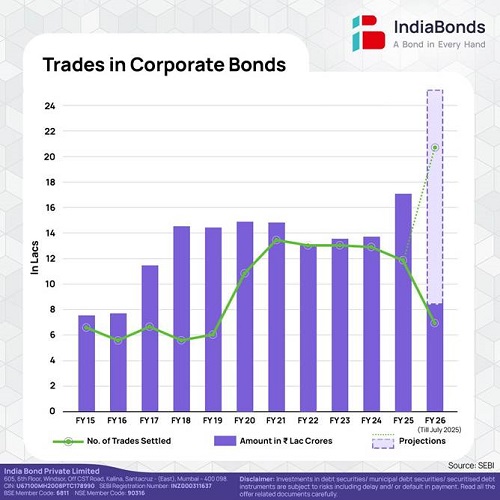

The team at IndiaBonds.com has collated data on the Trades in Corporate Bonds in India. The source of the data is Securities and Exchange Board of India (SEBI)

For FY 24-25 this volume stood at INR 17.1 lac crores (~US$200bn) which is a +24.5% jump from previous year where volumes were almost flat lining for 7 years! However, the number of trades fell to ~11.9 lacs (1.19 million). Remember the entire corproate bond market stood at US$ 627 billion at FY 24-25 (+13.42% vs FY 23-24)

What's exciting is that for the 4 months of FY 25-26 we are already at a traded volume INR 8.47 lac crores which if annualised (3x for 12 months) will make the volume grown by a staggering 48.5% for FY 25-26. But here is the gem .. the growing power of retail - number of trades are already at 6.9 lacs and when annualised could reach 20.69 lacs (2.07 million) implying a 74% jump!!

The above are base and linear annualised estimates. Of course, we could get variations - up or down - as we progress into the seasonality of the full financial year. However, the writing on the wall is clear. After flat lining for 6-7 years > The corporate bond market in India is undergoing a cathartic change with the advent of OBPPs

Above views are of the author and not of the website kindly read disclaimer

Tag News

Comments on US Fed Rate Cut, FOMC`s 25 bps Rate Cut 17th September 2025 by Mr. Vishal Goenka...