Debt and Forex Market Update September 2025 by CareEdge Ratings

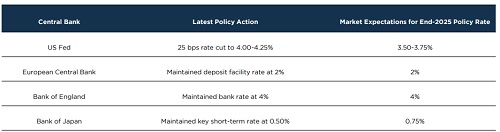

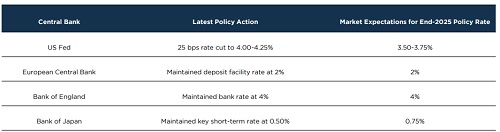

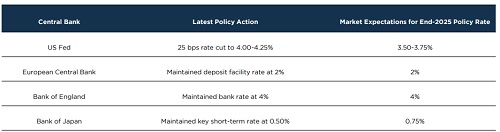

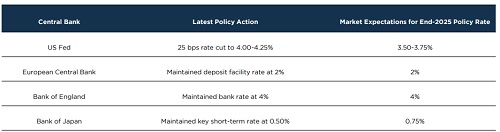

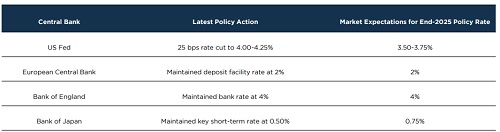

Fed Cuts Rates; ECB, BoE and BoJ Hold Steady

* The Fed lowered its policy rate by 25 bps in September, with the median dot plot now pointing to two more cuts this year, up from one previously. Weak labour market data has strengthened market expectations of further easing.

* Inflation in Japan has been easing but has consistently stayed above the central bank’s 2% target for more than three years. The market expects a potential rate hike by the Bank of Japan in the October policy, though the decision remains a close call.

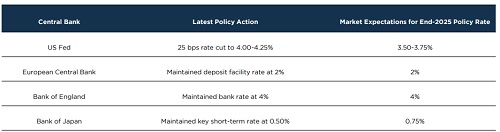

India CPI Inflation Rises Slightly but Remains Contained

* CPI inflation rose to 2.1% in August as the base effect faded and food prices moved out of deflation, but remained comfortable. Core inflation stayed soft at 4.1%.

* GST rate cuts are expected to lower CPI inflation by 70–90 bps annually, assuming effective pass-through.

* The upcoming introduction of the new CPI series with a 2024 base year will be important to track, as it could alter the estimated impact of GST changes.

* Alongside subdued food prices and contained demand pressures, we project average CPI inflation at 2.7% for FY26.

* We do not expect an RBI rate cut in the October MPC, but prolonged 50% US tariffs could weigh on growth and may reopen room for a 25 bps cut later in the year.

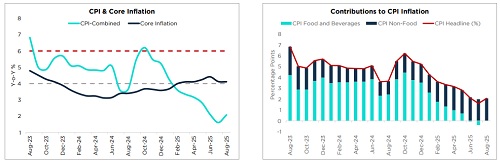

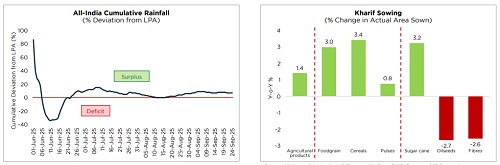

Cumulative Rainfall 7% Above the LPA

* The Southwest monsoon remained favourable, standing 7% above the Long Period Average (LPA) as of 24 September.

* Total sown area rose 1.4% YoY, and oilseeds and fibres sowing remained weak, as of 19 September.

* This year’s monsoon withdrawal has been early, with parts of Rajasthan already witnessing retreat; going forward, IMD expects further withdrawal over northwest India.

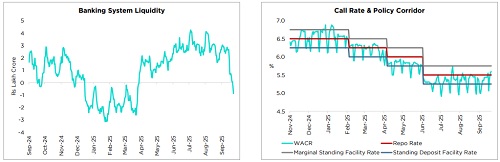

Liquidity Slips into Deficit

* Banking system liquidity slipped into a deficit, largely driven by tax outflows.

* The WACR averaged 14 bps below the policy rate during the month, but has recently moved above the repo rate as liquidity conditions tightened.

* Amidst tight liquidity conditions, the RBI has been conducting VRR auctions.

* Liquidity conditions are likely to stay tight in the near term but are expected to return to surplus, supported by government month-end spending and the second tranche of the CRR cut on 04 October.

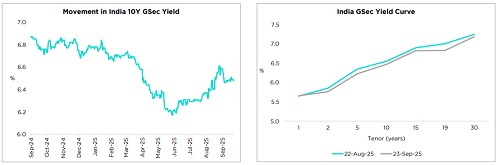

10Y GSec Yield Remains Elevated

* India 10Y GSec yield reduced by around 7 bps over the past month, supported by limited fiscal impact of GST rationalisation and prospects of inclusion of Indian bonds in the Bloomberg Global Aggregate Index. However, yields remain elevated versus end May 2025.

* Going forward, markets await the borrowing calendar for the second half of the fiscal year. We expect borrowings to be largely in line with the budget, but the tenor-wise distribution will be key to watch amidst market concerns about oversupply of longer-tenor debt.

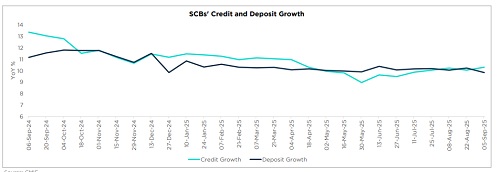

Bank Credit Growth Outpaced Deposit Growth

* Credit growth slowed to 10.3% YoY as of 05 September, as compared to 13.4% in the same period last year.

* Deposit growth also slowed to 9.8% YoY as compared to 11.2% last year.

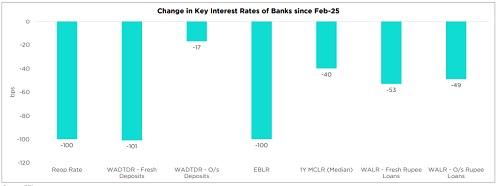

Continued Policy Rate Cut Transmission

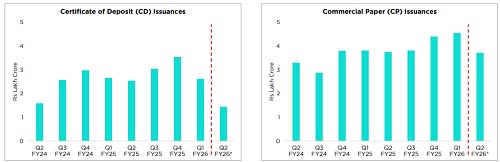

CD Issuances Remain Moderated, CP Issuances Maintain Momentum

* FYTD CD issuances reached Rs 4.1 lakh crore (as of 05 September), marking a 10.1% YoY decline.

* FYTD CP issuances rose to Rs 8.2 lakh crore (as of 15 September), showing a 17% YoY increase.

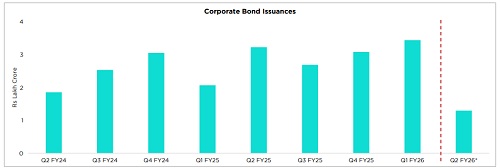

Corporate Bond Issuances Muted in Q2 FY26 (Jul-Aug)

* Corporate bond issuances moderated to Rs 1.3 lakh crore in Q2 FY26 (Jul-Aug) as compared to Rs 2.0 lakh crore in the same period last year.

* However, FYTD issuances rose 18% YoY to Rs 4.7 lakh crore (up to August).

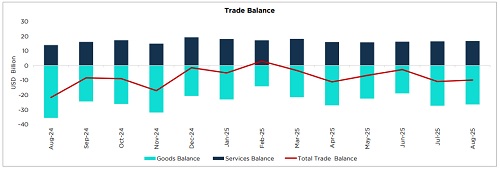

FYTD (up to Aug) Trade Balance Improves Led by Services

* On an FYTD basis, the goods deficit was stable at USD 122.4 billion (vs USD 122.5 billion a year ago), while the services surplus improved to USD 81.0 billion (vs USD 68.2 billion).

* As a result, the overall trade deficit (goods & services) eased to USD 41.4 billion FYTD, compared with USD 54.3 billion in the same period last year.

* We expect India’s goods exports to soften in FY26, weighed down by slower global growth and tariff war. Non-petroleum exports are projected to contract by 0.8% YoY in FY26, a reversal from the 6% expansion seen in FY25.

* In contrast, services exports are likely to remain a key support, with growth estimated at 8.2% YoY in FY26, despite some headwinds.

* Recent developments, such as the increase in H-1B visa fees, could weigh on India’s services sector and lingering uncertainty warrants close monitoring.

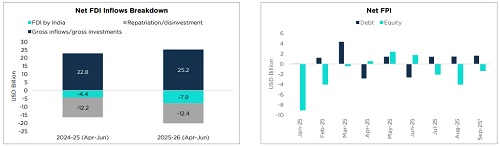

Sluggish Net FDI; FPI Pressures Remain

* Net FDI inflows moderated to USD 4.9 bn in Q1 FY26 (–21% YoY), as a sharp 79.6% jump in outward FDI outweighed a 10.5% rise in gross inflows.

* August saw the highest net FPI outflows in four months at USD 2.3 bn (equity + debt), while September (as of 24 September) has recorded marginal net inflows of USD 0.2 bn.

* CYTD net FPI outflows (equity + debt) totalled USD 10.3 bn, driven by equity outflows of USD 16.2 bn, partially cushioned by debt inflows of USD 6.0 bn.

* Looking ahead, net FDI inflows are likely to stay muted in FY26.

* Developments around the US-India trade deal and recent US H-1B visa fee announcement may have a bearing on market sentiments and FPI flows.

Rupee Trading Near Record Lows

* The rupee has depreciated by 0.9% against the dollar over the past month, weighed down by the implementation of US secondary tariffs, the recent announcement of a hike in US H-1B visa fees and persistent FPI outflows.

* We expect the rupee to remain under pressure in the near term. However, the RBI is likely to intervene to limit currency volatility.

* We maintain our FY26-end forecast of 85–87 for USD/INR, supported by a soft dollar, a firm yuan, India’s manageable CAD, and the prospects of a US–India trade deal.

* We expect India’s CAD to be 0.9% of GDP in FY26 (with US tariffs at 25%). However, if the 50% tariff persists, CAD could widen slightly to 1.2–1.3% of GDP but would remain manageable.

* FX reserves near a record high of USD 703 bn, providing the RBI ample room to intervene in the currency market if necessary.

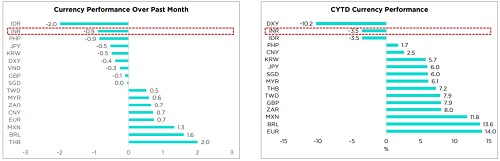

Global Currency Trends

* The dollar index has fallen by about 10% so far this year, pressured by US trade policy uncertainty, fiscal concerns, and expectations of Fed rate cuts. The outlook remains tilted to the downside as labour market weakness may prompt further policy easing.

* A weaker dollar, stronger PBOC fixings, and buoyant Chinese equities are likely to support the yuan in the near term. That said, the expiry of the US–China trade truce in November remains a key monitorable.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Technical Forecast : Nifty tanks; crucial support at 24450-24500 band by Vaishali Parekh, Vi...