Daily Derivatives Report 24th September 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,255.8 (-0.1%), Bank Nifty Futures: 55,723.8 (0.5%).

Nifty Futures and Bank Nifty Futures experienced a day of consolidation and profit booking yesterday. After an initial positive start, the indices pared gains and slipped into the red, reflecting cautious investor sentiment. Nifty Futures fell 21.9 points with a long unwinding indicated by a 0.7% decrease in open interest to 177.9 Lc, a decline of 1.3 Lc shares. In contrast, Bank Nifty Futures rose 252 points, indicating a long build-up with a 3.8% increase in open interest to 24.1 Lc, an addition of 87,290 shares. The premium for Nifty futures increased to 86 points from 75, while the Bank Nifty premium rose to 214 points from 187. Benchmark indices closed with minor losses for the third consecutive session amid a volatile trading environment driven by multiple ongoing IPOs and the weekly F&O expiry of the Nifty. Concerns over the sharp rise in H-1B visa fees further weighed on investor sentiment. While FMCG, realty, and IT shares declined, PSU Bank, metal, and auto stocks advanced. Despite negative global cues, domestic factors like robust festive demand and recent GST rate cuts provided some support, boosting the auto, metal, and financial sectors and preventing a more significant market decline. The India VIX, a measure of market volatility, rose 0.7% to settle at 10.63, reflecting a cautious and uncertain sentiment among investors. The Indian Rupee depreciated against the US Dollar, with the USD-INR pair trading around the 88.73 level, influenced by persistent FII outflows and concerns over US tariffs, which could impact Indian remittances and widen the trade deficit.

Global Movers:

US stocks fell yesterday on signals from Fed chair Powell that the policy path going forward will be a challenge. The S&P 500 fell 0.6%, while the Nasdaq 100 finished 0.7% down. Recent data around labor markets and inflation has been mostly mixed, and investors expect dissent between FOMC members to grow going forward. The focus now shifts to Friday's PCE, with the 3% mark closely watched -- anything above this may force stocks lower. In related markets, the VIX rose 3.4% while the dollar index and the US 10-year treasury yield fell. Gold ended 0.5% higher at $3764, but not before making another record high just shy of $3800, while brent rose 0.4% to finish just under $68 as sentiment was boosted due to rising risks to Russian crude oil.

Stock Futures:

AU Bank, PNB Housing, SAMMAANCAP, and Mphasis each recently experienced a notable surge in trading volume and heightened market volatility. These pronounced changes in market dynamics were due to distinctive factors specific to each firm.

AU Small Finance Bank Ltd. (AUBANK) surged 3.5% following the Reserve Bank of India's landmark in-principal nod to transition into a universal bank, marking a regulatory milestone and unlocking broader growth avenues beyond its lending-centric model. The stock registered a Long Addition with a 2.6% rise in open interest, adding 626 contracts to a total of 25,142. In the options space, call open interest declined by 427 contracts to 7,824, while put positions expanded by 668 contracts to 6,863. This shift suggests a cautious build-up of downside protection by option buyers, with writers likely adjusting to evolving sentiment amid structural transformation.

PNB Housing Finance Ltd. (PNBHOUSING) climbed 3.5% amid renewed buying interest, on the back of its recent board’s approval to raise up to Rs 5,000 Cr via Non-Convertible Debentures, reinforcing investor confidence in its capital strategy. The stock exhibited Short Covering, shedding 4.2% in open interest with a reduction of 1,179 contracts, bringing the total to 26,688. Futures premium narrowed sharply to 0.9 points from 3.35, reflecting tempered bullishness. Option data revealed a rise of 776 contracts in calls to 9,720, while puts contracted by 154 to 9,292, driving the PCR down to 0.96 from 1.06, indicating a tilt toward call writing as optimism moderates post-announcement.

Sammaan Capital Ltd. retreated 4.1% amid profit-booking and broader underperformance, triggering a Long Unwinding with a 3.9% drop in open interest and a reduction of 856 contracts to 20,979. Futures premium widened to 0.53 points from 0.2, hinting at residual bullish undertones despite price erosion. Option positioning saw call open interest fall by 1,144 contracts to 6,542, while puts dropped by 517 to 5,543, lifting the PCR to 0.85 from 0.79. The simultaneous decline in both call and put positions suggests waning directional conviction, with option writers likely paring exposure amid fading momentum.

Mphasis Ltd. declined 3.1% as part of a sector-wide IT sell-off triggered by concerns over increased H-1B visa fees in the US, despite the company’s clarification of minimal operational impact due to strategic hiring shifts. The stock saw Long Unwinding with a 4.2% contraction in open interest, shedding 698 contracts to 15,970. In options, call open interest surged by 1,938 contracts to 9,450, while puts rose by 634 to 5,353, pushing the PCR down to 0.57 from 0.63. The disproportionate rise in call positions signals aggressive call writing, reflecting bearish sentiment as traders brace for further downside.

Put-Call Ratio Snapshot:

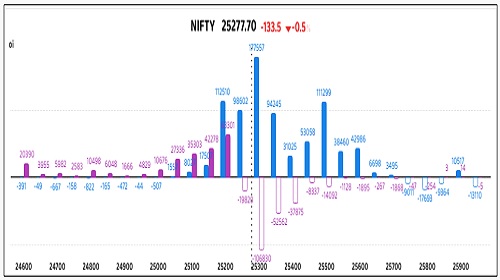

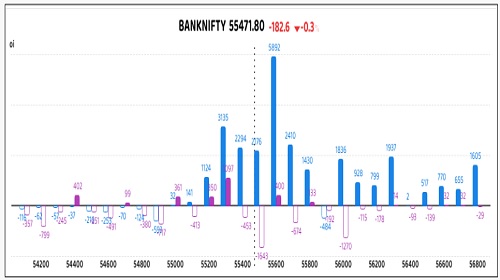

The Nifty put-call ratio (PCR) fell to 0.97 from 1.01 points, while the Bank Nifty PCR rose from 0.97 to 1.12 points.

Implied Volatility:

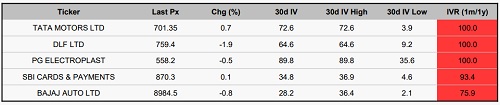

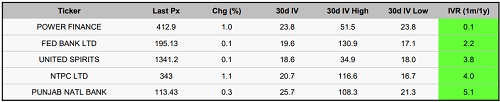

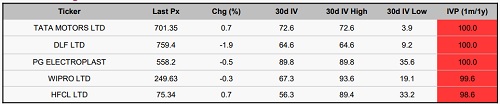

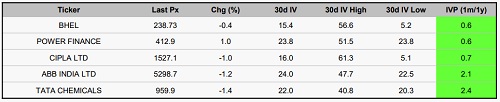

Tata Motors and DLF Ltd. are exhibiting a high implied volatility (IV) ranking of 100%, indicating that the market anticipates significant price swings. This has resulted in expensive options, with a realized volatility of 73% and 65% respectively. This environment carries heightened risk for traders, as the elevated cost of options increases the capital required to initiate a position, and the potential for erratic price movements is substantially greater. In contrast, PFC and Federal Bank have the lowest IV rankings within the group, with a realized volatility of 20% and 25%, respectively. This signifies a more stable trading environment and consequently, their options are more affordably priced. In such a low-volatility context, straightforward strategies, such as the direct purchase of calls or puts, are more attractive. The lower premiums reduce the cost of trade entry and mitigate risk from unexpected market fluctuations. Furthermore, low volatility is often beneficial for option sellers, as the reduced likelihood of substantial price swings makes it more probable, they will retain the premiums they collected.

Options volume and Open Interest highlights:

Tata Chemicals and Torrent Power are exhibiting strong bullish sentiment, evidenced by a high call-to-put volume ratio of 5:1. This robust demand for call options indicates that a significant number of market participants are anticipating a price appreciation. However, this heightened interest has led to an increase in option premiums, making entry more costly for prospective buyers. Conversely, Sun Pharmaceutical and Godrej Consumer are displaying notable bearish sentiment, as shown by their high put-to-call volume ratios. The accumulation of put options suggests that traders are positioning for a potential price decline. This bearish outlook may indicate that these stocks are approaching oversold conditions, which could attract contrarian investors who perceive them as undervalued and likely to experience a future rebound. Crompton Greaves is experiencing conflicting market sentiment, with a simultaneous increase in both call and put open interest. This mixed positioning from traders suggests a high potential for short-term volatility, as the market seeks a clear direction. Adani Green appears to be on a potential upward trajectory. A recent surge in call option buying indicates growing investor confidence and a strengthening bullish trend. For Suzlon Energy, the accumulation of put options signals a cautious stance from market participants. While a clear directional bias is not yet established, this increased put activity could lead to higher short-term volatility. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, a notable shift of 6,570 contracts reflects a divergent market sentiment among key participants. While clients and Foreign Institutional Investors (FIIs) exhibited a bullish outlook by cumulatively increasing their long positions by 1,814 and 2,076 contracts respectively, proprietary traders decisively unwound a substantial 6,570 contracts, signalling a strong bearish bias and a strategic divergence from the positive sentiment of other market players. Concurrently, the stock futures segment saw a total change of 12,940 contracts, revealing a harmonized positive sentiment, with clients and FIIs bolstering their positions by 1,348 and 11,592 contracts, respectively. This overwhelmingly bullish accumulation, particularly by FIIs, was only minimally offset by a marginal unwinding of 273 contracts by proprietary traders. This contrast between a contentious index-level positioning and a unanimous bullish stance in specific stocks highlights a nuanced market dynamic.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Tag News

Technical Forecast : Nifty tanks; crucial support at 24450-24500 band by Vaishali Parekh, Vi...