Daily Derivatives Report 19th September 2025 by Axis Securities Ltd

The Day That Was:

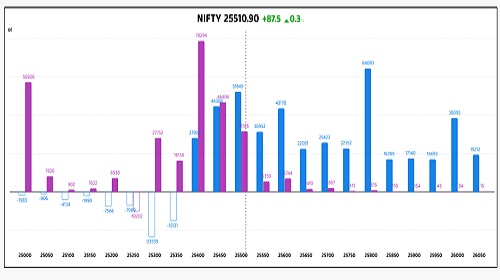

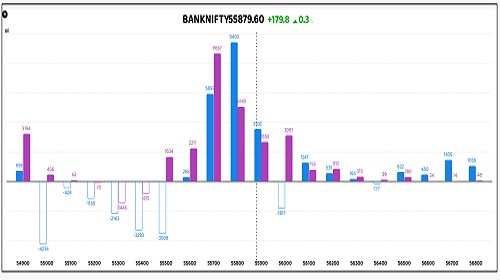

Nifty Futures: 25,510.9 (0.3%), Bank Nifty Futures: 55,879.6 (0.3%)

Nifty Futures and Bank Nifty Futures extended their gains for the third consecutive session, supported by positive global cues following the US Federal Reserve’s 25 bps rate cut. Nifty Futures rose 87.5 points, accompanied by a 0.1% increase in open interest to 1,79,29,050 contracts, an addition of 26,400 shares signalling a long build-up. In contrast, Bank Nifty Futures gained 179.8 points while open interest declined by 5.6% to 24,02,015 contracts, reflecting a reduction of 1,41,750 shares and indicating short covering. The futures premium narrowed, with Nifty Futures premium slipping to 87 from 93 points and Bank Nifty Futures premium contracting from 207 to 152 points. The indices maintained a steady upward trajectory throughout the day, with Nifty touching its highest level since July. The broader market witnessed a sustained recovery, supported by strength in the financial services, IT, and pharma sectors, while media, PSU Bank, and realty stocks underperformed. The India VIX fell 3.53% to 9.89, its lowest level in nearly a year, indicating subdued near-term volatility expectations. On the macro front, optimism from recent GST reforms and progress in India-US trade negotiations further buoyed sentiment, though caution prevailed as the Fed signalled a measured path for future easing. Meanwhile, the Indian Rupee ended its four-day winning streak, weakening by 31 paise to close at 88.13 against the US Dollar, aligning with regional currency trends amid a rebound in the greenback post-Fed announcement.

Global Movers:

In a rare event yesterday, all four major US indexes simultaneously clocked new records. The S&P 500 gained 0.5% to 6632, the Nasdaq 100 climbed 0.95%, the Dow rose 0.3% and the Russel 2000 advanced 2.5% to its first closing record since November 2021. The prospect of more rate cuts from the Fed is acting as a tailwind for stocks. Meanwhile, data showed that jobless claims dropped by the most in almost four years, reversing a shock jump seen in the previous week. In related markets, the VIX closed flat, while the dollar index and the 10-year treasury yield gained for a second day. Gold finished 0.4% lower at $3,644 in a session peppered with plenty of volatility, while Brent fell for a second day and closed under $67.50 as President Trump pressured allies to stop purchasing Russian oil.

Stock Futures:

Biocon Ltd, HFCL Ltd, LIC Housing, and Tata Chemicals all registered a significant increase in trading volume and heightened market volatility. This uptick in market activity and dynamics was directly tied to firm specific factors.

Biocon Ltd. experienced a notable surge, its stock price rallying by 3.9% on the back of pivotal company news. The ascent was fueled by the U.S. Food and Drug Administration's (FDA) approval of its subsidiary's two denosumab biosimilars, Bosaya and Aukelso, further buoyed by a provisional interchangeability designation that could unlock significant market penetration. This decisive price gain triggered a short covering event, with futures open interest contracting by 0.9%, seeing a shedding of 150 contracts to land at a total of 16,478. In the options arena, a nuanced picture emerged; while call option open interest declined by 673 contracts to 6,310, put option contracts saw an addition of 738, elevating their total to 4,447, indicating that while some bullish positions were liquidated, a new segment of market participants initiated defensive or bearish bets.

HFCL Ltd. rode a renewed bullish wave, with its stock price advancing by 3.7% following the recent Andhra Pradesh government's approval of a 1,000acre land allotment for defence manufacturing facilities, a significant catalyst within a sector enjoying robust tailwinds. The powerful upward momentum was confirmed by a long addition, as open interest in futures ballooned by 15.1%, adding 2,460 new contracts to a total of 18,799. This overwhelming demand saw the futures' premium to the spot price expand by 0.26 points to 0.34, while the Put-Call ratio (PCR) decreased to 0.53 from 0.72. The options data unequivocally mirrors this aggressive bullish sentiment; a massive addition of 3,286 call options propelled their total open interest to 7,327, while put options only saw an increase of 944 contracts to 3,849, signalling that bulls are actively initiating new, directional positions.

LIC Housing Finance Ltd. ascended with a 3.6% gain, propelled by a combination of strong quarterly results and a buoyant outlook for the housing finance industry. The positive shift catalysed a significant short covering event in the futures market, with open interest contracting by 2.9% as 850 contracts were shed, reducing the total to 28,472. Despite the price surge, the futures' premium to the spot price narrowed by 0.6 points to 1.15, suggesting a tempered enthusiasm in the derivatives segment. The PCR also declined to 0.57 from 0.76. Conversely, the options landscape saw a substantial influx of bullish bets, with call option open interest swelling by 3,996 contracts to a total of 12,088, overshadowing the addition of 744 put option contracts, highlighting that call writers are building up their positions in expectation of limited upside.

Tata Chemicals Ltd. retreated with a price decrease of 1.9%, reversing a prior upward trend as headwinds in the global soda ash market and price declines weighed on sentiment. The pullback was accompanied by a long unwinding, with futures open interest modestly declining by 0.7% as 62 contracts were shed, bringing the total to 8,317. This ebbing momentum was starkly reflected in the futures premium, which collapsed by 3.5 points to 2.05, and a declining Put-Call ratio (PCR) from 0.48 to 0.43. While the stock's price eroded, call option open interest surprisingly grew by 1,733 contracts to 15,367, while put options added only 104 contracts to 6,593, suggesting that bearish sentiment is gaining traction and that market participants are opting to write new call options in anticipation of further price consolidation.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) fell to 1.16 from 1.21 points, while the Bank Nifty PCR rose from 1.08 to 1.1 points.

Implied Volatility:

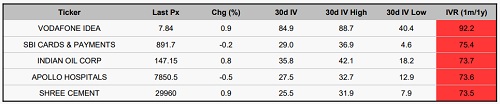

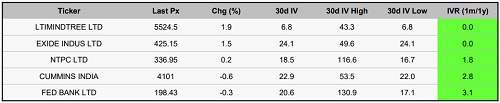

SBI Cards and Indian Oil Corporation (IOC) are currently trading with elevated implied volatility (IV) levels of 75% and 74%, respectively. These heightened IV readings indicate that the market anticipates significant price movements in the near term, resulting in inflated option premiums. Such conditions present increased risk for traders, particularly those deploying options-based strategies, as higher premiums raise the cost of position entry and amplify the impact of unpredictable price swings. In contrast, Exide Industries and NTPC are exhibiting the lowest implied volatility levels within the observed group, with IVs at 24% and 19%, respectively. This suggests relatively stable price action in the underlying securities, leading to more moderately priced options. In low-IV environments, straightforward directional strategies such as buying calls or puts typically offer more favourable risk-reward dynamics, as lower premiums reduce the cost basis while minimizing exposure to sudden market volatility.

Additionally, subdued volatility conditions tend to benefit option writers, as the reduced likelihood of sharp price movements increases the probability of retaining collected premiums, thereby enhancing overall strategy effectiveness.

Options volume and Open Interest highlights:

KFintech and KPIT Technologies are currently exhibiting strong bullish momentum, as evidenced by their elevated call-to-put volume ratios of 6:1 and 5:1, respectively. This pronounced skew in options activity reflects a high level of investor confidence in continued price appreciation. However, while the surge in call option demand highlights positive market sentiment, the corresponding increase in premiums may reduce the attractiveness of initiating fresh long positions at current levels. Conversely, Bajaj Finance and VEDL are experiencing significant bearish sentiment, indicated by elevated put-to-call volume ratios. The uptick in put option activity suggests growing pessimism among market participants, potentially signaling that these stocks are approaching oversold levels. This may, in turn, attract interest from contrarian investors seeking value in fundamentally sound counters under pressure. Sammaan Cap and Idea are witnessing a divergence in market expectations. The simultaneous rise in open interest (OI) for both call and put options suggests a buildup in positions on both sides, pointing to potential short-term volatility as participants maintain conflicting outlooks on future price direction. Meanwhile, Phoenix Mills and C G Power appear to be positioned for a potential upward move, supported by a recent increase in call option buying an indication of strengthening investor confidence in the near-term upside. On the other hand, Bharat Forge and Amber Ltd are seeing increased accumulation in put options. This trend signals a cautious stance among market participants, which could translate into elevated short-term volatility, despite the absence of a clear directional bias at this stage. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In index futures, a notable shift in market positioning saw a net increase of 9,284 contracts. This was primarily driven by a significant bullish stance from Foreign Institutional Investors (FIIs), who augmented their long positions by 7,001 contracts. Conversely, this was offset by a bearish sentiment among both retail clients and proprietary traders, who reduced their exposure by 3,889 and 5,395 contracts, respectively, indicating a divergence of opinion regarding the market's direction. Meanwhile, in stock futures, a total of 5,424 contracts changed hands, primarily reflecting a positive bias from clients who added 3,446 contracts. This was complemented by a modest increase of 493 contracts from FIIs. However, this overall positive momentum was entirely counteracted by proprietary traders, who aggressively unwound their positions by 5,424 contracts, suggesting a cautious outlook despite the client-driven optimism.

Nifty

Bank Nifty

Stocks with High IVR:

Stocks with Low IVR:

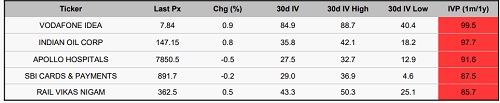

Stocks With High IVP:

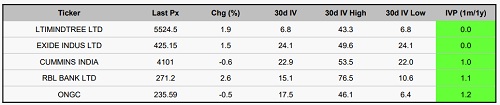

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Tag News

Technical Forecast : Nifty tanks; crucial support at 24450-24500 band by Vaishali Parekh, Vi...