Daily Derivatives Report 17th September 2025 by Axis Securities Ltd

The Day That Was:

Nifty Futures: 25,331.4 (0.7%), Bank Nifty Futures: 55,339.6 (0.4%).

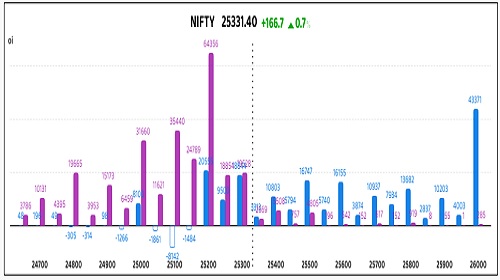

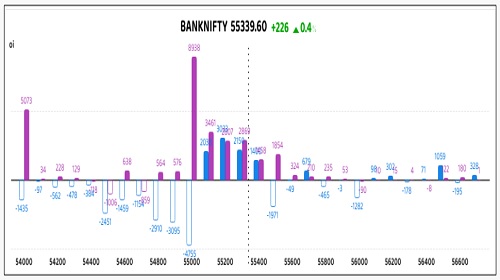

Nifty and Bank Nifty futures continued their positive trajectory, closing the day with significant gains amid a bullish market sentiment. Despite some intraday volatility, both domestic benchmarks ended with major gains, supported by positive developments in U.S.-China and U.S.-India trade negotiations. Buying interest was particularly strong in banking heavyweights, buoying investor confidence. The primary driver of this optimism was renewed global hopes for an interest rate cut by the U.S. Federal Reserve, with the market widely anticipating a minimum 25 bps reduction this week. Nifty Futures rose 166.7 points, with a 2.3% decrease in open interest to 1,80,81,675 shares, a reduction of 4,30,200 shares, indicating short covering. Similarly, Bank Nifty Futures climbed 226 points, also experiencing a 2.3% decrease in open interest to 26,74,140 shares, a decrease of 63,350 shares, which also points to short covering. The Nifty futures premium narrowed to 92 points from 96, while the Bank Nifty premium decreased to 192 from 226 points. Excluding the FMCG sector, all other sectoral indices closed in the green. The India VIX, a key measure of market volatility, reflected this sense of calm by closing at a low of 10.2775, down from its previous close, suggesting that market participants do not expect significant near-term volatility. Meanwhile, the Indian Rupee has recently been under pressure against the U.S. Dollar, trading around the 88 mark.

Global Movers:

US stocks slipped yesterday as traders awaited the Fed's decision later today. The S&P 500 and Nasdaq 100 both slipped 0.1%. Meanwhile, data showed that retail sales beat expectations in August, sending a message that the economic slowdown is not as bad as feared. In related markets, the VIX jumped 4.3% to 16.4, while the dollar index and the 10-year treasury yield continued their slide. Gold rose 0.3% and settled at a new record of $3,690/ounce after breaking through $3,700 during the day, while brent finished near $68.50 for its sixth gain in seven days on concerns about Ukraine's attacks on Russian oil infrastructure.

Stock Futures:

Cyient Ltd, GMR Airports, Suzlon Energy, and Varun Beverages all saw a significant rise in trading volume accompanied by increased volatility. These company-specific events, along with a broader shift in market sentiment, drove the heightened price movements and trading activity in these stocks.

Cyient Ltd. surged forward, propelled by a key strategic partnership between its subsidiary, Cyient Semiconductors, and US-based Anora. This collaboration, poised to establish a new test floor in Bangalore and deliver turnkey semiconductor solutions, catalysed a "Long Addition" in the stock. The stock's price gained 4.2% as open interest swelled by 5.5%, reaching a current future open interest of 7,976 contracts with the addition of 413 new contracts. In the options arena, call open interest stood at 4,395 contracts and put open interest at 2,890 contracts; a fresh addition of 207 call contracts and 666 put contracts suggests that while there is an aggressive stance by put writers, call writers are showing caution.

GMR Airports Ltd. soared on the back of favourable developments, including a decisive Delhi High Court ruling and the unveiling of a new special purpose vehicle for a cargo city project. The company's stock rallied with a 3.9% price gain, while a "Short Covering" dynamic was evidenced by a 0.4% decrease in open interest, shedding 119 contracts to a current future open interest of 31,090 contracts. In the options market, call open interest totalled 10,423 contracts against 5,936 put contracts, with a notable addition of 730 call contracts and 1,525 put contracts. The increasing put-call ratio from 0.46 to 0.57, coupled with an aggressive stance by put writers, suggests a bullish undertone.

Suzlon Energy Ltd. ascended on the news of a monumental 838 MW wind power project secured from Tata Power Renewable Energy, marking the company’s largest order for FY26 and its second-largest ever. The stock’s 1.6% price gain, coupled with a 10.2% surge in open interest, signals a "Long Addition," with 1,798 new contracts swelling the current futures open interest to 19,398. In the options segment, call open interest stands at 14,243 contracts and put open interest at 8,788 contracts; the addition of 49 call contracts and 1,218 put contracts, alongside an increasing put-call ratio from 0.53 to 0.62, indicates a dominant stance by put writers, lending significant support to the stock price.

Varun Beverages Ltd. faced headwinds, with its stock declining 1.9% amidst broader sector weakness and disappointing sales volume and revenue in its Q2 results, attributed to unseasonal rainfall. This "Short Addition" was characterised by a 5.5% increase in open interest, as 1,884 new contracts were added, pushing the current futures open interest to 36,156. The futures closed at a premium of 2.15 points to the spot price, a decrease of 0.05 points from the previous session's premium. In the options market, call open interest sits at 16,237 contracts and put open interest at 6,808 contracts, with a significant addition of 2,329 call contracts and 822 put contracts, signalling a cautious stance by call writers and an aggressive stance by call buyers, reflecting a bearish outlook on the stock.

Put-Call Ratio Snapshot:

The Nifty put-call ratio (PCR) rose to 1.29 from 1.14 points, while the Bank Nifty PCR rose from 1.04 to 1.09 points.

Implied Volatility:

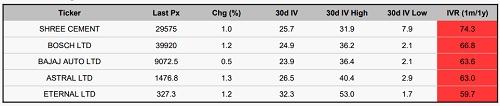

Shree Cement and Bajaj Auto are currently trading with elevated implied volatility (IV) levels of 74% and 64%, respectively. These heightened IVs indicate that the market is pricing in significant potential price movements, leading to inflated option premiums. Such conditions increase the overall risk exposure for traders engaging in options strategies. In contrast, Kalyan Jewellers and Eicher Motors exhibit the lowest implied volatility rankings within the group. Their realised implied volatility stands at 25% and 16%, respectively, reflecting relatively stable underlying price action. As a result, options on these stocks are more attractively priced. In low-IV environments, straightforward directional strategies such as long calls or puts tend to offer better risk-reward profiles. Additionally, these conditions are favourable for options writers, as the lower volatility reduces the likelihood of adverse price swings, enhancing the probability of premium capture.

Options volume and Open Interest highlights:

Cyient Ltd. and Voltas Ltd. are demonstrating significant bullish momentum, evidenced by a notable call-to-put volume ratio of 6:1. This imbalance in options trading suggests a strong conviction among investors for continued price appreciation. While this demand for call options indicates potent market optimism, the resultant increase in premiums may make new long positions less attractive. Conversely, Glenmark Pharma and ITC are under considerable bearish pressure. Their elevated put-to-call volume ratios reflect a predominantly negative market outlook. The surge in put volumes for these stocks hints at a potentially oversold condition, which may attract contrarian investors despite the prevailing pessimism. Nuvama Wealth and Piramal Pharma show a divergence in investor sentiment. The increasing open interest (OI) in both call and put options for these stocks points to a potential for heightened volatility as market participants hold conflicting views on their future direction. C G Power appears poised for a potential upward movement, driven by a recent surge in call buying that signals growing investor confidence. In contrast, Mazagon Dock is experiencing a simultaneous accumulation of put volumes, which indicates a more cautious market stance and could precede increased short-term volatility. (This data covers only stock options with at least 500 contracts traded on the day for both calls and puts).

Participant-wise Open Interest Net Activity:

In the index futures segment, a net decrease of 6,609 contracts by clients and a significant 7,367 contract reduction by proprietary traders were starkly contrasted by a robust addition of 11,595 contracts by Foreign Institutional Investors (FIIs), collectively contributing to a total change of 13,976 contracts. This divergent positioning signals a cautious yet strong bullish conviction from FIIs, even as domestic participants unwind their positions, potentially indicating a belief in upward market momentum. A similar pattern emerged in the stock futures market, where a total of 13,012 contracts saw a substantial decrease of 8,815 contracts from clients and a 4,197contract reduction from proprietary desks. This was offset by a strong influx of 9,986 long positions by FIIs, underscoring their selective bullish stance on specific stocks, while retail and proprietary traders are displaying a de-risking posture. This distinct polarization in positioning between FIIs and other participants is a critical indicator of a market bias driven by institutional optimism amid a backdrop of domestic caution.

Nifty

Bank Nifty

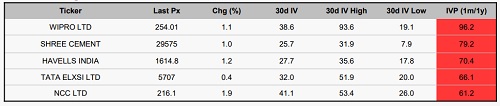

Stocks with High IVR:

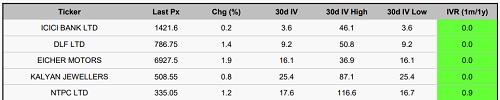

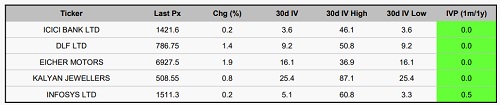

Stocks with Low IVR:

Stocks With High IVP:

Stocks With Low IVP:

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Tag News

Technical Forecast : Nifty tanks; crucial support at 24450-24500 band by Vaishali Parekh, Vi...