Chemicals Sector Update : Specialty Chemical Firms Struggle Amid Geopolitics & US Tariff Woes by Emkay Global Financial Services

Specialty chemical companies continue facing headwinds from geopolitical factors and uncertainty around US tariffs. Overall Q2 exports were muted, and the US saw clear pre-buying before the tariff announcement. Tariff is applicable on a number of major products exported to the US like R32/R125 for SRF, NFIL, and GFL, on MMA for Aarti, and on 2,4 D for Atul. Q2 is generally a weak period for most non-agri specialty chemicals. In general, H2 is expected to be better than H1 for most players. We have witnessed peaking of R32 prices in export markets, particularly the US, and hence continue to be cautious about ref gas players like SRF, NFIL, and GFL. Further, while Atul saw a price uptick in 2,4 D, Aarti saw strong volumes in MMA (from the Middle East, though US volumes are muted); hence we continue to favor bulk chemical names like Atul and Aarti, which we believe will see a gradual recovery in coming quarters.

We remain cautious about refrigerant gas players

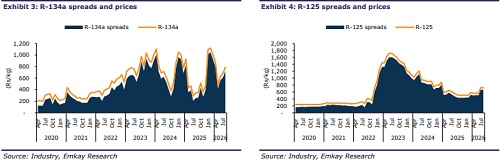

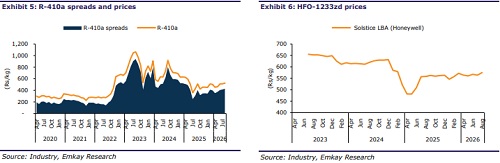

Ref gas prices have been rising on account of higher demand, which is owing to regulatory changes and phase-out plans globally from beginning-CY25. We are seeing initial signs of prices peaking for Indian refrigerant gas players exporting (especially R32) to the US, given the tariff impact. However, domestic prices remain firm as it is the off-season for most gases (import parity). As we enter the last year of the quota determination period in India (last season), higher channel inventory (lower RAC sales) and possible pressure from new capacity additions are likely to lead to a correction in domestic prices. Thus, in our view, the near-to-medium term upside for Indian refrigerant gas players is limited – higher pricing factored in the CMP (refer to our note).

Bulk chemicals seem to have bottomed out

Prices of bulk chemicals were under pressure on weaker crude oil prices, overcapacities leading to oversupply, and a muted macro environment, which ultimately led to organic chemical prices weakening. Prices of major RMs for Aarti, Atul, and Deepak Nitrite have corrected ~20-30% YoY, leading to pressure on finished product pricing as well as potential inventory write-offs. The spreads for phenol-acetone, ethyl acetate-acetic acid, PVC-EDC, ABS, etc remain depressed. Prices of caustic soda and soda ash also corrected in Q2. We see price stabilization for MMA/liquid epoxy resin/soda ash and increase in phenol/2,4-D prices. We expect the demand scenario to improve, leading to better prices.

Overall numbers in Q2 expected to be seasonally weak

Q2 is seasonally weak for most bulk chemicals (excluding chemicals for agri applications). Heavy/prolonged monsoons have slowed down manufacturing activity as well as capacity ramp-up. This, coupled with weaker exports due to pre-tariff buying in Q1, is likely to impact Q2 results of some companies (our detailed preview to come in Week-1 Oct-25). Thus, we expect H2 to be better than H1. In our coverage universe, we prefer Atul and Aarti, for which we expect gradual recovery in coming quarters.

Refrigerant gases pricing and spreads – SRF, NFIL, GFL

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354