IT Sector Update : Cautious FY26 guidance weighs on sentiment by Prabhudas Liladhar Capital Ltd

Cautious FY26 guidance weighs on sentiment…

Accenture’s (ACN: NYSE) revenue performance in Q4 came in above consensus estimates and at the top end of guidance band, aided by outsourcing revenues (+6% YoY). The growth was predominantly driven by Fin. Service (+12% YoY CC), third consecutive quarter of double-digit growth. However, the underlying demand beyond the vertical is weak with no visible uptick in discretionary spends. The client investments in GenAI are finding their ways through cost optimization initiatives instead of opportunities around revenue accelerations. The slowdown in net hiring and moderate guidance ensure no incremental recovery in demand on ground. For the Indian counterpart, nothing encouraging in term of outsourcing or bookings perspective, while continued momentum in Fin Service is a positive for the companies having higher concentration mix of BFS.

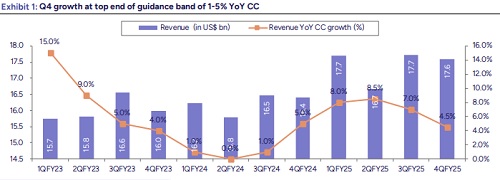

* Demand & Outlook: ACN’s delivered Q4 performance at the upper end of its guidance for the second consecutive quarter. For FY25, the company reported a robust 4% constant currency (CC) organic growth, outpacing its comparable peers. However, the FY26 organic revenue growth guidance of 0.5–3.5% signals a still-subdued demand environment, suggesting the sector may face yet another challenging year following two consecutive years of weakness. ACN also faces headwinds in its Federal business, expected to impact FY26 revenue by 1–1.5%. This challenge is less relevant for Indian peers, given their limited exposure to the US Federal segment.

* Outsourcing business continues to moderate: The outsourcing business moderated for the second consecutive quarter, recording 6% YoY CC growth after slowing to 9% YoY CC in Q3. While outsourcing bookings turned positive after three consecutive quarters of decline, this appears largely seasonal. The discretionary spending environment shows no meaningful recovery, with client focus continuing toward highly competitive managed services programs—likely keeping margins range-bound for most players in the sector.

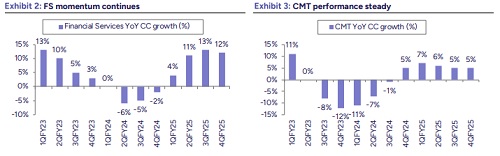

* FS charge continues: ACN delivered broad-based growth during the quarter, except in the Health segment, which was affected by headwinds in the US Federal business. The Financial Services segment posted double-digit growth for the third consecutive quarter, with strong traction in data and AI projects—a trend which is positive for Indian peers.

* Sharp decline in net employee: Net headcount declined sharply for the second consecutive quarter, down by 11.4k following a 10.4k reduction in Q3. However, planned additions in FY26, supported by an anticipated demand recovery, could serve as a positive indicator for the sector.

Accenture 4Q-2025 first take:

* Revenue at US$ 17.6 bn, up 7.3% YoY (4.5% CC YoY) came at the top end of guidance band of 1-5% YoY CC growth and above street estimates of 5.8% YoY growth. For FY25 ACN reported revenue of US$69.7 bn, up 7% YoY in CC with organic growth of 4%

* Outsourcing revenue (50% of mix) came at US$ 8.8 bn, up 1.2% YoY in reported & 6% YoY in CC term while Consulting revenue came at US$ 8.7 bn, down 2.6% YoY (+3% CC YoY). Outsourcing revenue moderated down from 9% YoY CC growth in Q3

* FY26 revenue guidance at 2-5% with inorganic contribution of 1.5% is excluding the US Federal Business impact of 1-1.5%

* Adjusted EBIT margin came at 15.1% (up 10 bps YoY). FY26, adjusted Margin guidance of 15.3-15.8% is an increase of 10-30 bps over FY25

* New booking came at US$ 21.3bn up 3% CC terms & 5% YoY in reported terms. Outsourcing bookings grew by 7% YoY to US$ 12.44 bn while consulting booking grew by 3% YoY to US$ 8.87 bn. Gen AI new bookings came at US$ 1.8 bn compared to US$ 1.5 bn in Q3

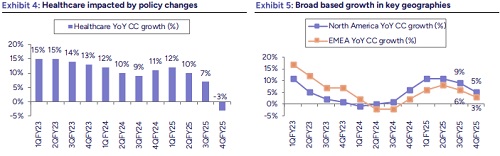

* FS continued its momentum with 3rd successive quarter of double-digit growth with growth of 12% YoY in CC while CMT, Products, & Resources all reported growth of 5% YoY in CC. Healthcare segment slowdown continues as it reported revenue decline of 3% YoY in CC

* Geography wise the growth was broad based with Americas, EMEA & APAC reporting a growth of 5%, 3% & 6% YoY CC respectively

* Net employee declined sequentially by 11.4k, bringing the total headcount to 779k employees

Other KTA’s

* Geography- & sector-wise performance: In the Americas, growth was primarily led by the US, supported by strength in banking and capital markets, industrials, and platforms, though partly offset by weakness in Healthcare. In EMEA, key growth drivers included life sciences, insurance, utilities, and consumer goods. In APAC, growth was underpinned by banking and capital markets, public services, and utilities, but moderated by a decline in energy. On a geography-specific basis, revenue growth was led by Japan and Australia.

* Gen AI booking momentum continued with new bookings of USD 1.8 bn in Q4 and full year bookings of USD 5.9 bn. Demand remains strong with enterprise funding Gen AI projects from cost saving programs.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271