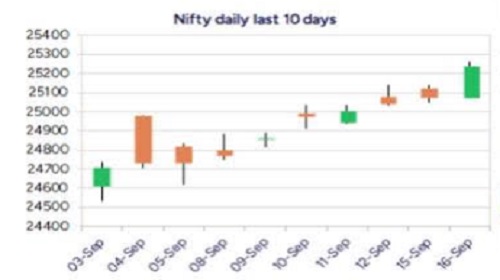

Technical Forecast : Nifty gains momentum; attains 25250 zone by Vaishali Parekh, Vice President - Technical Research at PL Capital

Market Preview

Nifty gains momentum; attains 25250 zone

Nifty witnessed an overall positive session gaining momentum to touch the 25250 level which is an important resistance zone which needs to be breached decisively to establich conviction for further rise in the coming days. BankNifty picked up some momentum to cross the 55000 zone anticpating for further positive developments with the Fed Outcome awaited. The market breadth was positive with the advance decline indicating a ratio of 2:1 at close.

Market Forecast

Nifty daily range 25100-25500

Nifty, gained further with a robust move witnessed during the session improving the bias and arriving near the important hurdle of 25250 zone which needs to be breached decisively to establish conviction and thereafter, anticipate for further rise in the coming days. With the sentiment easing out and further developments awaited in the coming days, we can expect positive move in the indices with the 50EMA zone at 24800 level positioned as the near-term important support which needs to be sustained as of now.

BankNifty, witnessed a decent rise moving past the 55000 zone ahead of the Fed Outcome which is expected in the coming sessions and as mentioned earlier, would need a decisive move past the 50EMA at 55150 zone to overall improve the bias and thereafter, establish conviction to anticipate for fresh upward move in the coming days. The 53600 zone shall be positioned as the important support zone from current rate which needs to be sustained to maintain the overall bias intact.

The support for the day is seen at 25100 levels, while the resistance is seen at 25500 levels. BankNifty would have the daily range of 54700-55700 levels.

Please refer disclaimer at https://www.plindia.com/disclaimer/

SEBI Registration No. INH000000271

Tag News

Technical Forecast : Nifty tanks; crucial support at 24450-24500 band by Vaishali Parekh, Vi...