2025-09-04 02:37:21 pm | Source: Colliers India

Within real estate, the slashing of GST on cement will play a critical role in rehauling project cost structures as cement forms a major value component in the overall cost of construction. Residential real estate, particularly new homebuyers, stand to gain as developers are likely to pass on the benefit of lower costs in the form of reduced housing prices. Developers’ profitability margins, too can potentially improve, enhancing the overall financial health of the real estate sector. The timing of this rollout is appropriate, with the festive season in the offing and the real estate sector is already reaping the benefits of favourable interest rates.

Quote on Reduction of GST on construction materials and its impact on the Real Estate sector by Mr Vimal Nadar, Senior Director & Head of Research, Colliers India

Below the Quote on Reduction of GST on construction materials and its impact on the Real Estate sector by Mr Vimal Nadar, Senior Director & Head of Research, Colliers India

The newly announced two-slab GST structure of 5% and 18% is a progressive move to rationalize the prevailing inverted duty structure, improvise classification, simplify approvals & processing refunds. These measures will surely cut costs at different tiers while enhancing the ease of doing business and driving consumption.

Within real estate, the slashing of GST on cement will play a critical role in rehauling project cost structures as cement forms a major value component in the overall cost of construction. Residential real estate, particularly new homebuyers, stand to gain as developers are likely to pass on the benefit of lower costs in the form of reduced housing prices. Developers’ profitability margins, too can potentially improve, enhancing the overall financial health of the real estate sector. The timing of this rollout is appropriate, with the festive season in the offing and the real estate sector is already reaping the benefits of favourable interest rates.

Above views are of the author and not of the website kindly read disclaimer

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or

investment advice. Investments in financial markets are subject to market risks, and past performance is

not indicative of future results. Readers are strongly advised to consult a licensed financial expert or

advisor for tailored advice before making any investment decisions. The data and information presented

in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the

content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

Evening Roundup : A Daily Report on Bullion Energy &...

Company Update : Rushil Decor Ltd by Prabhudas Lilla...

India, EU to hold 14th round of free trade agreement...

Adani Enterprises to build Sonprayag-Kedarnath ropew...

Nifty future closed negative with losses of 0.14% at...

AI growing fast, regulation must keep pace: FM Nirma...

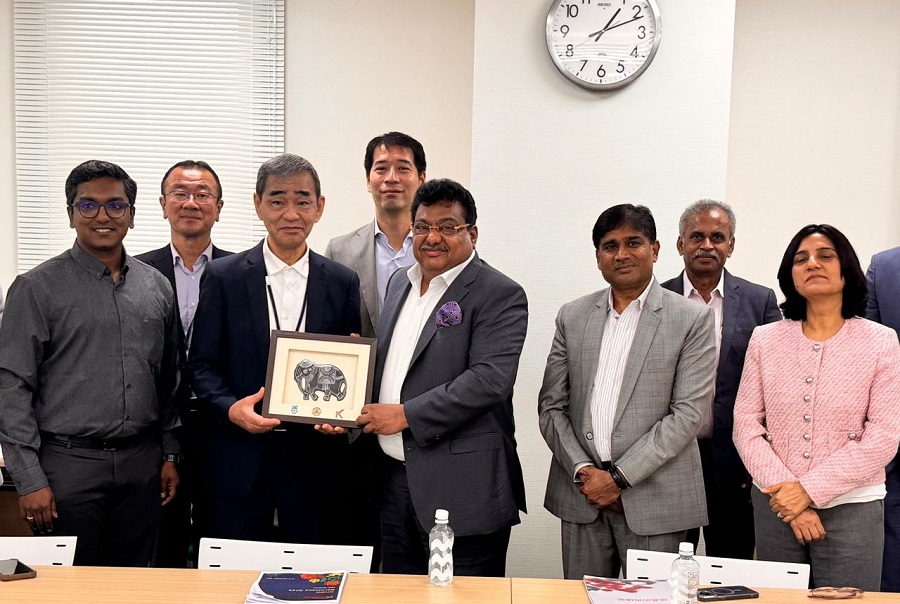

Investment of Rs 4,000 crore from Japanese companies...

Quote on Market Wrap 15th September 2025 by Shrikant...

India?s trade deficit narrows to $26.49 bn in August...

FIIs stood as net buyers in equities as per Septembe...