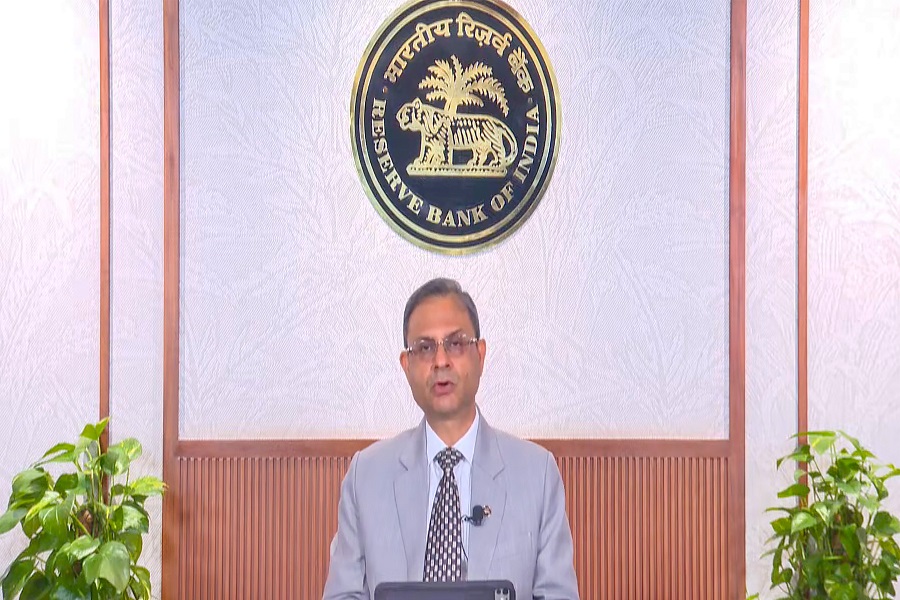

Perspective on CPI data by Rajani Sinha, Chief Economist, CareEdge Ratings

Below the Perspective on CPI data by Rajani Sinha, Chief Economist, CareEdge Ratings

Headline inflation inched up to 2.1% in August as the favourable base effect waned and food prices moved out of deflation. However, it remained at comfortable levels owing to muted food inflation. Core inflation stayed benign at 4.1%. However, precious metals continued to witness elevated double-digit inflation. Within the food basket, deflation in items such as vegetables, pulses, and spices has helped contain price pressures. Looking ahead, food inflation is likely to stay moderate, supported by healthy agricultural activity and a favourable base. A good monsoon progress, adequate reservoir levels, and strong kharif sowing bode well for food price stability. That said, risks remain from the late withdrawal of the monsoon and heavy rains in certain regions, which could risk crop damage. Additionally, persistently high double-digit inflation in edible oils warrants close monitoring, given weak sowing trends, import dependence, and elevated global edible oil prices.

On the external front, while global commodity prices are broadly expected to remain stable, intermittent spikes cannot be ruled out amid ongoing geopolitical tensions. Concerns over potential additional sanctions on Russian crude could disrupt supply chains for major importers such as India and China. Although OPEC has spare capacity, global oil dynamics could shift and will need close monitoring.

Looking ahead, the recent rationalisation of GST rates is expected to have a positive impact on the overall inflationary environment. We estimate that it could lower CPI inflation by 70–90 bps annually under the current basket, assuming effective pass-through to consumers. With food inflation subdued and demand-side pressures contained, we now lower our inflation projection for FY26 to 2.7% from 3.1% earlier. Additionally, the forthcoming introduction of the new CPI series with a 2024 base year will be an important development to watch, as it may influence the estimated impact of the GST changes. From a monetary policy perspective, a stronger growth in Q1FY26 reduces the likelihood of additional RBI rate cuts. However, prolongation of 50% US tariffs on Indian imports coupled with downward pressure on inflation from GST cuts may prompt the RBI to consider further rate cuts.

Above views are of the author and not of the website kindly read disclaimer