Quote on De-mystifying the implications for various sectors and economy at large by Ashwini Shami, AVP & Portfolio Manager, OmiScience Capital

Below the Quote on De-mystifying the implications for various sectors and economy at large by Ashwini Shami, AVP & Portfolio Manager, OmiScience Capital

India’s Economic Resilience: Q1 FY26 GDP Analysis:

India’s robust GDP growth of 7.8% in Q1 FY26 demonstrates remarkable economic resilience amid global uncertainties, including ongoing tariff disputes and regional conflicts. This performance underscores the fundamental strength of India’s economic framework.

Key Growth Drivers:

Services Sector Leadership: The services sector emerged as the primary growth engine, expanding 9.3% compared to 6.8% in Q1 FY25. This acceleration reflects India’s competitive advantage in technology, financial services, and business process outsourcing.

Government Expenditure Revival: Public spending showed significant momentum with 9.7% nominal growth versus 4% in the previous year’s corresponding quarter. This fiscal stimulus provided crucial support during uncertain global conditions.

Private Consumption Dynamics: While private consumption at 7% appears modest year-on-year, the absolute figures remain encouraging. Several policy initiatives are expected to boost consumer spending in upcoming quarters, including GST rate rationalization and income tax relief measures announced in the recent budget.

Future Outlook: The convergence of favorable macroeconomic conditions—low inflation, reduced interest rates, and targeted policy interventions—creates an optimal environment for sustained growth.

Key catalysts include: Enhanced domestic consumption driven by improved disposable income Private sector capital expenditure growth as business confidence strengthens Sustained fixed capital formation supporting long-term economic expansion

Investor Takeaways: This economic trajectory presents strong fundamentals for equity markets. The combination of domestic demand recovery, infrastructure investment, and services sector dynamism positions India favorably for continued growth momentum.

Above views are of the author and not of the website kindly read disclaimer

More News

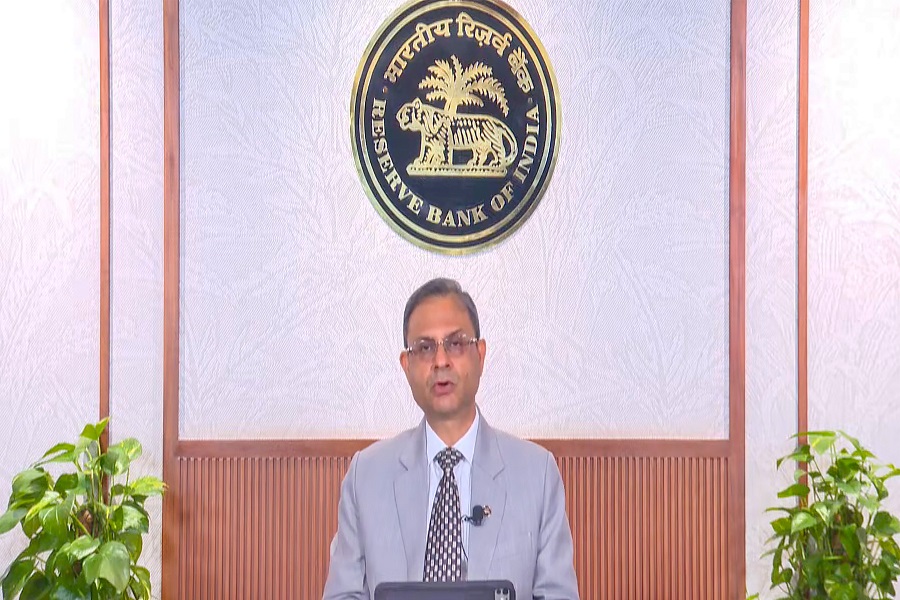

Reaction on the RBI policy by Vimal Nadar, Head of Research at Colliers India