Perspective on the GDP Data by Ms. Rajani Sinha, CareEdge Ratings

Below the Perspective on the GDP Data by Ms. Rajani Sinha, CareEdge Ratings

“Strong first quarter GDP growth comes as a big boost in midst of tariff related uncertainties. However, the critical aspect would be sustenance of this growth momentum. Given that global trade scenario remains uncertain, domestic demand enabling measures by the government would be critical in the coming quarters.

Q1FY26 GDP growth came in at 7.8% much higher than market expectations. The sharp growth was led by sharp jump in manufacturing sector and services sector growth. On the expenditure front, a key positive was the sharp pickup in private final consumption expenditure, supported by the rationalization of income tax slabs, easing food inflation, a favourable monsoon, and recent RBI rate cuts. Moreover, the government spending rebounded strongly. Investment growth was healthy at 7.8%, supported by strong government capex in this quarter.

The revival in domestic demand, despite global headwinds, is critical—not only for recovering private capex momentum but also for cushioning the potential loss of export amidst elevated tariffs. Given the upside surprise in the first-quarter numbers, we have revised our FY26 GDP growth projection upward to around 6.5% under the base-case scenario. This assumes a reduction in U.S. tariffs on Indian imports to around 25% (with the removal of additional tariff of 25%). Government support to consumption in terms of GST reforms and transmission of the previous rate cuts should further strengthen consumption. From a monetary policy perspective, stronger growth reduces the likelihood of additional rate cuts. However, given that policy is forward-looking, the RBI will remain attentive to external developments. We do not anticipate further rate reductions unless downside risks to growth materialize”.

Above views are of the author and not of the website kindly read disclaimer

More News

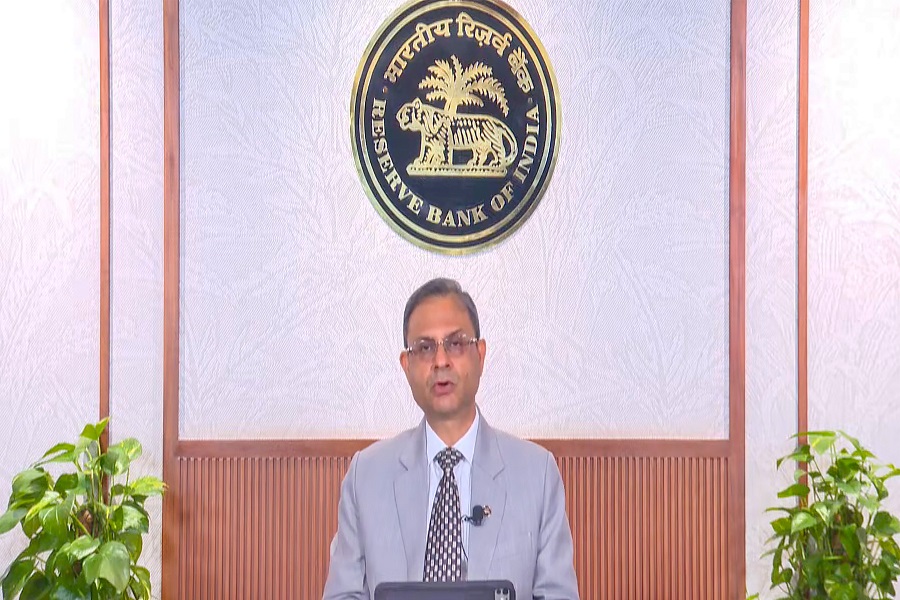

Quote on RBI Monetary Policy by Mr. Shriram Ramanathan, CIO, Fixed Income, HSBC Mutual Fund