Non-Life Premium Growth Remains Sluggish in August 2025 by CareEdge Ratings

Overview

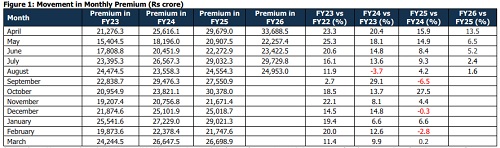

As of August 2025, the non-life insurance sector continued to experience a slowdown in premium growth, with total collections reaching Rs 24,953.0 crore - a modest 1.6% rise year-on-year, compared to a 4.2% increase in August 2024. This decline can be put down to the switch to the 1/n rule, deferrals due to expected cuts in the Goods and Services Tax (GST) and a decline in crop insurance. The softer market for passenger vehicles also played a role. However, steady growth in health, fire, and engineering segments has partially offset the slowdown.

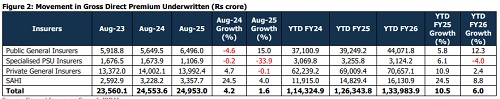

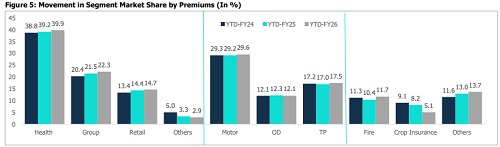

* Public sector general insurers maintained their faster growth rate for the eleventh consecutive month in August 2025, largely driven by renewals in the fire, engineering, health, and motor third-party segments. However, the switch to the 1/n rule has affected overall headline growth. At the same time, private non-life insurers (including SAHI) retained their dominant 70% market share in August 2024 and August 2025, up from 68% in August 2023. On a y-o-y basis, private insurers continued to hold the majority share, at 64.8% as of August 2025, although this is slightly lower than the 66.4% share reported a year ago. Meanwhile, the share of public sector insurers increased to 35.2% from 33.6% in August 2024.

* Specialist insurers saw a 33.9% y-o-y decline in premiums in August 2025, reversing the strong momentum from earlier in the year and hindering overall industry growth. This drop was partly due to a high base and softer activity in crop and credit insurance. In crop insurance, lower enrolments under PMFBY, unpredictable monsoon patterns, and reduced state-level participation resulted in lower premium inflows. At the same time, demand for credit insurance was affected by weaker export momentum, as global trade headwinds and tariff-related uncertainties reduced coverage requirements. The segment decreased by 4.0% by the end of the year 2026, compared with a 6.1% growth during the same period the previous year.

* Standalone Health Insurers (SAHIs) experienced a slowdown in growth, with premiums increasing by 4.0% y-o-y in August 2025, compared to24.5% growth in the previous year. This deceleration may be due to rising premiums. Despite this, SAHIs continue to gain market share, mainly at the expense of private general insurers.

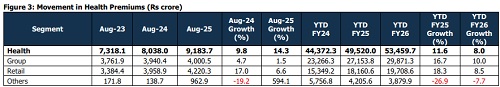

* Health insurance continues to be the largest segment within the non-life insurance industry, recording a 14.3% growth. This growth was attributed to improved traction in other segments. However, overall momentum has moderated due to the 1/n rule and affordability challenges arising from higher premiums. Within the segment, SAHIs have consistently outperformed.

* The group health segment grew the fastest in YTDFY26, driven by policy renewals and premium hikes amid rising medical inflation. However, growth moderated to 10.0%, down from 16.7% in the same period last year.

* Retail health insurance growth moderated to 8.5% in YTDFY26, down from the 18.3% pace seen in YTDFY25. The deceleration is partly linked to the 1/n rule and further exacerbated by rising medical inflation, which has pushed premiums higher and weighed on affordability.

* SAHIs remain concentrated in the retail segment, whereas general insurers continue to dominate the group business. With new SAHIs set to enter the market, competitive intensity is expected to rise over the medium term.

* The Others’ segment reported a significant y-o-y growth of around 594.1% in August 2025. This rebound was driven by higher premium booking under government health schemes (market share rising to 6%) alongside stronger demand for overseas medical policies as international travel gained traction. A favourable base effect from the previous year further magnified this growth.

* The expectations of GST reductions on health insurance would lower the overall cost for policyholders, making products more affordable and potentially increasing demand. Insurers may see higher new business premiums and improved penetration, especially in retail segments. The reduced tax burden could also enhance customer retention, as renewal costs become relatively cheaper.

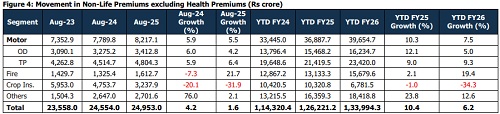

* The growth of the non-life insurance industry, excluding health, stood at 1.6% as of August 25. Furthermore, a sizable proportion of this growth was attributed to the motor and fire segments, which accounted for over 70% of the non-life insurance excluding health.

* Motor OD grew by 5.0% in YTDFY26 (vs. 12.1% for YTDFY25), and motor TP rose by 9.3% (vs. 9.0% for YTDFY25). Muted PV sales have contributed to a cooling of motor OD growth, whereas the motor TP segment has grown at a faster rate. Additionally, the Ministry of Road Transport and Highways (MoRTH) is evaluating a proposed upward revision in motor TP insurance premiums, following a recommendation from IRDAI, which could support the growth in the motor TP segment. Furthermore, expectations of GST reductions on vehicles could stimulate demand, potentially boosting motor OD premiums over the medium term.

* The fire insurance segment continued to grow, increasing by 19.4% YTDFY26, a sharp rise from 2.1% in the same period last year. Meanwhile, the engineering segment grew by 12.9%, up from 6.2% in YTDFY25. Conversely, crop insurance saw a major decline of 34.3%, compared with a 1.0% growth previously, attributed to lower enrolments under the Pradhan Mantri Fasal Bima Yojana (PMFBY), uneven monsoon patterns, and reduced statelevel participation, which impacted premium inflows.

* The other segment recorded a growth of 12.6% in YTDFY26, propelled by a significant 25.7% rise in personal accident premiums and 36.3% rise in credit guarantee premiums, reflecting heightened awareness of individual risk protection and higher group policy issuances. Steady gains were also observed in the engineering segment, supported by infrastructure expansion.

CareEdge Ratings View

According to Priyesh Ruparelia, Director, CareEdge Ratings, “Non-life insurance premiums crossed Rs 3 lakh crore in FY25, supported by regulations, digitalisation, and a growing middle class. The Bima Trinity initiative and the adoption of Insurtech are expected to drive further growth. Standalone health insurers remain strong in retail segments, while motor insurance will track vehicle sales and third-party tariff revisions. The rollout of composite licences may alter competitive dynamics, and GST reductions are likely to improve affordability, policy sales, compliance, and penetration. Overall, competition, regulatory changes, and global uncertainties will shape the sector’s trajectory.”

According to Saurabh Bhalerao, Associate Director, CareEdge Ratings, “In August 2025, the non-life insurance industry reported premiums of Rs 24,953.0 crore, reflecting a muted 1.6% year-on-year growth, lower than the 4.2% recorded in August 2024. This slowdown could be attributed to the shift to the 1/n rule, deferral due to expectations of a Goods and Services Tax (GST) reduction and a reduction in crop insurance. However, steady activity in health, fire and engineering segments continues to support the industry growth.”

Above views are of the author and not of the website kindly read disclaimer