Nifty has an immediate Resistance at 24840 and on a decisive close above expect a rise to 24900-24970 levels - Nirmal Bang Ltd

Market Review:

Indian benchmark closed with minor gains on Monday, supported by recent GST reforms and positive economic cues, though late profitbooking capped the upside. On the other hand, IT stocks remained under pressure amid speculation over possible restrictions on IT services exports. The S&P BSE Sensex added 76.54 points or 0.54% to 80,787.30. The Nifty 50 index rose 32.15 points or 0.13% to 24,773.15.

Nifty Technical Outlook

Nifty is expected to open on a positive note and likely to witness positive move during the day. On technical grounds, Nifty has an immediate Resistance at 24840. If Nifty closes above that, further upside can be expected towards 25900-24970 mark. On the flip side 24700-24640 will act as strong support levels.

Action: Nifty has an immediate Resistance at 24840 and on a decisive close above expect a rise to 24900-24970 levels.

Bank Nifty

Bank Nifty’s next immediate resistance is around 54740 levels on the upside and on a decisive close above expect a rise to 54970-55240. There is an immediate support at 54270-54000 levels.

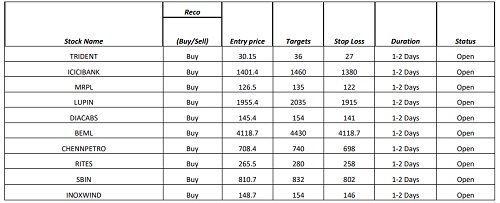

Technical Call Updates

Please refer disclaimer at https://www.nirmalbang.com/disclaimer.aspx

SEBI Registration number is INH00000176

Tag News

Stock Option OI Report 26th September 2025 by Nirmal Bang Ltd

More News

Morning Market Quote : Market Bottomed Out, But Volatility Persists Says Dr. V K Vijayakumar...