MCX Natural gas Sep is expected to dip towards Rs 264 level as long as it stays below Rs 282 level - ICICI Direct

Bullion Outlook

• Spot Gold is likely to take a pause in its rally after rallying almost 40% this year. Further, expectation of rise in US inflation numbers could lower the probability of 75 bps rate cut in this year. A strong dollar and higher global government yields would limit its upside. Meanwhile, prices will get support from uncertainty over US tariffs and geopolitical risks. Also, political uncertainty in France and Japan is driving demand for gold as a safe-haven asset. Also increased gold buying from China’s central bank is positive for prices as the PBOC continued its purchase for the 10th consecutive month. All focus will remain on key US PPI and CPI numbers which could bring further volatility in price.

• MCX Gold Oct is expected to face hurdle near Rs 109,900 level and correct towards Rs 108,000 level.

• MCX Silver Dec is expected to decline towards Rs 123,200 level as long as it trades under Rs 126,800 level.

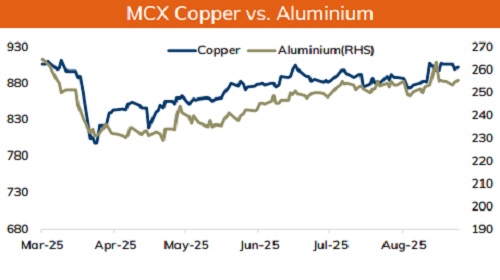

Base Metal Outlook

• Copper prices are expected to trade with a positive bias on supply concerns and demand improvement from China. A prolonged disruption at the second largest copper mine in Indonesia could tighten the market. Additionally, disruption at EL teniente mine in Chile could also challenge the supplies. On the demand front, prices may move north on signs of increasing demand from China. Yangshan copper premium a gauge of China's appetite for importing copper rose to $58 a ton, 3-month high. Further, prices may inch up buoyed by growing expectations of a Fed interest rate cut after soft job data. Meanwhile, sharp upside may be capped on expectation of weak economic numbers from China.

• MCX Copper Sep is expected to rise towards Rs 907 level as long as it stays above Rs 895 level. A break above Rs 907 level prices may rally further towards Rs 912 level

• MCX Aluminum Sep is expected to rise towards Rs 257 level as long as it stays above Rs 253 level. MCX Zinc Sep is likely to consolidate in the band of Rs 272 and Rs 277 level. Only below Rs 272 it would turn weak.

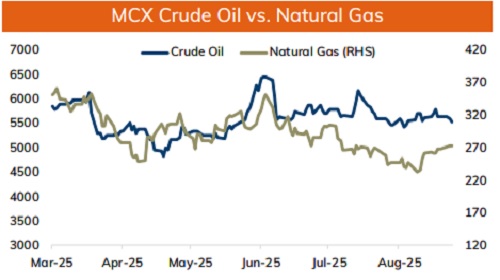

Energy Outlook

• Crude oil is likely to trade with positive bias and rise towards $65 level on rising tension in the Middle East. Recent attacks on Hama’s leaders in Qatar by Israel forces has increased supply concerns from one of the key energy exporter. Further, prices may move up on concerns over tighter supply due to potential new sanctions on Russia after country’s biggest air attack on Ukraine set fire to a government building in Kyiv. Moreover, U.S. President Donald Trump said he was ready to move to a 2 nd phase of restrictions. Additionally, all eyes will be on meeting between US and EU top sanctions officials.

• WTI crude oil is likely to rise towards $65 level as long as it trades above $62.00. MCX Crude oil Sep is likely to rise back towards ?5680 level as long as it stays above Rs 5450 level.

• MCX Natural gas Sep is expected to dip towards Rs 264 level as long as it stays below Rs 282 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631