MCX Gold Oct is expected to rise towards Rs109,900 level as long as it holds above Rs108,500 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is likely to hold its gains and trade higher on increasing prospects of loose monetary policy from the US Federal Reserve. Signs of slowdown in the US labor market and steady US inflation numbers would strengthen the chances of more than 50 bps rate cut in this year. As per the CME fed watch tool, 25 bps rate cut stands above 96%. Precious metals will continue to get support from fund buying of precious metal ETFs. Gold ETF holding rose to a 2-year high and CFTC net speculative longs hit 5-month highs. Silver holdings in ETF rose to 3-year highs.

• MCX Gold Oct is expected to rise towards Rs109,900 level as long as it holds above Rs108,500 level.

• Spot Silver is expected to rise towards $42.80 per ounce mark, as long as it trades above $41.60 mark. MCX Silver Dec is expected to extend its gains towards Rs 129,800 level as long as it trades above Rs 127,400 level.

Base Metal Outlook

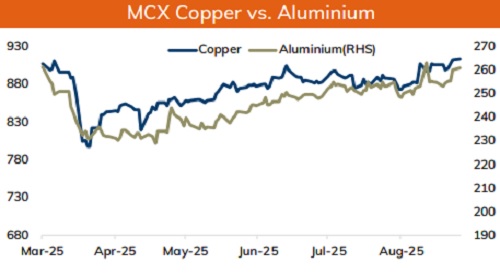

• Copper prices are expected to take a pause in its rally after weaker than expected economic number from China. Industrial production in China hit its lowest in this year, signaling weak demand. Additionally, drop in retail sales numbers and persistent weakness in house prices would hurt its demand outlook. Meanwhile, a prolonged disruption at the second largest copper mine in Indonesia could tighten the market. Moreover, capacity constrain in China would limit downside in the metals. Meanwhile, most investors will await the central bank policies for further clarity.

• MCX Copper Sep is expected to face hurdle near Rs 920 level and move lower towards Rs 905 level.

• MCX Aluminum Sep is expected to rise towards Rs 264 level as long as it stays above Rs 258 level. MCX Zinc Sep is likely to rise towards Rs 282 as long as it stays above Rs 276. A soft dollar and capacity constrain in China would likely to support the metal prices.

Energy Outlook

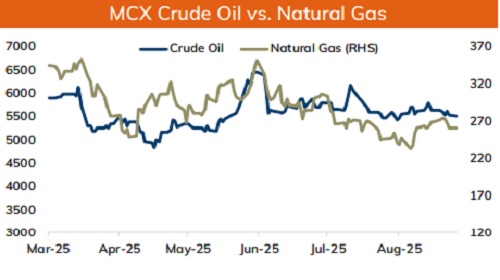

• Crude oil is likely to find support on renewed concerns of supply disruption from Russia. Russia has announced that negotiations with Ukraine were in pause, despite Trump’s push. Further, concerns over fresh sanctions of Russia from Euro zone could hurt global supplies. On the supply side, forecast of supply boost from OPEC+ would counter the supply issues from Russia. Meanwhile, soft dollar and growing bets of lose monetary policy from the FOMC and additional push from China could limit its downside.

• WTI crude oil is likely to hold its ground near $61 level and rebound towards $64 per barrel mark. A strong put base near $60 strike would act a major support for price. MCX Crude oil Oct is likely to move higher towards Rs 5700 level as long as it stays above Rs 5400 level.

• MCX Natural gas Sep is expected to dip towards Rs 255 level as long as it stays below Rs 270 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631