MCX Copper Oct is expected to rise back towards Rs 950 level as long as it stays above Rs 938 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is likely to face stiff resistance near $3780 level and correct towards $3720 amid strong dollar and rise in U.S treasury yields across curve. Further, investors fear that stronger than expected economic data from U.S may strength the case for rate pause from Federal Reserve in upcoming meetings. As per CME FedWatch tool market is now pricing in 85% probability of another 25bps cut at the central bank's October meeting and a 14.5% chance of a pause. This is down from 90%-92% odds of a 25-bps cut on Wednesday. Additionally, investors will remain cautious ahead of key inflation data as it could shape the Federal Reserve's next interest rate moves. Hotter than expected PCE reading would further weigh on gold prices

• MCX Gold Oct is expected to slip towards Rs 112,000 level as long as it stays below Rs 113,300 level

• MCX Silver Dec is expected to face stiff resistance near Rs 137,700 level and correct towards Rs 135,000 level.

Base Metal Outlook

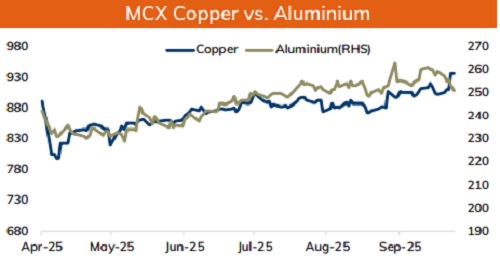

• Copper prices are expected to trade with a positive bias amid renewed concerns over supply disruption in Mines and persistent decline in inventories at LME registered warehouses. Proposed controls on smelting capacity in China and Freeport-McMoRan slashing its Indonesian mine production forecast, intensified supply concerns. Further, stronger than expected economic data from U.S signals that the economy is continuing to expand, a supportive factor for industrial metals. Meanwhile, strong dollar and risk aversion in the global markets would weigh on prices. Market sentiments are hurt as U.S. President Donald Trump unveiled a fresh round of tariffs. He announced that U.S. would impose 100% duties on imported branded drugs, 25% tariffs on heavy-duty trucks and 50% tariffs on kitchen cabinets

• MCX Copper Oct is expected to rise back towards Rs 950 level as long as it stays above Rs 938 level. On contrary, break below Rs 938 prices may correct sharply towards Rs 931 level

• MCX Aluminum Oct is expected to slip towards Rs 253 level as long as it stays below Rs 258 level..

Energy Outlook

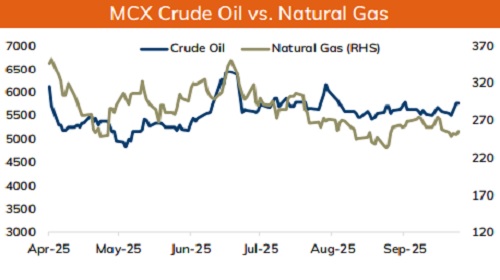

• Crude oil is likely to trade with positive bias and rise further towards $66 level amid escalating tensions between Russia and NATO after EU diplomats said they are prepared to shoot down Russian aircraft if further airspace violations are detected. Further, prices may move up on concerns over supply disruption as Ukraine has intensified drone strikes on Russia’s energy facilities. Moreover, Russian Deputy Prime Minister Alexander Novak said country would introduce a partial ban on diesel exports until the end of the year and extend an existing ban on gasoline exports, fueling supply concerns. Additionally, stronger than expected economic data from US would be supportive for the prices. Meanwhile, sharp upside may be capped on strong dollar and more oil expected from Iraq and Kurdistan

• MCX Crude oil Oct is likely to rise towards Rs 5850 level as long as it stays above Rs 5650 level.

• MCX Natural gas Oct is expected to rise towards Rs 292 level as long as it stays above Rs 279 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631