Hold JSW Steel Ltd for the Target Rs. 1,064 By Prabhudas Liladhar Capital Ltd

Superior execution & VASP to drive growth

Quick Pointers:

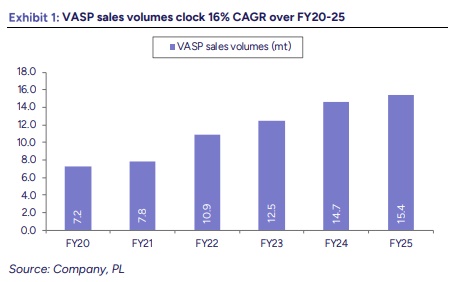

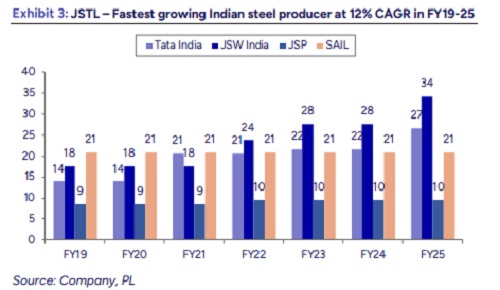

JSTL’s crude steel capacities and value-added special products (VASP) volumes grew at 14% and 16% CAGR respectively over FY20-25.

The management reiterated FY26 guidance of cons sales volume at 29.2mtpa with expectation of demand uptick as monsoon recedes in the next 2 weeks.

We recently met the management of JSW Steel to gain insights into domestic steel demand and the company’s initiatives to improve margins. Newly commissioned 5mtpa at JVML has been ramping up well over the last few months. Brownfield Phase III 5mtpa expansion at Dolvi is on track to be commissioned by Sep’27, while in the near term, BF#3 at Vijayanagar is expected to undergo planned 6-month shutdown to upgrade capacity by 1.5mtpa by end of FY26. With another 0.5mtpa debottlenecking, JSTL would reach 36.4mtpa by FY26E. We expect JSTL to continue to capture market share as domestic demand improves aided by GST rationalization. JSTL remains India’s fastest growing steel producer with its superior execution capabilities. Over the last 5 years, its VASP volumes improved from 7.2mt to 15.4mt while its India crude steel capacity grew at 14% CAGR to 34.2mtpa – highest amongst peers.

Several countries have witnessed a boom in steel demand post reaching 100kg per capita consumption mark, and India is expected to follow suit in the next few years. We expect JSTL to be a prime beneficiary of this demand acceleration as it has outlined several capacity expansion avenues over FY25- 31E, to reach 50mtpa mark. Although steel prices declined sharply post May’25, expected demand uptick post monsoon, safeguard extension and China’s policies would improve situation. We cut FY26/27E EBITDA by ~4%/5% adjusting for near-term pricing weakness and introduce FY28 EBITDA estimates. We expect JSTL to deliver strong 26% EBITDA CAGR over FY25-28E on a low base. At CMP, the stock is trading at 8x/7.4x EV on FY27/28E EBITDA. We maintain ‘HOLD’ rating with revised TP of Rs1,064 (Rs1,068 earlier), valuing the company at 7.5x EV/Sep’27E EBITDA (rolling forward from Mar’27).

Focus on value-added products:

JSTL has come a long way since its collaboration with JFE Corp in FY11 and over the last 15 years, it has improved its market share in the automotive sector to ~34% in FY25. With consistent addition of downstream capacities, JSTL is also capturing high-margin segments such as color-coated products, galvanized sheets, and LRPC, etc. where growth potential is also higher. Although its crude steel capacities are also growing at a fast pace, JSTL aims to maintain its share of VASP at over 50% of total sales volumes. It has already doubled VASP sales from 7.2mtpa in FY20 to 15.4mtpa in FY25 and intends to sustain this share going forward.

Efficient growth strategy: JSTL incurs a capex of USD500-550/t to build new steel capacity, much below compared to peers. JSTL can postpone some of the ongoing capex in the event of lower profitability as most of the capex is expected to be funded by internal accruals. As per our estimates, net debt to EBITDA is expected to improve substantially if stable steel pricing continues for the next 3 years. Learning from past mistakes, JSTL has also refrained from aggressive participation in recent iron ore mine auctions, where premiums have exceeded much beyond 100% and would significantly increase overall cost of production. Therefore, JSTL has opted for a more calculated approach in its bidding strategy.

Approved capex for next 3 years (Rs bn) Earlier approved capex for crude steel capacities 478.0 Dolvi sinter & CPP 31.5 Mining & cost saving projects 42.1 Value-added product facilities 27.0 Sustenance capex 40.1 Total 618.6 Source: Company, PL

Aiming to become India’s first CRGO steel producer:

JSW JFE Electrical Steel will produce India’s first cold-rolled grain-oriented (CRGO) electrical steel at the recently acquired Thyssenkrupp Electrical Steel India plant in Nashik. JSTL plans to scale up the production capacity from 0.05mtpa to 0.25mtpa. This is going to be a significant value addition over other VASP. JSTL, in collaboration with JFE, has also committed capex for another 100ktpa CRGO capacity at Odisha with capex of Rs70bn in the first phase. Over the next few years, it will be expanded to 350ktpa in the second phase, at capex of ~Rs150bn.

Rising raw material security aiding predictability:

JSTL has 12 captive iron ore mines operational, which were purchased via auctions: 9 in Karnataka (~11mtpa) and 3 in Odisha (~15mtpa). Following mines are likely to be operationalized over the next few quarters: 3 in Karnataka (4.5mtpa), 3 in Goa, 1 in Odisha, and 2 exploration blocks each in Maharashtra and Andhra Pradesh.

JSTL has secured total 1.6bt of R&R of iron ore, mainly in Karnataka 0.28bt; Odisha, 0.9bt; and Maharashtra, Andhra Pradesh and Goa, 0.43bt. Recent JV with Andhra Pradesh Mineral Development Corporation for linkage and setting up of iron ore beneficiation plant, is expected to yield ~1.3mpa of high-grade ore. These iron ore mines are expected to provide long-term security, consistent grades to enhance BF productivity, and optimize the logistics cost over time.

On the coking coal front, JSTL secured 3 mines in Jharkhand with R&R of 380mt and ~5mt of long-term linkage from Coal India, which are expected to commence over the next 2-3 years and yield ~3.5mtpa clean coking coal. JSTL acquired 20% effective interest in high-grade mines in Illawarra, Australia with total reserves of 97mtpa, ~6.4mtpa average production in the last 5 years, and 20% offtake arrangement.

JSTL is in the process to acquire Minas de Revuboe hard coking coal predevelopment stage mine project in Mozambique. It has ~800mt reserves, with potential to yield ~280mt of clean coking coal, though operations are expected to commence only after 3-5 years.

Above views are of the author and not of the website kindly read disclaimer