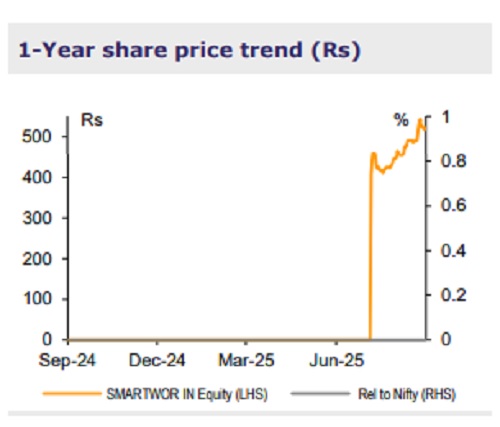

Company Update : Smartworks Coworking Spaces Ltd By Emkay Global Financial Services Ltd

We met the management of Smartworks Coworking Spaces (SCS), to understand the ongoing industry trend and the company’s growth plans. KTAs:

Terms of lease aimed at mitigating cash-flow risks

SCS primarily follows a straight lease business model, wherein it leases bare shell properties on long-term basis mainly from passive and non-institutional landlords. It usually enters into 10-15Y lease agreements (15% rentals escalation every 3Y) with landlords, wherein SCS has lock-in period of 60 months, while landlords are locked-in for the entire duration. On the other hand, lease agreements with clients are usually for 3- 5Y (average tenure: 49 months for >300 seats). Rentals for clients have escalation of 5% pa; and clients are not permitted to terminate unless SCS causes a material breach.

Pricing strategy is devised to achieve rental revenue from clients, which is at least double the lease rentals that it owes to its landlords. Focus is on mid and large enterprises (>300 seats), which are sticky in nature with longer lock-in period and a high retention rate of >80%; hence, it mitigates the asset-liability mismatch risk. Largest client size has increased progressively, from deal size of >3,500 seats in FY23 to >6,300 seats in FY25. Contractual arrangements with clients as of FY25 cover SCS’s rental obligations for FY26- 27 toward the landlords. Further, SCS typically does not lease more than 30% space in a center to a single client, reducing client concentration risk (revenue contribution from the top-10 clients has significantly reduced, from 33% in FY19 to 19% in Q1FY26).

Rapidly scaled up; more additions under way

SCS’s lease signed portfolio witnessed 31% CAGR to ~9msf in terms of super built-up by area (SBA), while total capacity seats increased 33% CAGR to 203,118 during FY20-25. Further, as of Q1FY26, SCS had SBA of ~12msf, of which 8.3msf is operational (rest under fit-outs, hand-over stage, and LOI). Currently, 190,000 seats are operational, and another ~40,000 to be added in FY26 are already contracted for. Further, it has signed LOI/term sheet for an additional 1.9msf space which translates into 43,000 seats; revenue from these would be realized in FY27. Overall, the operational seat-count is expected to increase from 190,000 to 275,000 within the next 4-5 quarters.

Making the campus space more capital-efficient

SCS typically does 20-25% pre-leasing before any center comes in. Within the first 12 months, it aims to reach 65-70% occupancy and achieve breakeven. Most initial opex incurred for a center is recovered by then. Post this, it typically recovers the entire payback with a steady-state ramp-up of occupancy in 30-32 months. Once the center stabilizes and recovers the capex, margins continue to stabilize, while ROCE keeps on improving. SCS’s budgeted capex at ~Rs1,350/sqft and monthly center operation cost at Rs34-36/sqft range is lower than the industry average. Also, brokerage expense at 4% of revenue in FY22 has reduced to ~3%, as dependency on the brokerage system continues to reduce. SCS’s RoCE is >13% currently and, with improvement in cash flow as well as capital efficiency, it aims to double this in the next 2-3 years.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354