Commodity Morning Insights 24th September 2025 - Axis Securities

Commodity Derivatives Snapshot

Comex Gold surged to a fresh record high in the previous session, reaching around $3,791 before settling near $3,765 for the first time. The Federal Reserve Chairman acknowledged the strength of the labour market and hinted at the prospect of additional rate cuts later this year. However, he maintained a modest stance on the timing and scale of easing, which could provide support for gold at lower levels. That said, the rally in bullion this year has been parabolic, and we advise investors to remain cautious in the near term

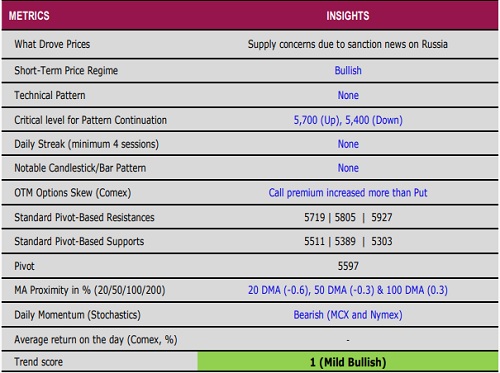

Nymex Crude Oil snapped its losing streak and gained close to 2% in the last session. Prices were supported by renewed concerns over supply after the European Union threatened sanctions on Russia, which raised the risk of potential disruptions. This development helped crude recover from recent weakness.

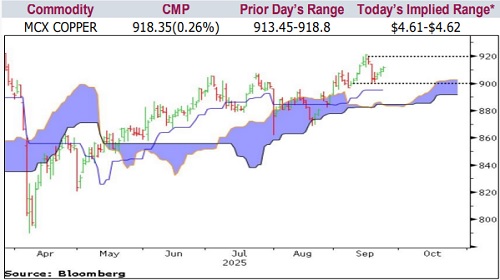

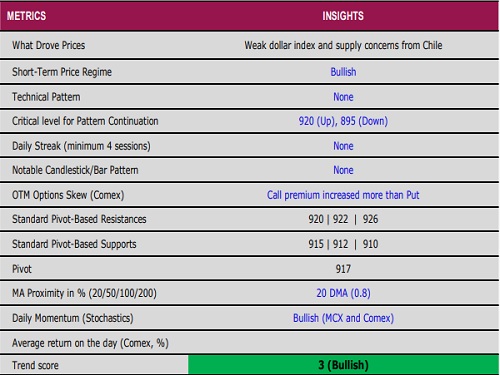

Comex Copper ended marginally lower as mixed news flows kept prices in a tight range. Operations at Indonesia’s Grasberg mine remain impacted by ongoing rescue efforts. Meanwhile, Chile’s state-owned Codelco warned that its El Teniente mine will take longer than expected to return to full production. At the same time, weaker economic data limited any upside momentum in the red metal

Nymex Natural Gas also managed to break its losing streak in the last session, largely driven by short covering. The contract had come under sustained selling pressure due to ample supply and a mild weather outlook that weighed on demand. Immediate resistance is placed near the $3.2 level, and a breakout and close above this threshold could push prices higher towards $3.3 in the near term

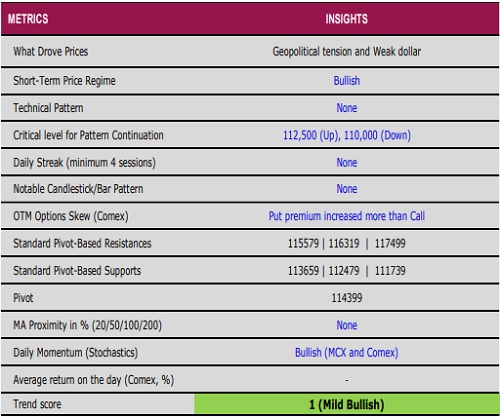

Gold

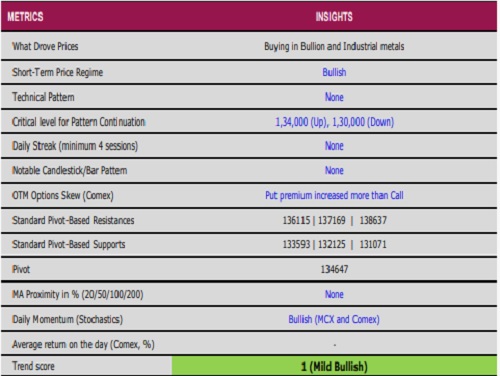

Silver

.

.

Crude Oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633