Buy Star Cement Ltd For Target Rs. 265By Emkay Global Financial Services Ltd

We interacted with Tushar Bhajanka, Deputy MD of Star Cement, to understand the company’s growth plans and the demand-supply outlook in the Northeast. KTAs: 1) The Northeast remains one of the fastest cement consuming regions, with ~10% medium-term CAGR backed by infrastructure spends of Central/state governments. 2) Led by upcoming capacity expansions, Star aims to strengthen its leadership in the Northeast, beyond its current volume market share of ~27%. 3) The unlikely entry of any new player in the Northeast in the next ~4Y would augur well for cement prices. 4) Star aims to diversify geographically, with clear expansion plans in Rajasthan; it has already secured limestone mines in the state through government auctions. 5) It is on track to reach capacity of ~18mtpa (vs ~8mtpa currently) in the medium term. 6) Focus remains on cost-efficiency through capex on efficiency parameters.

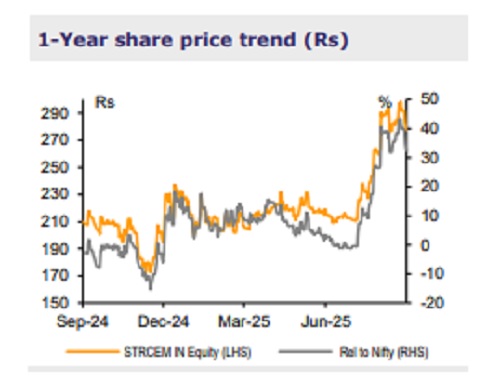

We like Star’s regional dominance and endeavor to stretch its leadership over peers in the Northeastern market. Further, entry into Rajasthan will help it shed the tag of a regional player and establish its brand in North India, coupled with >2x its existing capacity base. We note that the recent surge in the stock price (up >30% in the past 2M) could limit upside in the near term. Also, at the CMP, Star trades at ~11x FY27E EV/EBITDA, ie near +1SD (5Y mean). We maintain BUY and our earnings estimates, with a TP of Rs265.

With home turf guarded well, Star shall look to diversify in North India

Star commands ~27%/33% volume/capacity market share in the Northeast. With the commissioning of Silchar and Jorhat GUs in FY26E and FY27E, we see Star’s volume/capacity share rising to a robust ~29%/45% in the Northeast by FY27E. The management guided for a greenfield expansion project (a 4-5mtpa IU) in Rajasthan as the next leg of expansion, after the completion of ongoing projects. Star shall achieve cement capacity of ~18mtpa (>2x its current capacity) in ~5Y, with the completion of Rajasthan project.

Robust balance sheet to support expansions

We estimate Star’s cumulative operating cash flows at ~Rs25bn over FY26-28 vs total capex outflow of Rs18bn, thus expecting it to turn net-cash positive by FY27E-end. Further, it allows the company to opt for large capacity expansions (planned 4/5mtpa IU expansion in Rajasthan), with a mix of internal accruals and equity fund raise keeping leverage in check. Excluding incentives, we estimate Star’s EBITDA/t at ~Rs1,240, Rs1,265, and Rs1,315 in FY26E, FY27E, and FY28E, respectively, and see its RoE rising to 13-14% in the medium term vs ~6% in FY25

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354