Buy Sobha Ltd for the Target Rs.1,800 by Choice Broking Ltd

Strong Launch Pipeline Complements Expected Project Completions

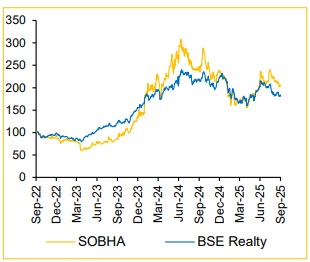

We upgrade SOBHA to BUY rating with a revised TP of INR 1,800/sh. We believe the stock price correction of 47% from its high adequately prices in all the negatives. We expect FY26 and FY27 to be a be a launch heavy year which will drive healthy pre-sales growth and revenue recognition of 4 msf worth of deliveries in FY26/27 would materially lift reported financials. EBITDA margins (reported) would gradually move up as higher priced and higher margin projects start getting completed and get recognised in the reported financials.

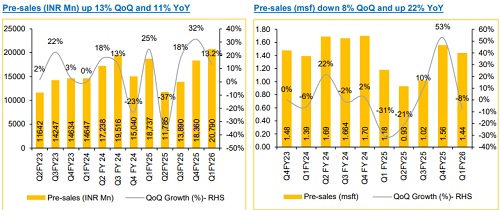

Pre-sales decreased 6% in FY25 which worried the market, but FY26 to be a launch heavy year:

SOBHA reported a decline in pre-sales during FY25, primarily due to approval delays, but has guided for a 30% YoY growth in FY26 and is targeting INR 100Bn in pre-sales by FY27E. In Q1 FY26, SOBHA achieved its highest-ever pre-sales of INR 20.8Bn and plans to launch 8 msf of projects over the next 3 quarters with a GDV of approximately INR 100Bn. From its ongoing and completed projects, Sobha expects to generate net cash flows of INR 111Bn over the next 4–5 years, while future projects are projected to yield INR 70.0Bn over the next 5–6 years from 18 msf of planned launches.

Expanding into new geographies:

Sobha is slowly and gradually expanding its presence beyond the Southern market, as it is not in a hurry to increase its inventory within a short span of time. Sobha has already made an impressive start in the NCR region and also started investing in new geographies like Pune and Hyderabad and increasing its presence in Kerala. Sobha also has plans to penetrate into the MMR market, although it is at a nascent stage.

Rights issue of INR 20Bn to support future growth:

SOBHA has raised INR 20Bn through rights issue, which will be used for funding certain project-related expenses for ongoing and forthcoming projects, capex, acquisition of land parcels and partial debt payment. Despite higher land prices across Tier-I and Tier II cities, we believe Sobha has the execution wherewithal to generate over 30% project-level EBITDA.

Valuation:

Based on the SOTP valuation approach, we arrive at a target price of INR 1,800, factoring in the Residential Business, Commercial Rental, Contract & Manufacturing Business, as well as the land bank.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131