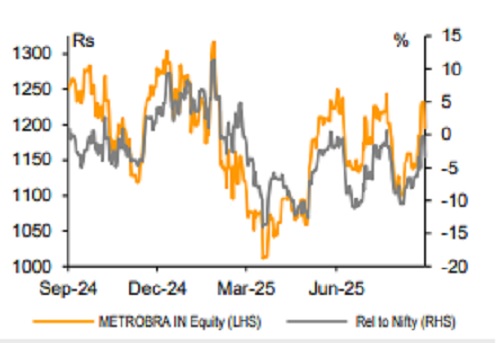

Buy Metro Brands Ltd For Target Rs. 1,475 By Emkay Global Financial Services Ltd

We reiterate BUY on Metro, while revising up our TP by ~14% to Rs1,475 (60x Sep-27E pre-IndAS EPS). The change in TP is led by near-equal contribution from upward revision of estimates and earnings rollover. Given the GST reduction and improving outlook on value-format Walkway, we build in better LTL trends and higher expansion across formats. We also factor in margin gains, helped by operating leverage on Metro’s recent tech/team investments and the margin turnaround in FILA (150-250bps impact in FY24/FY25). The recent Metro Crossover (all-day shoes) launch is a perfect match for evolving consumer preferences; new format ‘Shoe Depot’ should also help cater to the discount-seeking consumer better. Metro’s healthy balance sheet (~40% cash) makes it a go-to-partner for incoming global brands, and further portfolio augmentation remains a potential upside.

GST reduction sharpens Walkway positioning; aids overall growth improvement

Metro has ~40% sales mix in the <Rs2,500 priced footwear, and GST reduction to 5% should drive higher throughputs, in our view. Assuming demand elasticity of 0.8x and pass-on of the entire benefit to consumers, we see scope of ~3% increase in topline and an operating leverage-driven benefit of ~7% in EBITDA. In addition, the GST reduction improves prospects for focused value-format Walkway, as it is likely to drive a superior value proposition and accelerate the shift from unorganized channels. Walkway offers the deepest penetration potential, as comparable peer (Bata) has COCO/franchisee penetration in 335/505 unique towns.

Crossover, Shoe Depot – Attractive launches in line with consumer preferences

Metro has recently launched a premium crossover range (priced at Rs4,490-6,990), which combines both fashion and comfort. The products are designed for effortless wear all day long, helped by a Ortholite footbed and a lightweight EVA sole. In addition, Metro has launched own outlet-store format ‘Shoe Depot’, which addresses the needs of discount-seeking consumers in select markets. The format houses its inhouse brands (Metro/Mochi), exclusive brands (Crocs/Fitflop/FILA), as well as outside brands (Puma).

S&A a big growth lever; Metro making conscious investments

The S&A industry has seen high-teens revenue CAGR over FY19-24 and entails a big growth opportunity, as sports adoption is miniscule in India currently, albeit rising at a rapid pace. Metro has made conscious efforts toward gaining exclusive partnerships (FILA/Footlocker) in setting up dedicated business units (separate P&L) in AI/Analytics technology and in streamlining of its supply chain (BIS challenges). In our view, both Footlocker and FILA have medium-term potential of becoming >Rs10bn brands/formats and are being led by seasoned leaders (Adidas/Nike heritage). Metro’s balance sheet is strong and offers further scope for filling white spaces in its S&A portfolio.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354