Buy Kalyan Jewellers Ltd For Target Rs. 610 by Centrum Broking Ltd

Charting Newer Strategies; Execution Will Hold Key

Kalyan Jewellers (KALYANKJ IN) result was largely in-line with our estimates. Key highlight was a shift in strategy towards (i) pausing of debt reduction and utilizing cash towards opening regional brands and (ii) building jewellery manufacturing hub in Thissur to drive efficiencies. The regional brand strategy will enable the company to upgrade consumers from unorganized to organized; however execution will hold key. Demand trends in early Q2 have been healthy and there will be benefit of early festive days; however base quarter was high due to duty cut. All key metrics in Q1 have seen healthy growth in terms of (i) store addition (9/8 Kalyan/Candere), (ii) strong SSSG (+18%YoY), (iii) stud portfolio seeing good growth (+30%YoY), (iv) new customer addition and (v) broad based growth in south and non-south. While Kalyan has demonstrated good execution in terms of expansion of store network through FOCO route and charting debt reduction strategy; we believe new pivots will need to be monitored and execution will hold key.

Healthy Topline trajectory Continues

Kalyan’s consolidated revenue grew by 31.3%YoY driven by healthy growth across India (+31%YoY) and international business (+32%YoY). India business growth was driven by (i) strong SSSG (+18%YoY), (ii) healthy new customer addition (~38% share) and (iii) store addition. Domestic business saw broad based growth across south (+30%YoY) and nonsouth (+33%). Despite gold price volatility, the studded revenue grew by 30% YoY and contributed ~30.2% to overall revenue while Gold revenue grew by 32% YoY. Middle East reported revenue growth of 27%YoY with studded jewellery seeing healthy growth leading to its share increasing by ~200bps YoY to 18.4%.

Gross Margin Moderation Continues Due to Inc In Franchisee Mix

Gross margins contracted by 47bps YoY to 13.9% owing to higher contribution from margin dilutive FOCO stores. Lower other expenses (-43bps YoY as % of sales) and employee expenses (-23bps YoY as% of sales) led to EBITDA Margins expansion. EBITDA Margins expanded by 20bps YoY to 7%. EBITDA grew by 35.1%YoY while PBT grew by 48.6%YoY as Other income doubled during the quarter. PAT grew by 48.7%YoY. The margins in the quarter were positively impacted by (i) pilot project towards leaner credit period, (ii) higher growth in better margin silver & platinum segment and (iii) operating leverage.

Superior Growth + Store Addition; Maintain BUY

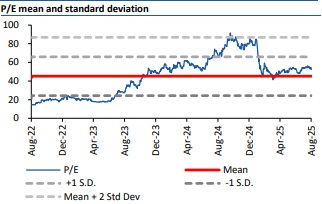

Kalyan has been driving industry leading growth and store addition. We believe, the healthy growth momentum to continue. However, pause of debt reduction was a slight disappointment. The new strategy of launching regional brands and building manufacturing hub will need to be monitored closely. We estimate revenue/PAT CAGR of 24%/29% over FY25-28E. We assign BUY rating on the stock. We roll forward our EPS estimates to Sept’27 EPS of Rs13.5 resulting in target price of Rs610 based on target PE multiple of 45x.

For More Centrum Broking Disclaimer https://www.centrumbroking.com/disclaimer/

SEBI Registration No.:- INZ000205331