Buy Juniper Hotels Ltd for the Target Rs. 410 by JM Financial Services Ltd

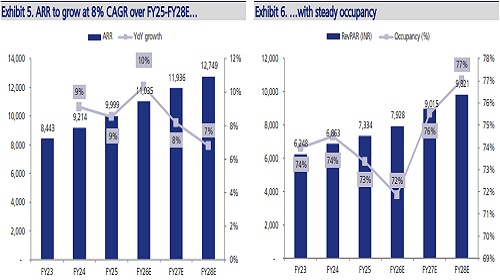

Juniper reported 11% YoY growth in revenue to INR 2.2bn (-20% QoQ) which in line with our estimates. Growth during the quarter was led by 9% YoY growth in ARR along with 15% YoY increase in anuity income. Occupancy was steady at 71% (flat YoY) and the flagship assets of Grand Hyatt, Mumbai (GHM) and Andaz operated at an occupancy of 67%/72% occupancy respectively. The higher flow-through on account of improved ARR and low base of 1QFY25, resulted in 5pps expansion in EBITDA margin for the quarter. The company has a strong development pipeline of c. 850 keys across 3 assets in Bengaluru, Guwahati and Kaziranga. With an extremely comfortable leverage position and steady cash flows from its existing portfolio, Juniper is well positioned to fund the addition of c. 2,000 rooms over the next 3-4 years, which will be primarily sourced through ROFO assets, organic expansion and new acquisitions. We estimate revenue CAGR of c.14% and EBITDA CAGR of c.22% over FY25-28E, with EBITDA margin expected to reach 43% by FY28E. We maintain a BUY rating with a TP of INR 410, valuing the company at 18x Mar’27E EBITDA.

* In-line performance: Juniper reported revenue of INR 2.2bn (+11% YoY; -20% QoQ), in line with our estimates. F&B and MICE revenue was up by 12% YoY to INR 690mn and annuity assets contributed INR 340mn to total revenue (+15% YoY). Occupancy during the quarter was steady at 71% (flat YoY) as it was impacted by the geopolitical tensions in North India. Gross Portfolio ARR came in at INR 10,598, growing 9% on a YoY basis (-15% QoQ). Andaz and GHM recorded 13% and 9% YoY growth in ARR respectively. In 1QFY26, the GHM and Andaz hotels operated at 67%/72% occupancy respectively.

* ARR growth drives margin expansion: Juniper’s EBITDA came in at INR 798mn (+27% YoY; -32% QoQ) with EBITDA margin improving 500bps YoY to 36.2%. Margin expansion was primarily driven by higher flow-through resulting from 9% YoY increase in ARR and also benefited due to the lower base impact in 1QFY25. It was also supported by lower energy cost due to increased renewable mix. The management highlighted that margin could have been higher if not for the disruption witnessed in May’25.

* Robust development pipeline: The construction and development for Phase I at the Bengaluru asset is on track and it should start operations by Q4FY26. The company has secured all the approvals for the Kaziranga hotel with construction scheduled to begin in Sep’25. It has also initiated design and approval process for the Bengaluru Phase II and Guwahati assets which will be completed by FY29E. Beyond these four developments, the Juniper remains active in identifying expansion opportunities and has submitted bids for new assets in NCR and Bihar. The management has reiterated that the ROFO transaction will be completed by FY27E.

* Maintain BUY; Mar’26 TP of INR 410: We estimate revenue CAGR of c.14% and EBITDA CAGR of c.22% over FY25-28E, and expect EBITDA margin to reach 43% by FY28E. EBITDA growth will be driven by ramp-up in new inventory and higher ancillary revenue at GHM. We maintain BUY with a TP of INR 410, valuing Juniper at 18x Mar’27 EBITDA

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361