Buy Gravita India Ltd for the Target Rs. 2,300 by Emkay Global Financial Services Ltd

GRAV’s sustained trajectory of stable growth was highlighted in FY25, along with steady revenue growth and profitability. GRAV saw a standout surge in operating cash flow to Rs2.8bn, translating into FCF of Rs1.7bn (vs a deficit last year). EBITDA margin held firm, while PAT margin rose to 8.1% on lower finance cost. GRAV’s ‘Vision 2029’ roadmap, doubling of capacity, higher VAP share to over 50%, strict capital discipline, and strong ESG focus position it well to benefit from the strong demand and regulatory tailwinds. Growth looks sustainable, though timely project execution is key. We retain BUY and TP of Rs2,300.

Vision 2029: Disciplined growth anchored in sustainability

GRAV has laid out a clear and ambitious roadmap to establish itself among the top five recycling companies globally by 2029. The company targets over 50% revenue from value-added products (VAP), expansion of non-lead verticals to over 30% of the portfolio, and doubling of installed recycling capacity to 700kt by FY28, from 333kt in FY25, through a carefully sequenced Rs15bn capex program. GRAV’s growth is underpinned by strict capital discipline; each project must deliver ROIC of 25% or more, with recovery payback within 3Y, and sustain asset turns of 8–10x, ensuring expansions are both accretive and capital-efficient. Parallelly, GRAV has committed to a rigorous ESG agenda, including achieving water neutrality in India by FY34 and net-zero Scope 1 and 2 emissions by FY50. Taken together, these objectives reflect a growth strategy that is not only scalable and diversified but also aligned with globally sustainable capital flows.

Stable margins; strengthens balance sheet

GRAV’s cash profile strengthened further in FY25. Operating cash flow surged to Rs2.8bn in FY25 from Rs0.4bn in FY24, on tighter working capital (WC)/operating leverage. After the Rs1.1bn capex, FCF was Rs1.7bn in FY25 vs last year’s negative outflow. As a result, GRAV was net debt-free at year-end, supported by strong cash generation and proceeds from QIP. WC cycle improved to 80 days (vs 101 in FY24), aided by leaner inventory and higher domestic scrap procurement, underscoring GRAV’s ability to self-fund growth and enhance financial flexibility. EBITDA margin held firm at 10.4% despite cost pressures, aided by better product mix and efficiency gains. PAT margin rose to 8.1% (from 7.7%) on lower finance cost, higher other income. Overall, FY25 was a year of stable operating margin, with further expansion hinging on increasing VAP beyond the 46% mix now.

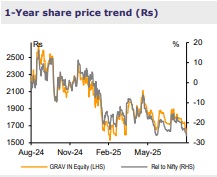

Steady FY25 performance; reiterate BUY

FY25 saw healthy margins, robust cash conversion, and negligible leverage, ensuring a strong balance sheet. Supported by strong demand, capacity expansion, and regulatory formalization, the growth outlook is robust, with our estimated revenue CAGR at 22% over FY25-28. Timely execution of projects, however, remains key to sustaining value creation. We retain BUY and target price of Rs2,300.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354