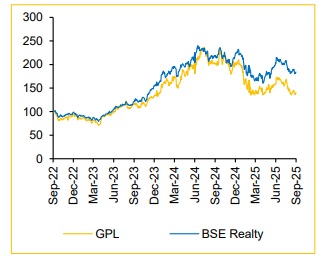

Buy Godrej Properties Ltd for the Target Rs.2,500 by Choice Broking Ltd

See Through Q1FY26 Soft Patch

We maintain our BUY rating on Godrej Properties Ltd (GPL). We fine tune our operating cash flow, land purchases related outflow and cost of capital assumptions which results in a lower TP of INR2,500/sh (vs INR3,500 earlier).

Strong launch pipe line ahead:

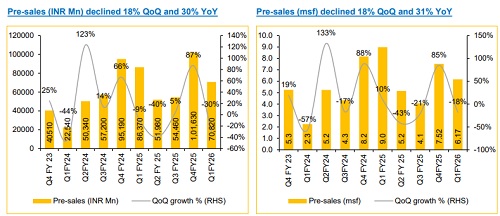

Q1FY26 pre sales came in at INR 70.8Bn, lower by 18% YoY which may be viewed as a slowdown. However, GPL targets FY26 pre sales of INR 323.9bn (+10% YoY) on the back of healthy launch pipeline spread across Gurgaon, Greater Noida, and Worli in Q2FY26/Q3FY26, with major launches like Godrej Golf Links, additional projects like Indore, Rajendra Nagar, Upper Kharadi Ahmedabad, and Raipur. Even if some of these expected launches slip into FY27, there is scope for GPL’s FY26 Pre-sales beating guidance of INR 323.9Bn.

Real Estate cycle in India is in its 5th year, pricing is no longer a tailwind:

GPL generally sells ~80+% of the inventory in a launched project while the rest is retained to capture any price appreciation. Price increases in most of GPL’s launched projects across regions is in the range of 1-3%, which is quite modest, but it is understandable given the cycle maturity. GPL’s launch pipeline and opportunistic business development can easily offset price increase slowdown, in our view.

GPL has outperformed its FY25 guidance on all fronts:

GPL has achieved 122% of its presales guidance of INR 270Bn, 114% of its customer collection guidance of INR 170Bn and has delivered 18.4 msft, which is 123% of its guidance of 15 msf. In addition, GPL has done business development of INR 264.5Bn, achieving 132% of its guidance of INR 200Bn.

Fund raise to support business development:

GPL successfully raised INR 60Bn crore through a Qualified Institutional Placement which will significantly support its business development while ensuring a strong balance sheet. In Q1 FY26, the company’s net debt-to-equity ratio improved to 0.26, down from 0.71 in Q1 FY25, providing ample financial flexibility to aggressively expand its project launch pipeline even though GPL intends to fund most Business Development (BD) through internal accruals. This will, in turn, sustain Pre-sales growth going forward. In addition, GPL has already achieved 57% of its FY26 business development guidance of INR 200Bn, indicating strong progress towards its targets for the year.

Valuation:.

Based on the SOTP valuation approach, we arrive at a target price of INR 2,500 factoring in ongoing and upcoming owned/JV projects, DM & commercial project pipeline and land bank.

\

\

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131