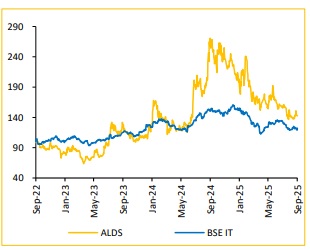

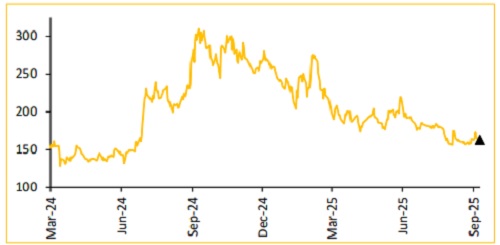

Buy Allied Digital ltd for the Target Rs.225 by Choice Broking Ltd

Key management meet takeaways:

We interacted with Mr. Nehal Shah, Executive director & Mr. Gopal Tiwari, CFO of Allied Digital Services Ltd (ALDS). Key takeaways are (1) Core focus remains on IT infrastructure & security services, with strong execution track record in government & enterprise projects, (2) Government projects around smart cities continue to be a major growth driver, with ALDS looking to expand its services into critical infrastructure projects such as metro/ railways surveillance & airport security, (3) US enterprise segment remains ALDS’s largest revenue contributor, though ongoing pricing pressures affects margin despite continued large deals wins, (4) Focus on acquisitions in cloud & AI services to strengthen strategic capabilities & (5) Expand cybersecurity offerings across IT & OT layers, giving clients a one-stop solution unlike competitors who separate these services. We maintain a BUY rating, with an unchanged TP of INR 225.

ALDS Scales Up With Government Projects & Global IT Wins:

ALDS has demonstrated strong execution & credibility through large deal wins, including a INR 5,000Mn Pune Smart City project & 5-year global IT services deal worth INR 4,200Mn from a leading European pharma MNC. The company aims to expand in government projects like metro, railway, & airport surveillance. However, macroeconomic uncertainties in IT services vertical are causing some clients to delay or renegotiate their IT spends. Overall, with improving macros, we expect strong growth in deal conversions, particularly in IT services, while smart city project wins remain contingent on favourable bid outcomes.

Targeting ITSM Growth with Digital Desk Rebrand:

ALDS has rebranded its ADiTaaS platform to Digital Desk, positioning it as a comprehensive ITSM solution that competes with industry leaders like ServiceNow. This strategic move underscores ALDS's commitment to expanding its recurring services business & enhancing revenue visibility through long-term contracts. By offering a competitive alternative to established ITSM solutions, ALDS aims to strengthen its position in the global market.

Pursuing Strategic Acquisitions in Cloud, AI, and Cybersecurity:

The company is looking for acquisitions that complement its existing offerings; ALDS seeks to expand its service portfolio, gain access to new markets, & enhance operational efficiencies. These acquisitions will help the company to deepen its expertise, improve cross-selling opportunities, & accelerate its footprint—particularly in areas like cloud services, AI-driven solutions, & cybersecurity, where demand is rapidly expanding.

Reaffirms INR 10Bn Revenue Target with Stable Margins: Management reaffirmed its INR 10Bn annual revenue run-rate target over 4-5 quarters, with INR 2.5Bn quarterly run-rate by H2FY26 backed by a strong order book. Margins are expected to remain stable in the near term, with medium term EBITDAM target of 12-13% (unchanged). Recovery is expected to be driven by AI-led automation, higher services mix & contract ramp-ups. Direct sales & partner network expansion is anticipated to support scale & margin resilience. Valuation – Maintain BUY rating with a TP of 225: Given strong execution across Smart Cities, expanding Solutions contribution, global enterprise deals & a healthy order book, we maintain our PE multiple of 15x despite short-term margin pressure & may consider an upward revision to PE multiple when there is a meaningful improvement in margin. We expect Revenue/ EBITDA/ PAT to expand at a CAGR of 19.5%/ 46.3%/ 48.2% over FY25-FY28E.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131