MOSt Advisor September 2025 by Siddhartha Khemka, Sr. Group Vice President, Head - Retail Research, Motilal Oswal Wealth Management Ltd

Equity markets ended lower in Aug’25, weighed down by uncertainty around US tariffs on India and persistent FII outflows. Nifty slid 1.4% in Aug’25, to close at 24,427. Broader markets significantly underperformed with Nifty Midcap100 and Smallcap100 declining by 2.9% and 4.1% respectively. Further FIIs were net sellers, with outflows of Rs.46,903 crore in August’25, while DII inflows remained robust at Rs.94,829 crore.

On the macro front, India’s real GDP growth accelerated to 7.8% YoY in 1QFY26 (highest in last five quarters), up from 6.5% in 1QFY25, showing strong domestic resilience amidst global turmoil. Also, India's retail inflation declined to an 8-year low of 1.55% in July (vs 2.10% in Jun’25).

In another positive development, S&P upgraded India’s sovereign credit rating to BBB from BBB- with a stable outlook after nearly 19 years, citing robust economic growth, fiscal consolidation efforts, and a conducive monetary policy stance.

The GST Council has rolled out the GST 2.0 reforms, rationalising the current four-tier rate structure (5%/12%/18%/28% + cess) into a simpler two-tier structure (5%/18%) with a 40% demerit rate for sin/luxury goods. Effective from 22nd Sep’25, the reforms aim to simplify compliance, improve ease of doing business, and pass benefits to consumers.

On the trade front, the US has imposed an additional 25% secondary tariff on Indian goods effective August 27, 2025, raising the overall tariff burden to 50%. This sharp hike has dampened market sentiment and heightened concerns around India’s export competitiveness. The move poses near-term headwinds for export-driven sectors such as IT, Pharma, Automobiles, and Textiles, until a trade agreement with the US is finalized.

Indian markets have been subdued due to weak earnings and macro/geopolitical headwinds. However, we believe that the influence of the US tariffs on Indian markets could be limited. At 22x FY26 P/E (vs 10Y avg. 20.7x), Nifty valuations look reasonable with scope for expansion, backed by our 10% PAT growth forecast for FY26.

On sectoral front, we are positive on domestic themes given the economy-wide benefits due to announcement of GST 2.0 and hence like Auto, Consumer Durables, Consumer Staples, Cement, Hotels, Insurance, Retail. Incrementally ,we are turning positive towards mid-caps owing to improved earnings and higher growth prospects

Technical& Derivatives Outlook

* Nifty index remained volatile throughout August as selling pressure was visible from 25000 zones while strong support-based buying emerged near 24350 levels. The index broadly traded within a range of 700 index remained volatile throughout August as selling pressure was visible from 25000 zones while strong support-based buying emerged near 24350 levels. The index broadly traded within a range of 700 points between 24350 to 25000 witnessing sharp swings on both sides during the month. On the sectoral front, continuous buying interest was observed in Auto and Auto Ancillaries, new age companies and selective Consumption stocks while Pharma, PSE, Energy, Metals, Banks, Infra and Defense sectors showed notable weakness.

* Technically, Nifty formed a bearish candle with a longer upper shadow on the monthly chart, highlighting sustained pressure at higher levels. The repeated defense of 24442 support zone indicated demand is emerging at lower levels, keeping the overall undertone positive with bouts of volatility. For September series, positional supports are seen at 24350 and then 24000 zones, while a decisive hold above 25000 could open the gates for the next leg of the rally towards 25350 and 25500 levels.

Derivative Strategy

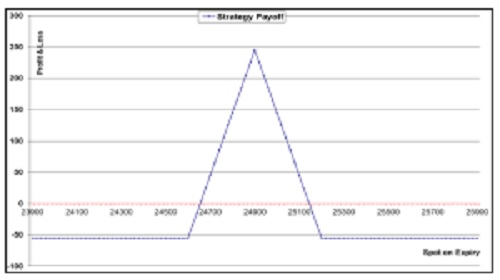

NIFTY

BUY 1 LOT OF 24600 CALL

SELL 1 LOT OF 24900 CALL

SELL 1 LOT OF 24900 CALL

BUY 1 LOT OF 25200

CALL Margin Required : Rs.80,000

Net Premium Paid : 50 Points (Rs.3450) Max Risk : 50 Points (Rs.3750)

Max Profit: 250 Points ( Rs.18750)

Lot size : 75

Profit if it remains in between 24650 to 25150 zones

* Nifty index has witnessed volatile moves over the past month but is holding well above its key support zones, with bulls managing to defend lower levels.

* On the weekly scale, the index is trading in a range of 24350 to 25000 for the past few weeks and is likely to continue within this band.

* Maximum Call Open Interest is concentrated at the 25000 and 24500 strikes, while Put Open Interest is visible at the 24000 and 24500 strikes.

* Considering this setup, a Bull Call Butterfly Spread is suggested as a suitable strategy to capture the upside within the range-bound move, especially with an expected decline in volatility going forward.

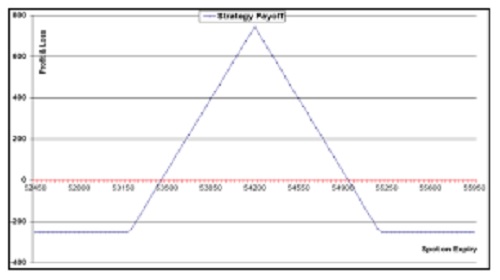

Bank Nifty

SELL 1 LOT OF 54200 CALL, SELL 1 LOT OF 54200 PUT,

BUY 1 LOT OF 55200 CALL, BUY 1 LOT OF 53200 PUT

Max inflow of 750 points Max risk of 250 points

Margin Required : Rs.100,000

Max Risk : 250 Points(Rs.8750)

Max Profit: 750 Points ( Rs.26250)

Lot size : 35 Profit if it remains in between 53450 to 54950 zones

* Bank Nifty has seen decent correction of more than 2000 points in last few sessions and gave range break down on weekly scale below 55000 zones.

* However rate sensitive Index is near to its previous all time high zones which may provide some support at lower levels.

* Maximum Put OI is intact at 53000 levels while Maximum Call OI is at 55500 strike.

* Thus suggesting Iron Butterfly Option Spread to play the benefit of time decay and Index likely to oscillate within this wider range in between 53000 to 55500

Commodities & Currency Outlook

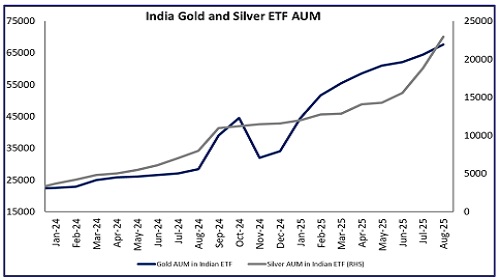

* Gold and silver prices soared to fresh highs on Comex and MCX, amidst safe haven buying and rupee depreciation

* MCX Gold and Silver reported ~5.8% & ~9.5% gains in August and ~35% and ~38% YTD, respectively

* Rupee surged past 88 marking an all-time low against dollar, supporting domestic prices

* Dollar index was stable hovering around 98 for most of Aug’25

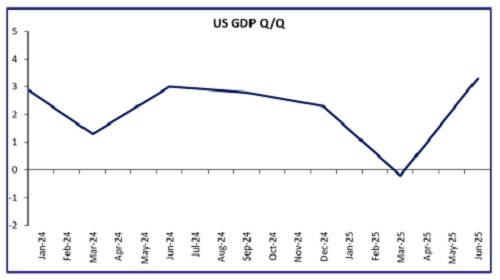

* Trump’s call to remove Fed Governor Lisa Cook sparked concerns over central bank independence

* A day after the meeting minutes, Powell’s Jackson Hole speech took a dovish turn, citing labor market worries

* Odds of a September rate cut for 25 bps jumped to 90% and bets for 50 bps are also being priced in

* Strong GDP but weak payrolls complicated Fed outlook

* Economic data last month showed economies resilience and possible tariffs impact on inflation

* Israel–Gaza conflict and Ukraine uncertainty lifted safe-haven buying

* Gold prices got an early boost amid confusion over a 39% Swiss gold tariff, widening price spreads

* U.S.–EU trade deal reduced gold’s safe-haven appeal

* U.S.–China talks in Stockholm extended the 90-day tariff truce

* Trump–Powell meeting drew attention but didn’t alter market expectations

* Trump–Putin Alaska summit lifted hopes of Ukraine ceasefire; however no positive outcome led the market to believe other wise

* Trump’s threat of new Russia sanctions kept geopolitical risk premium elevated

* Ongoing U.S.–India trade talks added to policy uncertainty

* Strong ETF inflows in U.S. and China supported rally

* Net India Gold and Silver AUM for ETF as on last month is ~67,000 cr and ~22,000 cr

* Festive and wedding restocking in India picked up despite high prices

* Focus this month will be on: US economic data, Changes in interest rate probabilities and Governor Powell’s comments, President Trump’s stance on Tariff, Geo-political developments, Fluctuation in currency i.e. USDINR and Dollar index and demand side scenario

* Both Gold and Silver could trade with a positive bias.

Commodities & Currency Outlook

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

MOSt Market Roundup : The Nifty dropped slightly by 26 points, or 0.1%, closing at 23,045, a...