Merchandise Trade : Sluggish trade activity cushions deficit By JM Financial Services

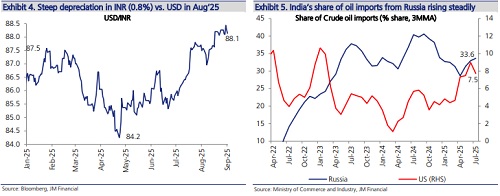

India’s merchandise trade balance narrowed to USD 26.5bn on the back of sluggishness in overall trade activity. August was the first month after the 25% tariff on India came into effect; its impact was not clearly evident in monthly trade activity with the US. Exports to US have normalised from the peak levels before the liberation day tariff announcement. Core trade activity was weak on a sequential basis while it improved on FYTD basis. The depreciation in INR was steep (0.8%) in August, which later stabilised at 88.14/USD in September. The impact of secondary tariffs will reflect in the upcoming months if there is no trade deal with the US. Hence, we continue to expect India’s CAD ~0.9-1% of GDP in FY26.

* Sluggish trade activity cushions deficit: India’s merchandise trade deficit narrowed to USD 26.5bn in Aug’25 vs USD 27.4bn in the previous month. The sequential fall in both exports (-5.7% MoM) and imports (-4.6% MoM) reflects the sluggishness in overall trade activity, including core goods. August was the first month after the 25% tariff on India took effect, the impact of which is not evident in monthly trade activity with the US. We observed that India’s exports to US normalised from the peak levels in Mar’25, just before the liberation day tariff announcement (Ex 10). The impact of secondary tariffs (25%) will reflect in September’s trade activity, which will weaken India’s trade balance if there is no trade deal with US. We expect India’s current account deficit ~0.9-1% of GDP in FY26.

* Core trade improves during Apr-Aug’25: On a broad level, trade activity reflected sluggishness across core categories on a sequential basis (Ex 1). There was a decline in major export categories like engineering goods (-5% MoM), electronic goods (-22% MoM), drugs and pharma (-5.7% MoM) and chemicals (-2% MoM), except petroleum products (3.2% MoM). The steep fall in electronic goods exports is mainly due to its high exposure to the US – which forms 26% of India’s total exports. Imports fell across categories except gold (37% MoM). Oil imports fell 15% MoM to USD 13.3bn. Despite the recent weakness, India’s trade in core categories has improved on a FYTD basis (Ex 2).

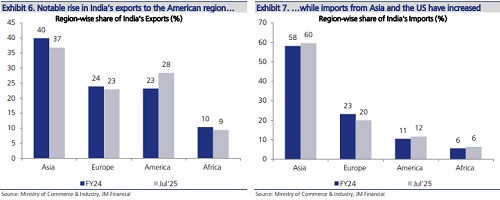

* Exports to US normalise to USD 6.9bn: Our assessment of India’s trade activity on a regional basis (Ex 6-9) reveals that exports to the American region have risen at the cost of Asia while imports have improved both in Asia as well in the American region. A closer look reveals that the improvement is mainly concentrated in US in the American region and China in Asia. The share of US in India’s trade activity has improved both in exports as well as imports. Despite the additional tariffs (25%) on India, exports to the US have not decelerated but normalised to USD 6.9bn from the peak levels of USD 10.1bn in Mar’25. Russia is not a major (top 10) trading partner for India, except that India buys ~34% of its total crude oil from it.

* Resilience in services surplus: Preliminary figures indicate that India’s services surplus remained resilient at USD 16.6bn in Aug’25 vs. USD 16.5bn in July. Services exports of USD 34bn was up marginally (0.95% MoM) along with 0.91% MoM improvement in imports at USD 17.4bn. We are building in growth of 12% in services surplus in FY26 to USD 212bn, which would cushion the overall trade balance in the upcoming fiscal as well.

* Expect CAD at 0.9-1% of GDP in FY26: Despite the additional tariffs of 25%, India’s exports to US decelerated to normalised levels from the peak levels (front-loading of exports) seen before the liberation day announcement in Apr’25. However, the actual impact of the secondary tariffs (+25%, w.e.f. 27th Aug) will reflect in the upcoming months unless a trade deal is finalised with favourable terms. Negotiations are currently ongoing, and as per the commerce ministry a deal is likely before Nov’25. However, India needs to diversify its trade activity across regions in a balanced manner vs. deficit concentrated in Asia and surplus only with the US currently. Until a deal is reached between India and the US, we believe that India’s trade balance is at risk of further deterioration; hence, we build in CAD at 0.9-1% of GDP for FY26.

Shifts in trade across regions

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361