The Credit-to-Deposit Ratio Remains Flat just below 80% by CareEdge Ratings Ltd

Synopsis

• Deposit growth has exceeded credit offtake in this fortnight, and credit offtake remains markedly lower than last year’s level.

* As of August 22, 2025, credit off take was Rs 186.4 lakh crore, showing a 10.0% increase year-on-year. This is significantly lower than the 14.9% growth seen in the previous year (excluding merger impact). The slowdown is mainly due to a high base effect and weak momentum in key areas and segments.

* Deposits rose by 10.2% y-o-y, totalling Rs 235.0 lakh crore as of August 22, 2025, a decrease from 11.3% the previous year (excluding merger impact). The slower growth is mainly driven by an ongoing deposit repricing and increased availability of alternative investment options.

• As of August 29, 2025, the Short-Term Weighted Average Call Rate (WACR) dropped to 5.45%, down from 6.59% on August 30, 2024. It now stands five basis points (bps) below the repo rate of 5.50%. This decrease occurred after three consecutive repo rate cuts and liquidity management by the Reserve Bank of India (RBI).

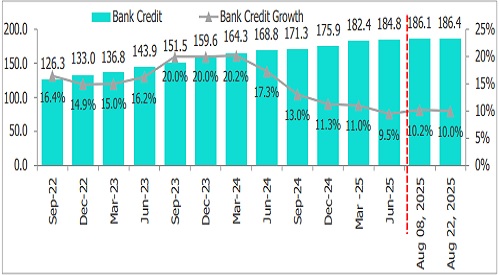

Bank Credit Growth Rate Cools for the Fortnight Figure 1: Bank Credit Growth Trend (y-o-y% %, Rs Lakh crore)

• Credit offtake rose 10.0% y-o-y in the fortnight ending August 22, 2025, marking a sequential uptick of 0.2% i.e. Rs 0.39 lakh crore over the previous fortnight. Despite this improvement, growth remained well below the 14.9% (ex-merger) recorded in the same period last year, reflecting both softer momentum and a high base effect. The moderation was partly driven by muted private sector capex, slower lending to corporates and unsecured personal loans, along with weaker credit flow to NBFCs.

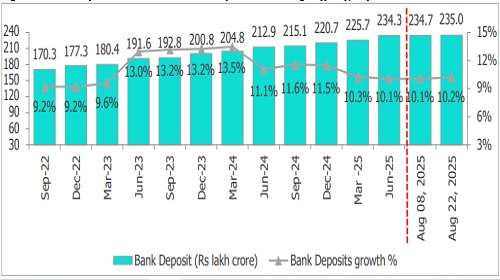

Figure 2: Bank Deposit Growth Rate Inched Up for the Fortnight (y-o-y, %)

• Deposits increased by 10.2% y-o-y and marginally increased sequentially in the current fortnight, reaching Rs 235.0 lakh crore as of August 22, 2025, yet continues to remain lower than the 11.3% growth (excluding merger impact) recorded last year. Time deposits grew by 9.2% y-o-y to Rs 206.1 lakh crore, moderating from 10.9% growth in the corresponding period last year. Meanwhile, demand deposits saw a rise of 18.2% y-o-y to Rs 28.9 lakh crore.

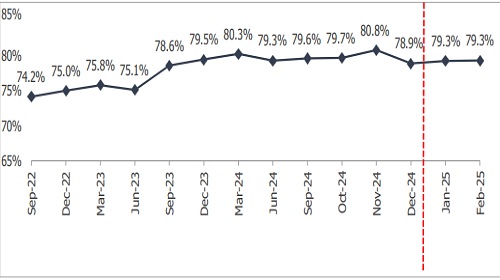

Figure 3: Credit-to-Deposit (CD) Ratio Remains Flat, Just Below 80% – Incl. Merger Impact

• The Credit-Deposit (CD) ratio remained flat sequentially at 79.3% and remained below the 80% mark for the 11th consecutive fortnight.

Share of Bank Credit Remains Flat, and the Government Investments Decrease Marginally

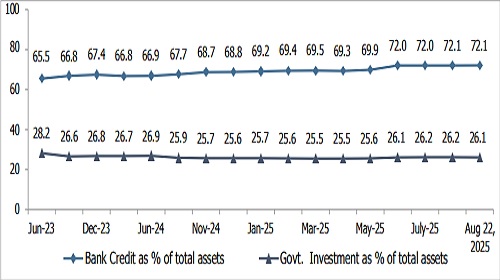

Figure 4: Proportion of Govt. Investment and Bank Credit to Total Assets (%)

• The Bank credit-to-total-assets ratio remained flat at 72.1%, whereas Government Investment-to-total-assets decreased marginally by one bp at 26.1% for the current fortnight. Additionally, overall government investments totalled Rs 67.6 lakh crore as of August 22, 2025, reflecting a y-o-y growth of 6.2% and a sequential rise of 0.1%.

Levels of O/s Commercial Papers (CPs) and Certificates of Deposit (CDs) Decreased Sequentially

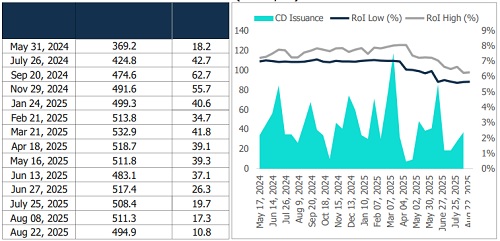

Figure 5: Certificate of Deposit O/s Figure 6: Trend in Certificates of Deposit Issued. (Rs’000, Cr.) and RoI

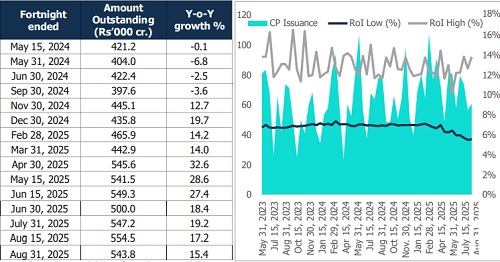

Figure 7: Commercial Paper Outstanding Figure 8: Trend in CP Iss. (Rs’000, Cr.) and RoI

Above views are of the author and not of the website kindly read disclaimer