Neutral Union Bank of India Ltd for the Target Rs.155 by Motilal Oswal Financial Services Ltd

Earnings in line; downgrade to neutral on weak business growth and NIM pressures

Margin contracts 11bp QoQ

* Union Bank of India (UNBK) reported 1QFY26 PAT of INR41.2b (11.9% YoY growth, in line), supported by a lower tax rate.

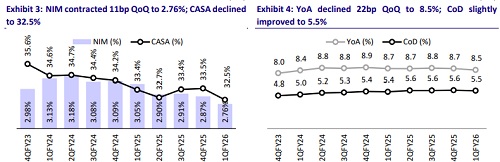

* NII declined 3.2% YoY to INR91.1b (in line). NIM contracted 11bp QoQ to 2.76% amid a decline in lending yields, led by loan repricing.

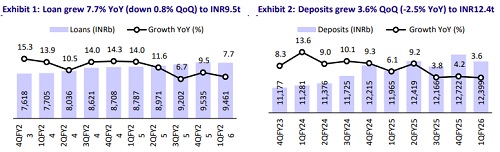

* Loan book grew 7.7% YoY/declined 0.8% QoQ to INR9.46t, while deposits grew 3.6% YoY/declined 2.5% QoQ. CD ratio, thus, increased 135bp QoQ to 76.3%.

* Fresh slippages increased 1.2% YoY to INR23.5b from INR23.2b in 1QFY25. GNPA/NNPA ratio improved by 8bp QoQ/1bp QoQ to 3.52%/0.62%. PCR ratio stood at 82.9%.

* We cut our FY26/FY27E earnings by -7.5%/-2.5% and estimate FY27 RoA/RoE at 1.1%/14.8%. UNBK’s stock has delivered ~20% return in recent months and now trades broadly at par with peers. Given the absence of near-term triggers, continued pressure on margins, and weak business growth, we downgrade our rating to Neutral while keeping the TP unchanged at INR155 (0.9x FY27E ABV).

Asset quality improves; CD ratio increases to 76.3%

* UNBK reported 1QFY26 PAT of INR41.2b (11.9% YoY, in line). NII declined 3.2% YoY to INR91.1b (down 4.2% QoQ, in line). NIM declined 11bp QoQ to 2.76%.

* Other income declined 0.5% YoY and 19.3% QoQ to INR44.9b (4.5% lower than MOFSLe), primarily due to the absence of PSLC income, although treasury gains stood at INR14.2b (INR16.5b in 4QFY25).

* Opex grew 9% YoY to INR66.9b (in line). C/I ratio increased 28bp QoQ to 49.2%. PPoP, thus, declined 11.3% YoY/ 10.3% QoQ to INR69b (7% miss).

* Business growth declined 3.4% QoQ, with advances rising 7.7% YoY/ declining 0.8% QoQ to INR9.46t. Within this, retail witnessed healthy growth of 25.6% YoY/ 5.7% QoQ and MSME witnessed 5.9% QoQ growth, while large corporate and agri segments declined 5.1% and 3.9% QoQ, respectively.

* Deposits grew 3.6% YoY but declined 2.5% QoQ to INR12.4t, led by a reduction in CASA and bulk deposits. CASA ratio decreased 100bp QoQ to 32.5%, while CD ratio increased 350bp QoQ to 76.3%.

* Fresh slippages increased 1.2% YoY to INR23.5b amid higher slippages from the retail as well as SME segments, while healthy recoveries and upgrades led to an improvement in the GNPA/NNPA ratio by 8bp QoQ/ 1bp QoQ to 3.52%/ 0.62%. PCR ratio stood at 82.9%.

Highlights from the management commentary

* NIM contracted 11bp QoQ, with a further 20-25bp moderation expected in the coming quarters. Management believes NIM will bottom out around 2.60% and improve thereafter.

* Recovery efforts are active, and management expects visible results from the next quarter.

* CASA dipped sharply QoQ due to temporary March-end corporate flows. The bank is actively addressing this by deploying 1,500 relationship managers to target 300-400 high-value clients and rebuild its deposit franchise.

* Loan growth was driven by a 25% YoY growth in retail and 18% YoY growth in MSME. The bank continues to avoid high-risk, low-margin lending to sustain profitability. The gold loan book expanded further, reflecting its focus on secured, high-yield segments.

Valuation and view

UNBK reported in-line earnings, supported by a lower tax rate, although PPoP missed our estimates. Business growth remained sluggish, with muted QoQ trends in both advances and deposits, while the CASA mix declined. Asset quality ratios continued to improve, driven by controlled slippages resulting in in-line provisions. We cut our FY26/FY27E earnings by -7.5%/-2.5% and estimate FY27 RoA/RoE at 1.1%/14.8%. UNBK’s stock has delivered ~20% return in recent months and now trades broadly at par with peers. Given the absence of near-term triggers, continued pressure on margins, and weak business growth, we downgrade our rating to Neutral while keeping the TP unchanged at INR155 (0.9x FY27E ABV).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412