Merchandise Trade : Broad-based growth in imports; Exports growth led by non-oil By JM Financial Services

Broad-based growth in imports; Exports growth led by non-oil

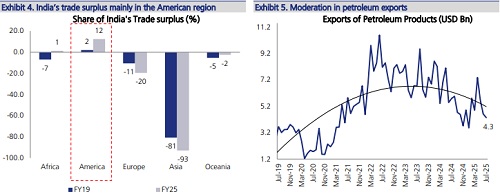

The deterioration in India’s trade deficit to USD 27.3Bn in July was a result of the growth in imports (19.8% MoM) outpacing exports (6% MoM). Overall trade activity improved in July, while oil imports reverted to positive growth after two consecutive months of decline. Exports growth was led by non-oil while oil exports continued to decline for third consecutive month. Growth in core imports and capital goods hints at the resilience in the domestic demand environment. The weaponising of tariff by US has complicated the global supply chain. While India would actively diversify to countries in West Asia and Africa, it is worth highlighting that ~90% of India’s trade deficit is concentrated in Asia and US is the only major region with which we enjoy a trade surplus. We believe that India’s trade surplus with US (USD 41Bn FY25) is unlikely to improve in Trump’s regime. As the tariff scenario unfolds, we expect India’s CAD to stretch in the range of 0.8% - 1% of FY26 GDP.

* Trade deficit widens to USD 27.3Bn: India’s merchandise trade deficit widened to USD 27.3Bn in July vs USD 18.8Bn in the previous month. The deterioration in trade balance was mainly led by sharp sequential growth in imports (19.8% MoM), which outpaced exports (6% MoM). Growth in imports was broad-based across categories, including oil which reverted from the declining trend in the previous two months. Secondary tariffs on India have complicated the trade scenario, which will deteriorate the trade balance further in absence of an early resolution. This will stretch the Current account deficit (CAD) in the range of 0.8% to 1% of GDP in FY26.

* Exports growth led by non-oil; Broad-based growth in imports: Overall trade activity picked up pace in July. At USD 37.2Bn, exports grew at higher single digits (7.3% YoY, 6% MoM). Growth was mainly led by Non-oil category (13.8% YoY) while oil exports declined (25% YoY) for third consecutive month. Sequential decline in two large categories i.e. petroleum (-5.9% MoM) and electronic goods (-9.2% MoM) dragged overall exports (Ex 1). Imports reverted (8.6% YoY) in July after 2 consecutive months of decline, sequential growth was stronger at 19.8% MoM. Unlike exports, growth in imports was broad-based including oil imports. Core imports (8.5% YoY) and imports of Capital Goods (14% YoY) was robust, indicating the strength in the domestic demand environment. At USD 3.9Bn, Gold imports was the highest in last four months despite elevated prices in INR terms. Despite the recent pickup, growth in the trade activity on FYTD basis trails the performance in the previous period (FYTD25, Ex 3).

* Services surplus moderates USD 15.6Bn: Preliminary figures indicate that India’s Services surplus moderated to USD 15.6Bn in Jul-25 vs USD 16.2Bn in the previous month. Services exports of USD 31bn declined (3.3% MoM) while imports of USD 15.4Bn were down (3.1% MoM). We are building-in growth of 10% in services surplus in FY26 to USD 208Bn, which would cushion the overall trade balance in the upcoming fiscal as well.

* Expect CAD to stretch to 1% of GDP in FY26: Tariff rate of 50% applicable on India including the levy of secondary tariff of 25% has complicated the entire supply chain. Traders would wait it out rather than trade at an unviable terms. The weaponising of tariffs by US has disrupted the global supply chain, the impact of which will reflect with a lag may be through altered trade relations. India has broadened its export focus to 50 countries across West Asia and Africa to reduce its overreliance on the US. However it is worth highlighting that ~90% of India’s trade deficit is concentrated in Asia while US is the only major region with a trade surplus. Broadly we continue to believe that it is the trade surplus with the US which is the cause of concern for the POTUS and hence it is unlikely that India’s trade surplus with US will improve from hereon. We expect the share US in India’s oil imports (~5% currently) to rise further at the cost of Russia. Amidst elevated tariffs and deteriorating relation with US, we expect India’s CAD in the range of 0.8% to 1% of GDP in FY26.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361