2025-08-30 10:28:34 am | Source: Motilal Oswal Financial Services

Company Update : Castrol India Ltd By Motilal Oswal Financial Services Ltd

Performance in line

- Castrol India’s (CSTRL) 2QCY25 revenue came in at ~INR15b, in line with our estimate (up 7% YoY).

- EBITDA was also in line with our estimate at INR3.5b (up 8% YoY).

- EBITDA margin expanded 30bp YoY/175bp QoQ. ? Gross margin remained flat YoY/QoQ.

- PAT was also in line at INR2.4b. However, other income stood below our estimate.

- The Board has recommended an interim dividend of INR3.5/sh (FV: INR5/sh)

- Other key highlights:

- Remarks from Mr. Kedar Lele, MD: The company remains optimistic about the road ahead. The industrial segment continues to be a key long-term growth driver, with the first half showing positive momentum—new customer additions, improved traction, and a growing share of locally manufactured products. Meanwhile, the rural strategy is progressing well and will be further strengthened in the coming months.

- Industrial Segment updated:

- The recently launched Rustilo DW 800 range of rust preventives—developed and manufactured locally—is now serving over 100 customers across the automotive, bearings, tube, and metal manufacturing sectors.

- Localized production of globally recognized metalworking fluids such as Hysol MB50 and the 20XBB range has enabled faster delivery and enhanced value creation.

- Chemical Management Services (CMS) have been successfully deployed at multiple new sites, further strengthening industrial service offerings.

- Focus on expanding distribution:

- CSTRL now has a presence in over 0.16m outlets, including 32,000+ bike points, 11,000+ multi-brand car workshops, and a broad dealer network.

- The Castrol Auto Service network continues to grow, currently supporting over 730 workshops across 340+ cities, offering reliable, professional services in the aftermarket.

- The full range of autocare products is now widely available across e-commerce platforms, modern trade outlets, and 50,000+ physical retail points across India.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or

investment advice. Investments in financial markets are subject to market risks, and past performance is

not indicative of future results. Readers are strongly advised to consult a licensed financial expert or

advisor for tailored advice before making any investment decisions. The data and information presented

in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the

content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

Evening Roundup : A Daily Report on Bullion Energy &...

Company Update : Rushil Decor Ltd by Prabhudas Lilla...

India, EU to hold 14th round of free trade agreement...

Adani Enterprises to build Sonprayag-Kedarnath ropew...

Nifty future closed negative with losses of 0.14% at...

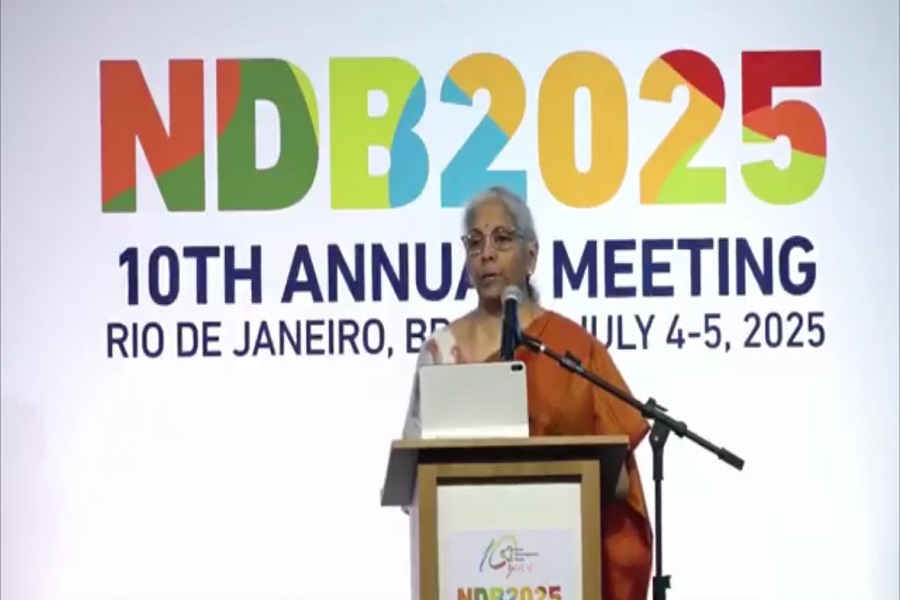

AI growing fast, regulation must keep pace: FM Nirma...

Investment of Rs 4,000 crore from Japanese companies...

Quote on Market Wrap 15th September 2025 by Shrikant...

India?s trade deficit narrows to $26.49 bn in August...

FIIs stood as net buyers in equities as per Septembe...