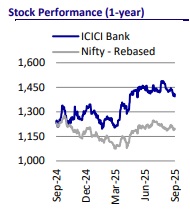

Buy ICICI Bank Ltd for the Target Rs. 1,670 by Motilal Oswal Financial Services Ltd

Compounding growth through prudent execution

Tech capabilities remain a key differentiator

* ICICI Bank’s (ICICIBC) FY25 annual report emphasizes the progress that the bank has made in building a resilient franchise to deliver sustained profitable growth. The bank has strengthened its branch network and credit models to cater to businesses and self-employed customers.

* The bank continues to focus on high-yielding segments, supported by datadriven onboarding, digital platforms, and transaction banking, which also boosts fee income. Business Banking segment has thus emerged as a key growth driver, delivering 34% YoY growth in FY25 and contributing ~20% of total loans.

* Its ‘Bank to Bank Tech’ theme has witnessed strong digital adoption, with online transactions accounting for ~95% of total transactions. IMobile Pay (10m+ users) and InstaBIZ (3m+ SMEs) are scaling up rapidly, alongside innovations like upgraded Neo Remittance and API Banking 2.0.

* The concentration of top 20 borrowers has declined, while top 20 depositors’ mix has inched up to ~4.2%, yet comfortable. ICICIBC purchased PSLCs worth INR1,183b (vs. INR1,097b in FY24) and sold PSLCs worth INR1,229b (INR880b in FY24). Banca fees grew at a tepid rate to INR10.8b (from INR9.8b in FY24).

* The bank’s focus on leveraging technology while scaling up Retail, SME business will increase efficiency, leading to a decline in the C/I ratio to ~36% by FY28E. We estimate ICICBC to deliver RoA/RoE of 2.3%/16.7% in FY27E and retain our BUY rating with a TP of INR1,670 (2.7x FY27E ABV + SOTP of INR270)

Loan growth healthy; estimate ~16% CAGR over FY26-28E

ICICIBC sustained healthy loan growth with ~15% CAGR over FY23-25, outpacing system growth, led by retail and business banking. Unsecured loan growth has, however, flattened and the segment now forms 12.8% of the loan book. Vehicle finance growth has been modest due to demand softness and pricing pressure, and we expect growth trends to recover in 2H, supported by reduced borrowing costs and lower GST & direct tax rates. The bank continues to focus on high-yielding segments, supported by data-driven onboarding, digital platforms, and transaction banking, which also bolsters fee income. We estimate ICICIBC to deliver ~16% loan CAGR over FY26-28E

Business Banking shines as a key growth engine

ICICIBC’s Business Banking segment has emerged as a key growth driver, delivering 34% YoY growth in FY25 (~30% YoY growth in 1QFY26). The segment now forms ~20% of total loans, supported by targeted investments in distribution, credit underwriting, and digital capabilities. The bank has strengthened its branch network and credit models to cater to business and self-employed customers, while digital offerings and transaction banking continue to drive both lending and fee income. The portfolio remains granular, well-diversified, and resilient with low credit costs, positioning the segment for sustainable growth. However, retail & rural loans grew at a modest 6.1% YoY in 1QFY26, though they continue to form the largest share at 58.5% of total loans.

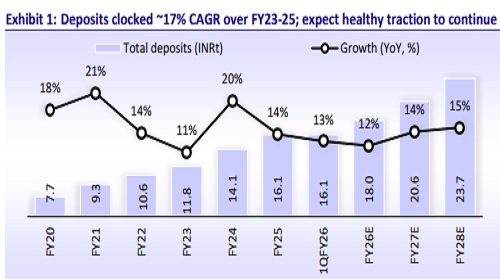

Focus on granular retail franchise; CASA moderation limited vs. peers

The bank reported healthy deposit growth of ~13% YoY in 1QFY26 (17% CAGR in FY23-25), supported by its strong digital platform, wide branch reach, and focus on low-cost deposits through salary accounts and transaction banking. These factors have enabled ICICIBC to maintain the best liability profile among peers. While retail deposits remain the core funding source, the bank also engages in wholesale banking to strengthen corporate relationships. Despite a moderation in CASA ratio to 41.2% (still ahead of peers), traction in current account deposits (+23% YoY) and a likely revival in SA amid an easing rate cycle should support its funding profile. With a healthy CD ratio of 84.8% and calibrated pricing strategy, we estimate ICICIBC to report ~15% CAGR in deposits over FY26-28E.

NIMs under slight pressure; bank maintains tight control on funding costs

The bank remains focused on strengthening its retail deposit base, with CASA at 41.2% and LDR at ~85%. Reported NIMs contracted by 7bp QoQ to 4.34% in 1QFY26 (4-6bp on adjusted basis aided by SA rate cuts). Retail TD repricing and reduced reliance on high-cost wholesale deposits lowered CoF by 16bp QoQ, though margin pressure is likely to persist in 2QFY26 as loan repricing outpaces deposits (53% book being repo-linked). The phased 100bp CRR cut will, however, boost liquidity and offset margin pressure. We thus expect NIMs to stabilize and recover thereafter from 2HFY26 onward, enabling 17% CAGR in NII over FY26-28E.

Opex growth continues to trail revenue growth; C/I ratio dips to 37.8%

ICICIBC has delivered strong operating efficiency, with the cost-to-income ratio improving to 37.8% in 1QFY26 (supported by treasury gains, 38.6% in FY25), despite continued investments in technology and business expansion. Alongside this, core fee income grew ~15% in FY25, aided by Retail and Business Banking initiatives, healthy credit card spends, and traction in transaction banking, FX, and derivatives. With operating expenses expected to grow at ~11% YoY over FY25- 27E, the bank’s focus on leveraging technology and scaling granular Retail/SME volumes should drive further efficiencies, enabling the C/I ratio to moderate to ~36% by FY28E

Digital platforms powering next-gen growth

ICICIBC’s ‘Bank to Bank Tech’ theme underscores its deep focus on embedding digital transformation across operations and customer engagement, with flagship platform, iMobile Pay (10mn+ active non-ICICI users) and InstaBIZ (3mn+ SMEs) driving onboarding and transactions. In FY25, digital adoption surged, as ~95% of individual financial transactions were conducted online, aided by initiatives like InstaBIZ 3.0 for non-customers, expansion of STACK ecosystems, and industry-first products such as Insta EPC. The bank also launched innovations, including an upgraded Neo Remittance System (USD25b processed), AI-powered fraud prevention, Digital Rupee pilots, and API Banking 2.0.

Asset quality stable; robust underwriting to enable controlled credit cost

ICICIBC has sustained strong asset quality across cycles, supported by prudent underwriting and real-time technology-backed risk management. The bank maintains a healthy PCR at 76% and carries contingent provisions of INR131b (~1% of loans), providing cushion against credit costs. While secured retail loan performance remains robust and NPLs in unsecured loans have stabilized, credit costs may inch up as the recoveries from bad loans moderate. GNPAs in the priority and non-priority sectors have also improved, with major improvement seen in the Industry and Services sectors (Exhibit 28). We estimate GNPA/NNPA to remain steady at 1.6%/0.4% by FY27 with normalized credit costs of ~50bp.

Capital ratios healthy; segmental performance remains balanced

Capitalization remains healthy, with Tier-1 at 15.7% and CAR at 16.3%, which will be further aided by the RBI’s policy reversal on NBFC/MFI risk weights, effective Apr’25 (bank reported CET1/CAR of 16.3%/~17.0% in 1Q, including profits). The bank’s segmental performance remained balanced, with Retail PBT rising 15% YoY, contributing ~35% of total profits on the back of 16% revenue growth, while Treasury delivered strong 26% YoY PBT growth (30% of profits). The Corporate segment saw revenue growth of 14% YoY, though PBT rose by a modest 8% YoY, reflecting subdued corporate demand, lower recoveries and NIM moderation.

MD&A: Prudent growth and robust buffers ensure resilient performance

* Prudent underwriting and risk filters: Management emphasized a calibrated growth approach with strengthened underwriting across Retail, SME, and Business Banking, leveraging data analytics and behavior scoring for prudent credit delivery. Exposure to lower-rated corporates is taken selectively, balancing risk and returns.

* Contingency buffers and provisions: The bank maintains healthy contingency provisions over and above regulatory requirements, supplementing PCR and standard provisions, reflecting a conservative stance. These buffers strengthen balance sheet resilience and provide flexibility to manage potential future asset quality challenges.

Other highlights

* Bank remains net PSLC seller; though PSL purchase continues in FY25: The bank purchased priority sector lending certificates (PSLCs) worth INR1183b (vs. INR1097b in FY24) and sold PSLCs worth INR1229b (INR880b in FY24).

* Bancassurance income has seen a tepid ~3% CAGR over FY21-25: Fees from bancassurance increased to INR10.8b (from INR9.8b in FY24). Fee from the sale of life insurance/MF & other products increased to INR3.3b/INR6.3b in FY25 (INR3.1b/INR5.4b in FY24); however, fees from the sale of non-life insurance declined to INR1.2b (INR1.25b in FY24).

* Contingent liabilities: Contingent liabilities grew ~30% YoY in FY25 (19% CAGR over FY23-25), primarily due to an increase in interest rate swaps/futures (up 41% YoY) and forward exchange contracts (up 11% YoY). Contingent liabilities form ~285% of total assets.

Valuation and view

ICICIBC has been reporting a stellar performance for the past few years, irrespective of the sectoral challenges such as unsecured asset quality issues, systemic growth moderation, liability accretion or NIM headwinds. During 1QFY26, the controlled NIM decline of 7bp was another solid beat in that series, compared to a double-digit contraction reported by many peers. The continued improvement in asset mix, limited NIM compression and healthy growth in Business Banking and select retail segments position the bank well to deliver robust profitability. The bank’s investment in technology has resulted in consistent productivity gains and steady improvement in cost ratios. Asset quality remains under control, while the bank continues to carry a contingency provisioning buffer of INR131b (1.0% of loans). We estimate ICICBC to deliver RoA/RoE of 2.3%/16.7% in FY27 and retain our BUY rating with a SoTP-based TP of INR1,670 (2.7x FY27E ABV + SOTP of INR270).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412