Buy Campus Activewear Ltd For Target Rs.310 by Motilal Oswal Financial Services Ltd

Weak start to FY26; growth recovery remains the key

* Campus Activewear (Campus) started FY26 on a weak note as warehouse consolidation and SAP implementation impacted online sales for 15 days.

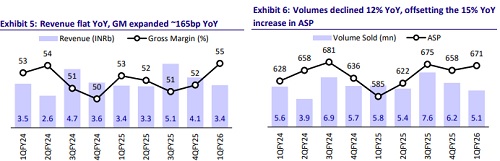

* As a result, revenue inched up 1% YoY as a 15% YoY APS increase (higher sneaker sales) was largely offset by a 12% YoY volume decline.

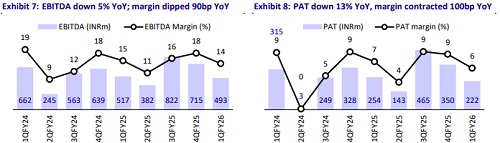

* Gross margin (GM) expanded 165bp on premiumization, but higher A&P spends and operating deleverage led to a 5% dip in EBITDA (13% miss).

* Management indicated that demand trends have improved in 2Q, and it remains confident of delivering double-digit revenue growth and a gradual improvement in margins to the 17-19% range.

* We cut our FY26-27E EBITDA and earnings by 4-8% as lower volume is only partially offset by higher ASP.

* We model an 11%/19%/24% CAGR in revenue/EBITDA/PAT over FY25-28E, with EBITDA margin improving to ~19% by FY28. We reiterate our BUY rating with a TP of INR310, premised on 45x Sep’27E P/E.

Weak 1Q; revenue flat YoY (5% miss), EBITDA dips 5% YoY (13% miss)

* Revenue inched up 1% YoY (vs. 12% YoY in 4Q) to INR3.6b (5% miss).

* Comparatively, Relaxo’s 1Q revenue declined ~12% YoY.

* Volume at 5.1m declined ~12% YoY, while ASP improved ~15% YoY to INR671, driven by higher sneaker sales.

* Gross profit was up 4% YoY to INR1.9b (2% below our estimate) as GM expanded 165bp YoY to 54.6% (160bp beat).

* On the other hand, Relaxo’s GM contracted ~20bp YoY.

* Employee costs rose 12% YoY (6% ahead), while other expenses were up 7% YoY.

* EBITDA declined 5% YoY to INR493m (13% miss) due to weaker revenue growth and higher employee costs.

* EBITDA margin contracted 90bp YoY to 14.4% (125bp miss) as higher GM was partly offset by operating deleverage.

* D&A rose 24% YoY, while finance costs increased 33% YoY.

* As a result, PAT declined 13% YoY to INR222m (13% miss). PAT margin came in at 6.5% (-100bp YoY).

Weak sales in online channel; distribution delivered steady growth

* Online: Revenue declined ~8% YoY to INR1.1b, owing to the impact of warehouse consolidation, which led to a loss of 15-20 days of sales (INR100- 120m). Volume declined ~19% YoY, while ASP rose ~13% YoY.

* Trade distribution: Revenue grew 8% YoY to INR1.9b, as ~18% ASP increase was offset by ~9% YoY volume decline.

* D2C (offline): Revenue declined marginally by 1% YoY to INR429m.

Key takeaways from the management commentary

* Demand trends: 1QFY26 sales were hurt due to the consolidation of the warehouse, which disrupted the supply of inventory for nearly three weeks (online sales -8% YoY), while distribution remained strong. Despite this, management reaffirmed double-digit FY26 growth guidance, citing a strong recovery in July, solid distributor orders, and sneaker-led premiumization.

* ASP & premiumization: ASP rose ~15% YoY in 1QFY26, driven by the higher salience of sneakers (150% YoY growth to 550k pairs) and rationalization of lower-priced product categories such as DIP school shoes and slippers. Campus continues to see good traction on premiumization, with 50%+ of sales coming from products priced at INR1,500 and higher. While the ASPs would continue to grow on a YoY basis, the growth over 1QFY26 levels may be modest.

* Margin: The company continues to target a 17-19% EBITDA margin over the next couple of years. Operational disruptions impacted short-term performance, but strategic actions and product mix improvements are expected to support this margin aspiration.

* Competition: The Value segment remains highly competitive, with unorganized players resorting to lower prices. Management expects BIS regulation to gradually benefit the large organized players, but competition remains high in the interim.

Valuation and view

* Campus’ innovative designs, color combinations, and attractive price points make it a market leader in the fast-growing Sports and Athleisure (S&A) category.

* 1Q marked a weak start to FY26, but we expect Campus to deliver double-digit growth over the medium term with an improvement in consumer sentiment and gradual overall demand revival. The BIS-led tailwinds and stabilization in the D2C online channel are likely to aid Campus’ margin recovery.

* We cut our FY26-27E EBITDA and earnings by 4-8% as lower volume is only partially offset by higher ASP.

* We model an 11%/19%/24% CAGR in revenue/EBITDA/PAT over FY25-28E, with EBITDA margina improving to ~19% by FY28. We reiterate our BUY rating with a TP of INR310, premised on 45x Sep’27E P/E.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412