Buy Apollo Hospitals Ltd for the Target Rs. 9,010 by Motilal Oswal Financial Services Ltd

Broad-based growth with a beat on EBITDA/PAT, led by cost optimization

Efforts underway to increase beds, stores, and access to online services

* Apollo Hospitals Enterprises (APHS) reported an in-line revenue in 1QFY26. However, it delivered better-than-expected EBITDA/PAT, with a 9%/13% beat. This was largely driven by a reduction in 24/7 operating costs, better operating leverage in AHLL, and higher growth in average revenue per patient (ARPP).

* APHS witnessed a spike in 1) the number of registrations (+21% YoY), 2) the number of active users (+55% YoY), and 3) daily medicine orders, as well as daily consultations. The company is implementing cost optimization measures to eventually improve the profitability of Healthco.

* APHS reported a soft volume growth in healthcare services for the quarter. However, this was offset by higher ARPP on a YoY basis.

* We raise our earnings estimates by 7% each in FY26/FY27 to factor in 1) faster reduction in operating costs and the growing revenue of the online platform, 2) a reduction in ALOS, driving better profitability for the hospital business, and 3) an increase in the international patient flow from newer geographies. We value APHS on an SoTP basis (30x EV/EBITDA for the hospital business, 20x EV/EBITDA for retained pharmacy, 25x EV/EBITDA for AHLL, 23x EV/EBITDA for front-end pharmacy, and 2x EV/sales for Apollo 24/7) to arrive at our TP of INR9,010.

* APHS has been optimizing the framework for a comprehensive healthcare service offering. It is also adding growth levers in each segment – adding beds in hospitals, adding stores in offline pharmacies, improving GMV/ reducing opex in its online pharmacy, merging the Keimed distribution segment, and scaling up the diagnostic business. Accordingly, we expect a 15%/21%/28% CAGR in revenue/EBITDA/PAT over FY25-27. Reiterate BUY.

Revenue growth in place; EBITDA/PAT beat estimates due to lower opex

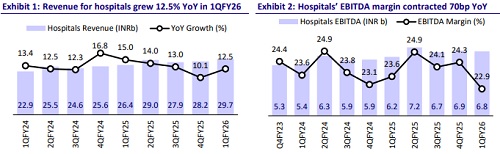

* APHS’ 1QFY26 revenues grew 15% YoY to INR58.4b (est. INR57.3b).

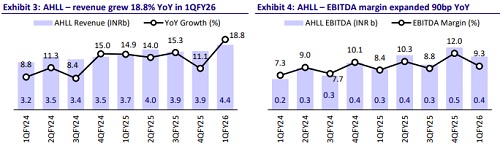

* Healthcare services revenue grew 11% YoY to INR29.4b. Healthco revenue grew 18.7% YoY to INR24.7b. AHLL’s revenue grew 18.8% YoY to 4.4b.

* EBITDA margin expanded 130bp YoY to 14.6% (our est. 13.6%) due to lower employee cost and other expenses (22bp/117bp YoY as % sales), offset by an increase in RM costs (26bp YoY as % sales).

* EBITDA grew 26.2% YoY to INR8.5b (surpassing our estimate of INR7.8b).

* Adj. PAT grew 41.8% YoY to INR4.3b (our est: INR3.8b).

* Hospital EBITDA grew 15% YoY to INR7.2b for 1QFY26. EBITDA margin expanded 90bp YoY to 24.5% in 1QFY26.

* Healthco exhibited EBITDA of INR940m for 1QFY26 vs INR230m in 1QFY25. EBITDA margins stood at 3.8% in Q1FY26.

* AHLL’s overall revenue/EBITDA grew 19%/31% YoY in 1QFY26 to INR4.4b/ INR400m.

Highlights from the management commentary

* APHS is on track to achieve cash EBITDA breakeven (excluding ESOP cost) in Healthco by 2QFY26/3QFY26.

*Surgical revenues grew 14% YoY, led by a healthy momentum in CONGO (cardiac, oncology, neurosciences, gastro, and ortho) therapies in 1QFY26.

* Better institutional tariffs, case mix, and inflation-linked price hikes fueled growth in ARPP for the quarter.

* The GMV comprises pharmacy, diagnostics, and the business driven by Apollo Group Hospitals. The redefinition of GMV related to Apollo Group Hospitals and the restated GMV of INR8b-INR9b would enable APHS to achieve EBITDA breakeven in the digital platform.

* APHS has reworked customer acquisition charges, discounts, and lifestyle costs to reduce the overall opex for the digital platform.

* Hospitals that would be operational in FY26 are the Women's Oncology Center in Delhi, a multi-specialty hospital in Pune, the acquired hospital in Bengaluru, and a multi-specialty hospital in Kolkata. The company would add 700 beds to the current operational bed size of 9,458.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412