Netra Report on Tariff Wars and The Gold Put - September 2025 by Sahil Kapoor, Head of Products and Market Strategist at DSP Mutual Fund

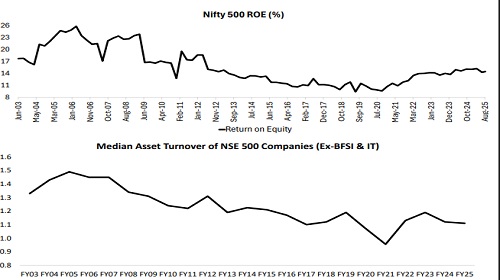

Why Return On Equity (ROE) Isn’t Higher?

During the 2003–07 upcycle, Indian corporates consistently delivered ROE in the range of 20–25% and ROA of 4–6%. Post-Covid, corporate India has witnessed a similar returns phase; characterized by strong topline growth, peak margins, and robust profit expansion.

The key question, however, is: if the operating environment today appears stronger like in the past, why are return ratios not higher? Where are the ROEs? One reason is the declining asset turnover. In the earlier upcycle, for instance, every ?100 of assets generated roughly Rs 150 of sales. Today, the same investment yields only Rs 120-130. At the same time, leverage levels have declined, which means that these assets are not levered leading to an increase in the equity base.

With intensifying competition, companies face mounting pressure to sustain profitability. Another reason for this is the slowdown in the nominal growth. As a result, while the current ~15% ROE may appear healthy, it is meaningfully lower than previous upcycles. Moreover, there is little assurance that this level will hold. Corporations may leverage up to improve asset turns, but that needs visibility of demand aka faster nominal growth.

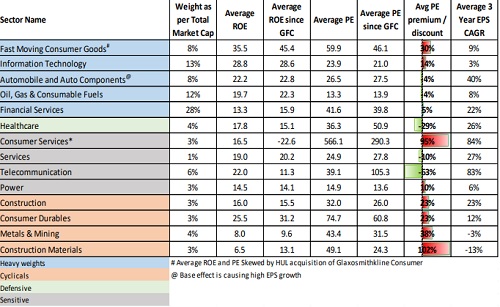

Why India Trades At Premium Valuation?

FMCG, IT, Auto, O&G, and Consumer Durables are among India’s most consistent high-ROE sectors.

A core high-ROE cohort of FMCG, IT, O&G (ex RIL), and Consumer Durables makes up over one third of market cap and earns ROEs about 50% above the rest. This is the source of India’s premium valuation over the long term. But since the pandemic, cyclicals such as metals, mining, and construction materials have rerated sharply despite weaker long-term ROEs.

Meanwhile, earnings momentum in the high-ROE cohort has cooled: revenue growth is slowing, and margins look late cycle.

The source of India’s premium valuation in this cycle is the weak ROE cohort, not the high-quality names. Yet the market still trades at an overall premium, buoyed by cyclicals and lower-quality names. Bargains will be available, sooner or later, in the high quality (high ROE) cohort when valuations cool. The high multiples for low quality businesses present a challenge for the broader market. This is a constructive setup for value investors who stay focused on quality

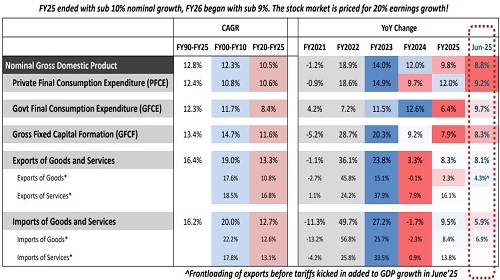

Current Growth Trend Is One of The Weakest

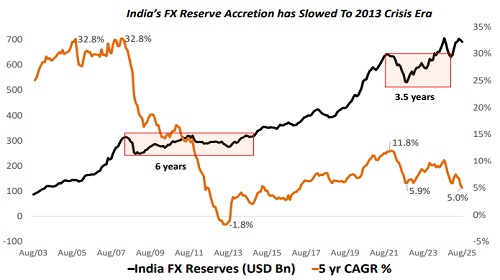

India’s FX Reserves – A Proxy For External Troubles

If you ignore pricey equity valuations and markets stay irrational, your mistake may be hidden for a while. You can also dilute risk through cross-asset allocation. If you are a bond investor who buys long duration just before rates rise, you can still hold to maturity and collect the promised coupons. In short, errors in stocks and bonds can often be managed by staying conservative.

Ignoring a lifetime low on a currency is different. It is a serious mistake.

FX markets involve a wide mix of real and financial participants. A currency that breaks a lifetime low does so despite the central bank, the biggest counterbalancing force. The Indian rupee has hit a lifetime low against the USD at a time when the US Dollar Index is not particularly strong. We have discussed many drivers of this trend.

A clear tell is the failure of FX reserves to rise. This is a signal to remain vigilant to spillover into bonds & stocks

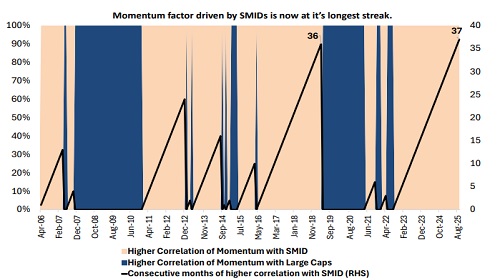

SMIDs Are The Momentum Factor. All Factors Mean Revert

The chart illustrates the relative correlation of the momentum factor across market segments. The blue area indicates that the momentum factor has a stronger correlation with large caps compared to the SMID (small- and mid-cap) segment, while the orange patch reflectsthe opposite.

Historically, nearly two-thirds of momentum performance has been driven by mid- and small-cap stocks, largely due to higher portfolio allocations toward this space. At the peak of market cycles, exposure tends to concentrate in SMID stocks; however, when a downcycle begins, these strategies are hit the hardest as widespread profit-taking and selling pressure emerge in priorwinners. Over the past three years, momentum has consistently favored the SMID segment, a trend that itself is unprecedented.

Yet, this tilt has also contributed to significant underperformance versus broader indices in the past year. With SMID valuations already elevated and momentum still biased toward this segment, the forward outlook for the momentum index appears challenging.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Aditya Birla SL AMC announces addition of schemes under daily SIP